|

|

|

|

|||||

|

|

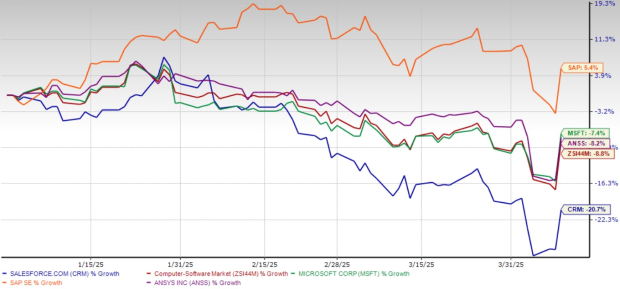

Salesforce, Inc. CRM has had a tough run this year, with the stock falling 20.7% year to date. That’s worse than the broader Zacks Computer – Software industry, which fell 8.8% during the same period. Compared to key competitors like Microsoft Corporation MSFT, SAP SE SAP and ANSYS, Inc. ANSS, Salesforce’s slump appears even more pronounced.

This steep decline raises the question: Should investors cut their losses and exit, or is it worth holding onto? While the near-term headwinds are real, the long-term growth story for Salesforce remains intact, making a strong case for retainment.

The company’s recent slump is part of a larger tech pullback triggered by fears of an escalating tariff war and slowing economic growth. That’s compounded by a less-than-stellar fourth-quarter fiscal 2025 result.

Although revenues grew 7.5% year over year to $9.99 billion, the figure slightly missed the Zacks Consensus Estimate. More concerning is CRM’s guidance, which forecasts that first-quarter and full-fiscal 2026 revenue growth may further slow down to 6-8%. This marks a clear deceleration from the double-digit growth investors had grown accustomed to in the previous years.

Salesforce Inc. price-consensus-eps-surprise-chart | Salesforce Inc. Quote

Enterprise customers are tightening their IT budgets due to economic uncertainty, which has slowed Salesforce’s momentum. Analysts anticipate that this cautious spending environment may persist. The Zacks Consensus Estimate for revenues depicts year-over-year growth of 7.6% in fiscal 2026 and a 9.3% increase in fiscal 2027.

While this is slower than its historical pace, Salesforce is far from a declining business — its leadership position in enterprise customer relationship management (“CRM”) software remains unchallenged.

Despite near-term growth concerns, Salesforce remains the undisputed leader in the field of CRM. The company continues to outpace competitors such as Microsoft, Oracle and SAP, holding the largest market share, according to Gartner’s rankings. This dominance isn’t fading anytime soon.

Salesforce has built an extensive ecosystem that integrates seamlessly across enterprise applications. Its acquisitions — such as Slack and, more recently, the Own Company — demonstrate a long-term strategy of expanding its footprint beyond CRM into enterprise collaboration, data security and artificial intelligence (AI)-driven automation.

AI is a key part of Salesforce’s growth engine. Since launching Einstein GPT in 2023, the company has embedded generative AI capabilities across its entire platform, allowing customers to automate workflows, enhance decision-making and improve customer interactions. As generative AI adoption accelerates across industries, Salesforce is positioned to capitalize on this trend.

Another long-term tailwind is rising global spending on generative AI. Gartner estimates that worldwide generative AI spending will hit $644 billion in 2025, implying a 76.4% year-over-year increase. Enterprise software, a key segment for Salesforce, is expected to grow even faster, with a projected 93.9% increase. Even if economic conditions slow down spending in the short term, digital transformation remains a top priority for businesses, ensuring steady demand for Salesforce’s solutions.

One of the silver linings of the recent sell-off is that Salesforce’s valuation has become more reasonable. The stock currently trades at a forward 12-month price-to-earnings (P/E) multiple of 23.31x, below the industry average of 27.82x. While not necessarily cheap, this valuation suggests that much of the near-term pessimism is already priced in.

Also, Salesforce is trading at a lower P/E multiple compared with industry peers such as Microsoft, ANSYS and SAP. At present, Microsoft, ANSYS and SAP have P/E multiples of 27.25x, 25.93x and 37.42x, respectively.

Salesforce’s recent struggles stem from a broader market correction and concerns about slowing growth. However, given its dominant position in enterprise software, ongoing AI initiatives and strong long-term growth potential, the recent pullback does not justify an exit.

Its valuation has also become more attractive relative to historical levels. While the company faces short-term headwinds, its fundamentals remain intact, making it worth holding onto. Salesforce carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 39 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite