|

|

|

|

|||||

|

|

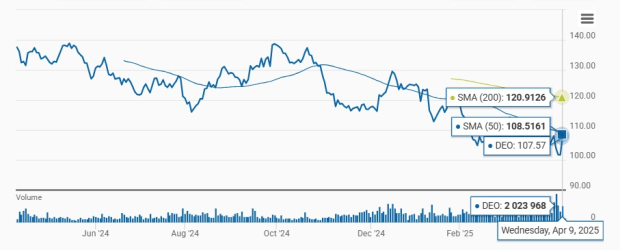

Diageo plc DEO has encountered a notable resistance level, prompting caution among investors from a technical standpoint. The company is trading below both the 200-day and 50-day simple moving averages (SMAs), suggesting a bearish trend.

Currently, at $107.57, DEO remains below its 200-day and 50-day SMA of $120.9 and $108.52, respectively, indicating a possible sustained downward trend.

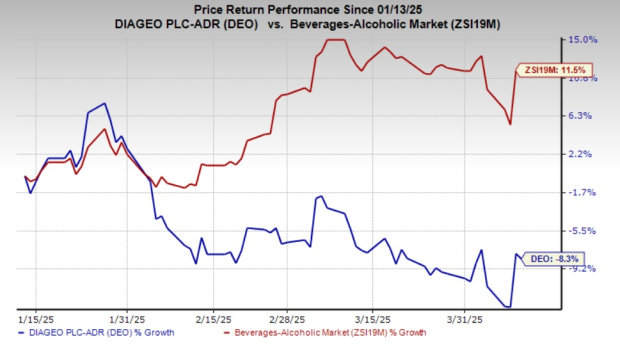

DEO faced significant headwinds recently, underperforming the Zacks Beverages - Alcohol industry. In the past three months, its shares have declined 8.3% against the industry's growth of 11.5%, highlighting company-specific challenges.

Diageo’s weak stock performance is primarily attributed to soft volume trends across key markets, which have adversely impacted the company's top line. In the first half of fiscal 2025, Diageo reported a 0.6% year-over-year decline in net sales due to macroeconomic headwinds, inflationary pressures and cautious consumer sentiment.

Declines in North America, Europe and LAC due to cautious consumer sentiment amid economic uncertainty and inflationary pressures led to a 0.2% drop in total volume, while organic volume remained flat. North America, Europe and LAC witnessed volume declines of 3.4%, 2.8% and 2.3%, respectively.

Diageo's stock has been negatively impacted by a combination of higher overhead costs, including staff and strategic investments, which have hurt profitability. Additionally, foreign exchange fluctuations have had a significant adverse effect on operating profit. These factors, coupled with lower organic operating profit and a contraction in operating margins, have led to investor concern, contributing to the decline in its stock performance.

Diageo’s performance in Asia Pacific showed signs of weakness, with reported net sales declining by 4% in the first half of fiscal 2025. This was due to a combination of factors, including a drop in organic sales, the disposal of Windsor and a reclassification of certain businesses to Europe. Organic net sales fell 2.6% year over year, largely due to challenging macroeconomic conditions in Greater China, difficult trading environments in Southeast Asia, and the previous year’s replenishment of Shui Jing Fang stocks.

The newly imposed 25% U.S. tariffs on goods imported from Canada and Mexico pose significant challenges for Diageo, given its reliance on these regions for production, especially for products like tequila and Canadian whisky, which make up approximately 45% of U.S. net sales. These tariffs are expected to increase input costs, which could squeeze margins and force Diageo into difficult pricing decisions, potentially impacting the competitiveness of its products in the United States.

The new tariffs are likely to disrupt Diageo’s supply chain by increasing production and transport costs, causing delays and inefficiencies. They may also lead to retaliatory tariffs from Canada and Mexico, adding further cost pressures. Combined with ongoing currency fluctuations, these issues create more uncertainty for Diageo’s financial outlook.

The Zacks Consensus Estimate for Diageo’s fiscal 2025 and 2026 earnings per share has declined by 0.5% and 1.5%, respectively, in the last 30 days. The downward revision in earnings estimates indicates that analysts are less confident about the company’s growth potential.

For fiscal 2025, the Zacks Consensus Estimate for AEO’s sales implies a 6.5% year-over-year dip, whereas the EPS estimate indicates a 7% year-over-year decline.

Diageo has been experiencing significant gains from improved price/mix, which have been aiding growth despite soft volume. In the first half of fiscal 2025, organic net sales rose 1% year over year, marking a return to organic sales growth and a sequential improvement from the second half of fiscal 2024. Hence, management expects to continue driving productivity and pricing to offset the cost inflation.

Diageo is refining its $2 billion productivity program to drive efficiency across the business to bring sustainable growth. A key focus is balancing cost savings with strategic reinvestment, particularly in marketing and brand activation. It remains committed to maximizing value while building the right capabilities for success.

Shares of Diageo have faced notable headwinds, underperforming the broader industry. Elevated costs, foreign exchange fluctuations, soft volume trends and the impact of newly imposed tariffs have all weighed on its performance. However, this does not suggest a lack of long-term potential.

Diageo is actively pursuing strategic initiatives, including a focus on premiumization, improved price/mix and a $2 billion productivity program aimed at driving operational efficiency. These efforts position the company for future growth. While the recent pullback in the stock may present a compelling entry point for long-term investors, margin recovery remains a key concern in the near term. Given these dynamics, DEO currently carries a Zacks Rank #3 (Hold).

Primo Brands Corporation PRMB is a branded beverage company with a focus on healthy hydration, delivering sustainably and domestically sourced diversified offerings across products, formats, channels, price points and consumer occasions, distributed primarily in every state and Canada. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Primo Brands’ current financial-year sales and EPS indicates growth of 146.9% and 57.4%, respectively, from the prior-year levels. PRMB has a trailing four-quarter earnings surprise of 7.2%, on average.

Molson Coors Beverage Company TAP, a global manufacturer and seller of beer and other beverage products, has an impressive diverse portfolio of owned and partner brands. TAP currently flaunts a Zacks Rank of 1.

The Zacks Consensus Estimate for Molson Coors’ current financial-year EPS indicates growth of 6.7% from the prior-year levels. The company has a trailing four-quarter earnings surprise of 18.1%, on average.

United Natural Foods, Inc. UNFI distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. It currently carries a Zacks Rank of 2 (Buy). UNFI delivered a trailing four-quarter earnings surprise of 408.7%, on average.

The consensus estimate for United Natural Foods’ current financial-year sales and earnings implies growth of 1.9% and 485.7%, respectively, from the year-ago figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 hours | |

| 13 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite