|

|

|

|

|||||

|

|

The Hain Celestial Group, Inc. HAIN posted first-quarter fiscal 2026 results, with the top and bottom lines declining year over year. The top line surpassed the consensus mark and the bottom line missed the same. However, HAIN shares rallied 12.2% yesterday as investors responded positively to the company’s latest quarterly update and management’s confident tone on its turnaround progress.

The company emphasized cost discipline, SG&A reductions and early benefits from pricing and trade efficiencies. The upbeat commentary around ongoing strategic actions, including a review with Goldman Sachs, and a focus on stabilizing growth and reducing debt, strengthened market confidence in Hain Celestial’s ability to rebuild profitability and long-term value.

The Hain Celestial Group, Inc. price-consensus-eps-surprise-chart | The Hain Celestial Group, Inc. Quote

The company posted an adjusted loss of 8 cents per share, wider than the Zacks Consensus Estimate for an adjusted loss of 4 cents. The bottom line also declined from the adjusted loss of 4 cents incurred in the year-ago quarter.

Net sales of $367.9 million beat the consensus estimate of $362 million. The top line declined 6.8% year over year. Organic net sales fell 5.8% from the same period last year, reflecting a 7-point decrease in the volume/mix, partially offset by a 1-point increase in pricing.

The adjusted gross profit was $71.9 million, which fell 12.3% from the year-ago quarter. The adjusted gross margin contracted 130 basis points (bps) from the year-ago quarter to 19.5%, lagging our estimate of 20.4%.

SG&A expenses were $65.5 million, down 8.2% from $71.3 million in the year-ago quarter. As a percentage of net sales, this metric decreased 30 bps year over year to 17.8% in the quarter under review.

Adjusted EBITDA was $19.7 million, down 11.8% from $22.4 million in the year-ago quarter. The adjusted EBITDA margin was 5.4%, meeting our estimate and declining 30 bps year over year.

Net sales in the North America segment dropped 11.8% year over year to $203.9 million, falling short of our estimate of $205.3 million. Organic net sales for the segment declined 7.4% due to softer snack volumes, partially offset by growth in beverages, baby & kids, and meal prep categories.

Adjusted gross profit came in at $46.2 million, down 3% from the prior-year quarter. Meanwhile, the adjusted gross margin expanded 210 basis points to 22.7%, driven by productivity gains and pricing and trade efficiencies, partially offset by an unfavorable volume/mix and cost inflation.

Adjusted EBITDA rose 36.5% to $17 million from $12.5 million a year ago. The improvement was primarily fueled by productivity savings, reduced SG&A expenses, and pricing and trade efficiencies, partly offset by volume/mix pressures and cost inflation. As a result, the adjusted EBITDA margin increased 290 bps to 8.3% from 5.4% in the prior-year period.

Net sales in the International segment totaled $164 million, beating our estimate of $158.4 million and marking a modest 0.3% increase from the year-ago quarter. However, organic net sales declined 3.9%, reflecting weaker performance in the baby & kids category, partially offset by growth in meal prep.

Adjusted gross profit for the segment was $25.7 million, down 25.2% year over year. The adjusted gross margin contracted 530 basis points to 15.7% due to unfavorable volume/mix and cost inflation, partially offset by productivity savings and pricing, and trade efficiencies.

Adjusted EBITDA decreased 38.4% to $12.6 million from $20.4 million in the prior-year period. The decline was mainly attributed to a lower volume/mix and cost inflation, partially mitigated by productivity improvements and pricing and trade efficiencies. Consequently, the adjusted EBITDA margin fell 480 bps to 7.7% from 12.5% a year earlier.

In the Snacks category, organic net sales declined 17.2% year over year, driven by continued velocity challenges and distribution losses in North America.

In the Baby & Kids category, organic net sales fell 9.5%, reflecting industry-wide volume softness in purees, particularly in the U.K.

In Beverages, organic net sales increased 1.8%, primarily driven by growth in tea products in North America.

For the Meal Prep category, organic net sales inched up 0.2%, as strong performance in yogurt was largely offset by weaker sales of meat-free products in the U.K. and soup in North America.

The company closed the quarter with cash and cash equivalents of $47.9 million, long-term debt (excluding the current portion) of $708.6 million, and total shareholders’ equity of $445 million.

Net cash used in operating activities was $8.5 million for the quarter compared with $10.8 million in the prior-year period.

Free cash flow for the quarter was an outflow of $14 million compared with an outflow of $17 million in the prior-year period. The improvement was primarily driven by better inventory management and delivery, partially offset by lower accounts receivable recovery and a decline in cash earnings.

Capital expenditure (CapEx) totaled $5 million for the quarter, down from $6 million in the prior-year period. The company expects fiscal 2026 CapEx to be $30 million.

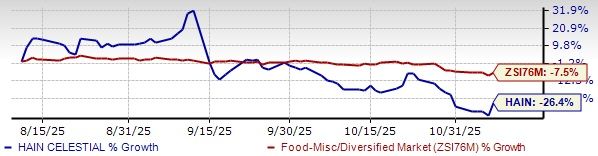

HAIN Stock Past 3-Month Performance

Shares of this Zacks Rank #5 (Strong Sell) company have lost 26.4% in the past three months compared with the industry’s 7.5% decline.

We have highlighted three better-ranked stocks, namely Lamb Weston Holdings, Inc. LW, United Natural Foods, Inc. UNFI and Chefs' Warehouse Holdings, LLC CHEF.

Lamb Weston is a leading global manufacturer, marketer and distributor of value-added frozen potato products, particularly French fries, and also provides a range of appetizers. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

LW delivered a trailing four-quarter earnings surprise of 16.1%, on average. The consensus estimate for Lamb Weston’s current fiscal-year sales and earnings indicates growth of 1.3% and decline of 6.3%, respectively, from the year-ago period’s reported figures.

United Natural Foods is the leading distributor of natural, organic and specialty food and non-food products. It flaunts a Zacks Rank of 1 at present.

The Zacks Consensus Estimate for United Natural Foods’ current fiscal-year earnings and revenues implies growth of 167.6% and 1%, respectively, from the year-ago actuals. UNFI delivered a trailing four-quarter average earnings surprise of 416.2%.

Chefs' Warehouse is a distributor of specialty food products. It currently sports a Zacks Rank of 1.

The Zacks Consensus Estimate for Chefs' Warehouse’s current financial-year earnings and revenues implies growth of 29.3% and 8.1%, respectively, from the year-ago actuals. CHEF delivered a trailing four-quarter average earnings surprise of 14.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 52 min | |

| Feb-23 | |

| Feb-21 | |

| Feb-19 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite