|

|

|

|

|||||

|

|

Content discovery platform Taboola (NASDAQ:TBLA) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 14.7% year on year to $496.8 million. On top of that, next quarter’s revenue guidance ($537 million at the midpoint) was surprisingly good and 3.3% above what analysts were expecting. Its GAAP profit of $0.02 per share was $0.02 above analysts’ consensus estimates.

Is now the time to buy Taboola? Find out by accessing our full research report, it’s free for active Edge members.

Often appearing as those "You May Also Like" or "Recommended For You" boxes at the bottom of news articles, Taboola (NASDAQ:TBLA) operates a digital platform that recommends personalized content to users across publisher websites, helping both publishers monetize their sites and advertisers reach target audiences.

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.88 billion in revenue over the past 12 months, Taboola is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

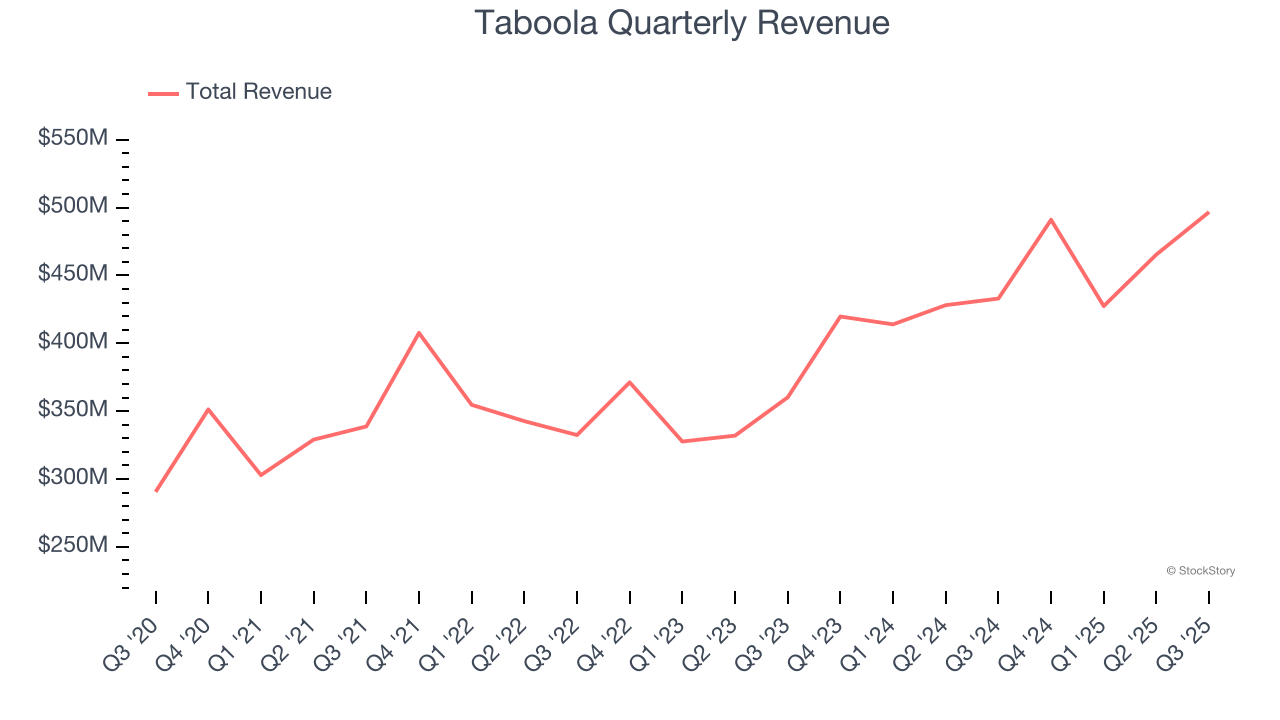

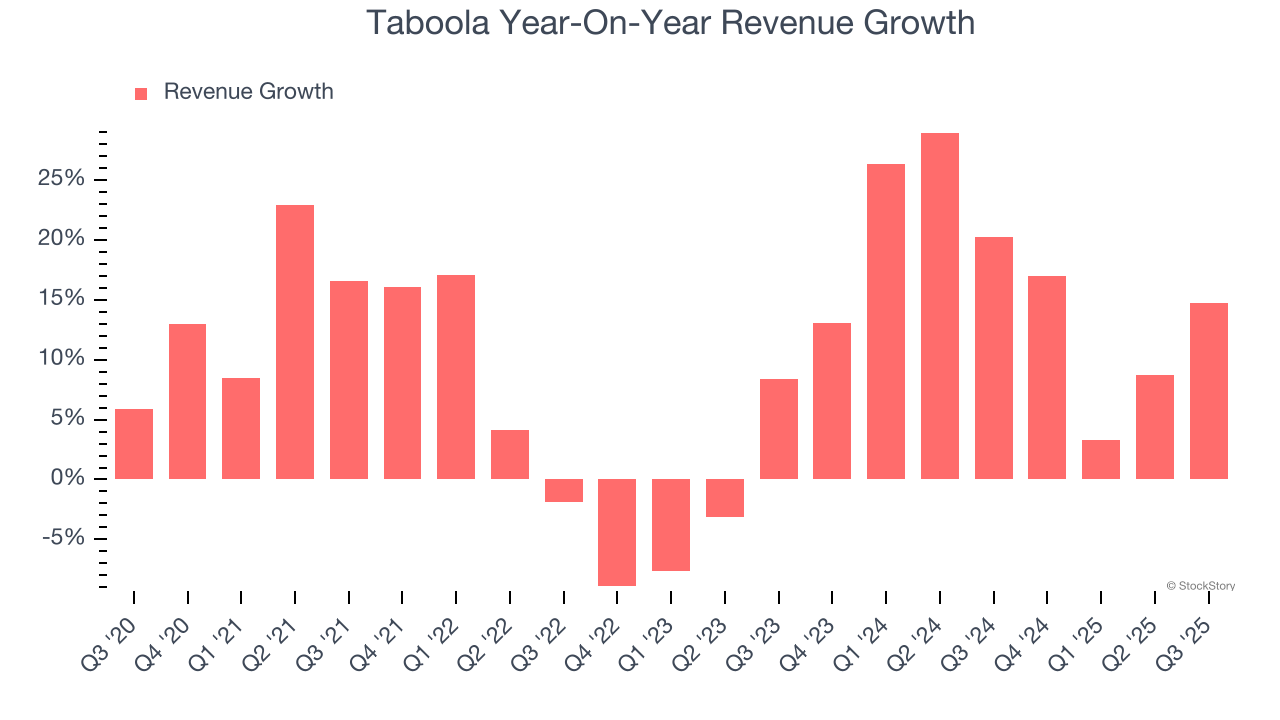

As you can see below, Taboola grew its sales at an impressive 10.4% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Taboola’s annualized revenue growth of 16.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Taboola reported year-on-year revenue growth of 14.7%, and its $496.8 million of revenue exceeded Wall Street’s estimates by 6.3%. Company management is currently guiding for a 9.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above the sector average and suggests the market is forecasting some success for its newer products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

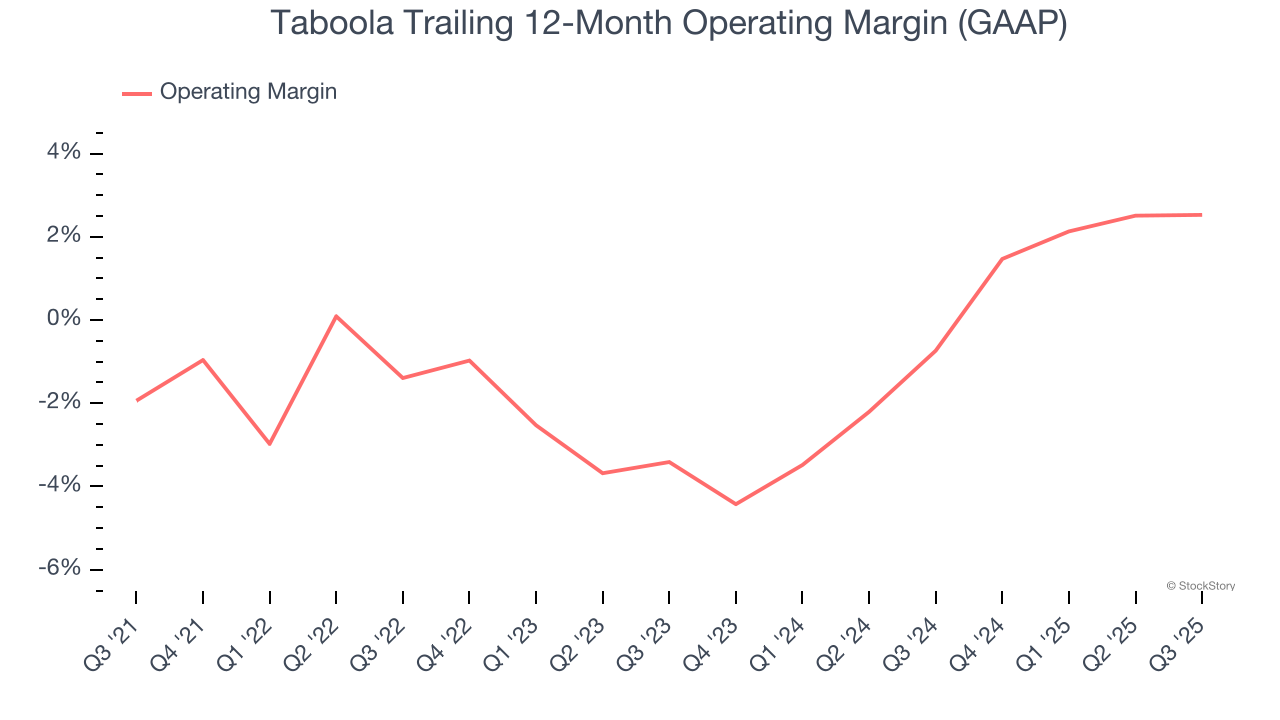

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Taboola was roughly breakeven when averaging the last five years of quarterly operating profits, one of the worst outcomes in the business services sector.

On the plus side, Taboola’s operating margin rose by 4.5 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Taboola generated an operating margin profit margin of 1.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

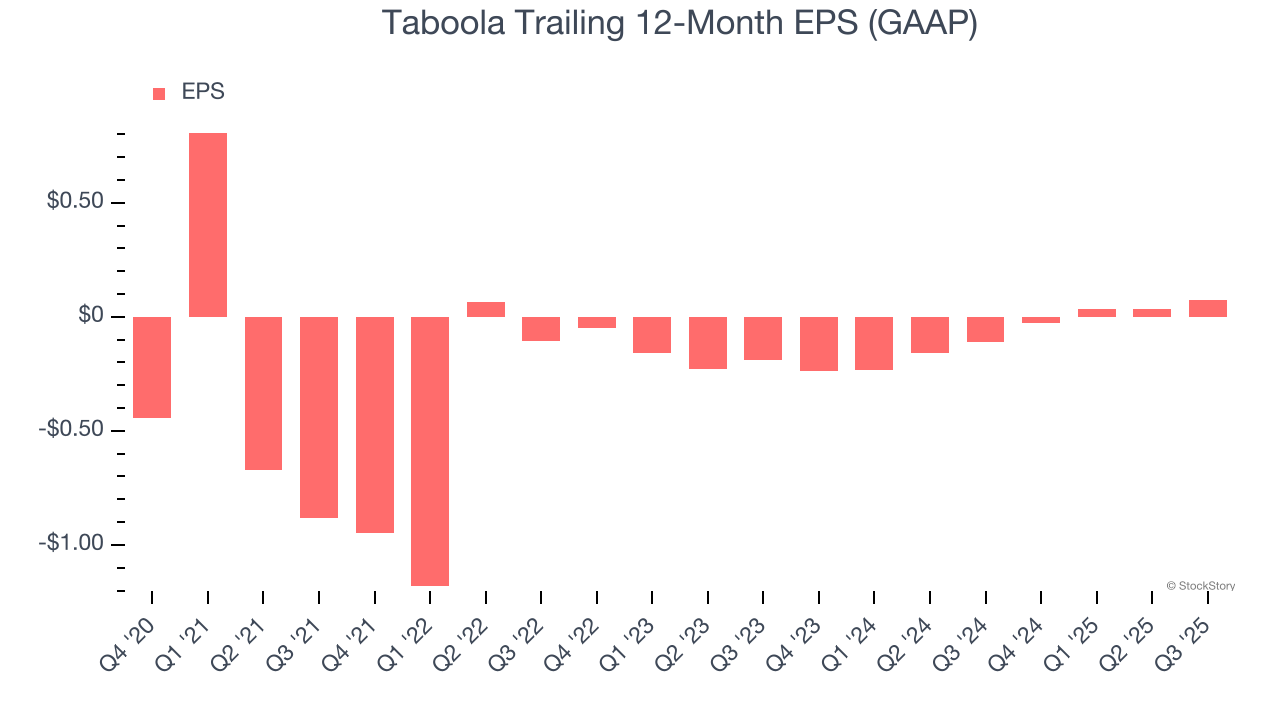

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Taboola’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Taboola, its two-year annual EPS growth of 54.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Taboola reported EPS of $0.02, up from negative $0.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

It was good to see Taboola beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 7.6% to $3.59 immediately after reporting.

Taboola may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| 12 hours | |

| Feb-05 | |

| Jan-28 | |

| Jan-28 | |

| Jan-21 | |

| Jan-20 | |

| Jan-07 | |

| Dec-29 | |

| Dec-22 | |

| Dec-21 | |

| Dec-18 | |

| Dec-15 | |

| Dec-04 | |

| Dec-03 | |

| Dec-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite