|

|

|

|

|||||

|

|

Eli Lilly’s LLY key top-line drivers are its GLP-1 medicines, Mounjaro for type II diabetes and Zepbound for obesity. Despite being on the market for around three years, Mounjaro and Zepbound have become key top-line drivers for Lilly, with demand rising rapidly. Mounjaro and Zepbound account for more than 50% of the company’s total revenues.

Mounjaro and Zepbound include the same compound, tirzepatide, a dual GIP and GLP-1 receptor agonist. The GLP-1 segment is a very important class of drugs for multiple cardiometabolic diseases and is gaining significant popularity.

In the United States. Mounjaro is the market leader in new prescriptions within type II diabetes incretin analogs, while Zepbound also holds a leading market share in the anti-obesity market.

Mounjaro recorded sales of $6.52 billion in the third quarter, rising 109% year over year. While sales continue to remain strong in the United States, the growth was mainly driven by robust outperformance in ex-U.S. markets, benefiting from launches in new markets. Zepbound recorded sales of $3.59 billion in the quarter, up 185% year over year.

Launches of Mounjaro and Zepbound in new international markets and improved supply from ramped-up production in the United States have led to strong sales growth in 2025.

Mounjaro is now launched in all major ex-U.S. markets and is gaining significant share in most major markets. Lilly is also seeing increased out-of-pocket use of Mounjaro for obesity in ex-U.S. markets despite limited reimbursement, suggesting high demand for weight loss drugs. Approximately 75% of Mounjaro revenues outside the United States are coming from people with obesity, and 25% from the type II diabetes indication. In some ex-U.S. markets, Mounjaro is approved for treating both type II diabetes and weight management.

In the third quarter, Zepbound’s total U.S. prescriptions in the branded anti-obesity market declined by approximately 2 percentage points compared to the second quarter due to disruption from the formulary changes made by CVS Caremark. Effective July 1, CVS Caremark, a major pharmacy benefit manager, began excluding Zepbound from its preferred drug list while retaining NVO’s obesity drug, Wegovy.

However, on the conference call, Lilly mentioned that Zepbound’s performance has improved and is back to the second-quarter levels. Zepbound exited the third quarter with a 71% share of new prescriptions.

Approvals for new indications can also drive sales of Mounjaro and Zepbound higher in the future quarters. In late December, the FDA approved Zepbound for its second indication, moderate-to-severe obstructive sleep apnea (OSA) in adults with obesity. Based on positive data from a phase III cardiovascular outcome study, Lilly plans to submit global regulatory applications to support a label cardiovascular indication by the end of 2025. Lilly is also conducting a phase III study for tirzepatide for type 1 diabetes. Lilly has also submitted an application for tirzepatide for pediatric and adolescent type II diabetes in the United States and the EU. Tirzepatide is also being evaluated in a phase II study for the treatment of metabolic dysfunction-associated steatotic liver disease.

The obesity market is heating up and is expected to expand to $100 billion by 2030, according to data from Goldman Sachs. Lilly and Novo Nordisk NVO presently dominate the market.

Mounjaro and Zepbound face strong competition from Novo Nordisk’s semaglutide medicines, Ozempic for diabetes and Wegovy for obesity.

Recently, President Trump announced deals with Lilly and Novo Nordisk to cut prices of Zepbound and Wegovy in exchange for Medicare access for the drugs and a three-year exemption from tariffs on pharmaceutical imports.

Both Lilly and NVO are investing broadly in obesity and have several new molecules currently in clinical development, including a range of oral and injectable medications with different mechanisms of action. Lilly’s next-generation obesity candidates are orforglipron, a once-daily oral GLP-1 small molecule, and retatrutide, a GGG tri-agonist, both in late-stage development.

Lilly plans to file regulatory applications for orforglipron in obesity later this year, setting up the timeline for a potential launch next year.

Several other companies, like Amgen and Viking Therapeutics VKTX, are also making rapid progress in the development of more potent and convenient GLP-1-based candidates in their clinical pipeline.

Viking Therapeutics’ dual GIPR/GLP-1 receptor agonist, VK2735, is being developed both as oral and subcutaneous formulations for the treatment of obesity.

NVO, LLY and VKTX are racing to introduce oral weight-loss pills, as Wegovy and Zepbound are both injectable drugs. Novo Nordisk has already filed a new drug application (NDA) for an oral version of Wegovy and also has several next-generation candidates in its obesity pipeline, like CagriSema (a combination of semaglutide and cagrilintide) and an oral pill, amycretin (a dual GLP-1 and amylin receptor agonist). The FDA is expected to decide on the Wegovy oral formulation NDA later this year.

Others like Roche, Merck and AbbVie are also looking to enter the obesity space by in-licensing obesity candidates from smaller biotechs, which could threaten Novo Nordisk and Eli Lilly’s dominance in the market. Pfizer PFE is looking to buy obesity drugmaker Metsera to gain a foothold in the obesity space. Pfizer is locked in a fierce battle with Novo Nordisk relating to its offer to buy Metsera.

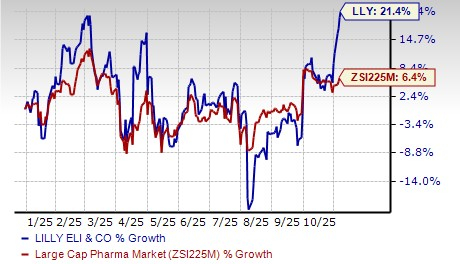

Lilly’s stock has risen 21.4% so far this year compared with the industry’s increase of 6.4%.

From a valuation standpoint, Lilly’s stock is expensive. Going by the price/earnings ratio, the company’s shares currently trade at 31.55 forward earnings, higher than 15.60 for the industry. However, the stock is trading below its 5-year mean of 34.54.

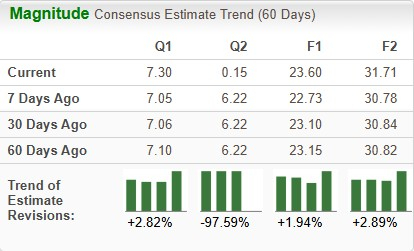

Estimates for Lilly’s 2025 earnings have risen from $23.10 to $23.60 per share in the past 60 days, while those for 2026 have risen from $30.84 to $31.71 over the same timeframe.

Lilly has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 22 min | |

| 45 min | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours |

Novo Nordisk Licenses Vivtex Tech for Up to $2.1 Billion to Deepen Obesity Push

NVO

The Wall Street Journal

|

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite