|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

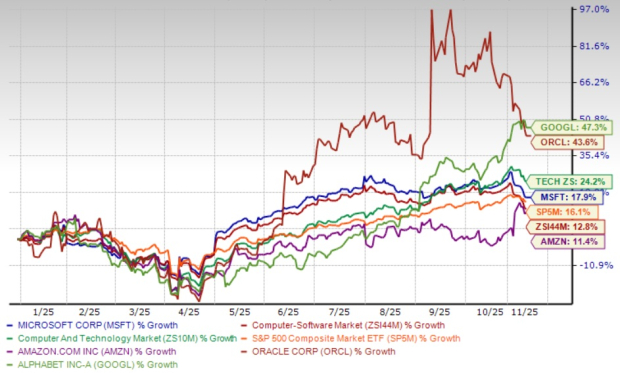

Microsoft MSFT shares have gained 17.9% year to date, outperforming the S&P 500, driven primarily by robust demand for its Azure cloud infrastructure and AI services. However, despite strong fundamentals and impressive cloud momentum, investors may be better served by adopting a cautious stance in the near term. The stock's premium valuation, coupled with capacity constraints and execution challenges, suggests that waiting for a more favorable entry point could prove prudent for new investors, while existing shareholders should maintain their positions given the company's long-term competitive advantages.

Microsoft's cloud business continues to demonstrate substantial momentum, with Azure posting consistent growth above 30% as enterprise demand for AI-enhanced cloud services accelerates. The company's AI business has achieved a remarkable milestone, surpassing a $13 billion annual revenue run rate, representing 175% year-over-year growth. This performance underscores Microsoft's strategic positioning at the intersection of cloud infrastructure and artificial intelligence, two sectors expected to drive technology spending through the remainder of the decade.

However, operational realities present near-term constraints on this growth trajectory. Management has acknowledged that Azure will remain capacity-constrained through at least the end of the fiscal year, as demand significantly outpaces current infrastructure buildout. This constraint introduces execution risk and may limit revenue acceleration potential in the coming quarters.

Despite near-term challenges, Microsoft's fundamental business strengths provide compelling reasons to hold existing positions. The company maintains dominant market positions across multiple high-value software categories, including productivity applications through Microsoft 365, enterprise resource planning via Dynamics 365, and professional networking through LinkedIn. These businesses generate substantial recurring revenue streams with high customer retention rates, providing predictable cash flows that fund continued investment in growth initiatives.

Microsoft's cloud infrastructure enjoys significant competitive advantages that should support sustained market share gains. The company's global data center footprint spans more regions than any other cloud provider, enabling enterprises to meet data residency and compliance requirements across diverse geographies. Azure's deep integration with Windows Server, Active Directory, and other Microsoft enterprise products creates switching costs that lock in existing customers and facilitate cloud migration projects. The partnership with OpenAI provides exclusive access to leading-edge AI models, differentiating Azure from competing cloud platforms.

The company's financial profile remains robust, with strong profitability metrics and cash generation supporting both shareholder returns and growth investments. Microsoft returned $10.7 billion to shareholders through dividends and share repurchases in the most recent quarter, demonstrating a commitment to capital allocation discipline. The company's balance sheet provides flexibility to fund aggressive capital expenditure programs required to expand cloud capacity while maintaining investment-grade credit quality.

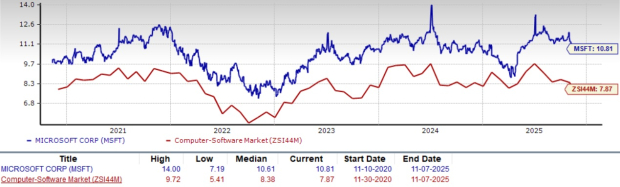

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

Microsoft currently trades at a forward price-to-sales ratio of 10.81 times, representing a significant premium to the Zacks Computer-Software industry average of 7.87 times. This valuation multiple reflects investor enthusiasm for Microsoft's cloud and AI positioning but suggests limited margin for error. The stock reached an all-time high of $555.45 in late October 2025 before retreating, indicating some profit-taking and valuation recalibration already underway.

The broader cloud computing market continues to expand rapidly, with industry projections indicating growth from approximately $1.3 trillion in 2025 to $2.3 trillion by 2030, representing a compound annual growth rate of roughly 12%. AI workloads are emerging as a primary growth driver across the industry, with AI-specific cloud services experiencing growth rates exceeding 140% in recent quarters. This secular tailwind supports Microsoft's long-term growth prospects, though near-term results may experience volatility as capacity comes online and competitive dynamics evolve.

Microsoft faces fierce competition across cloud infrastructure and AI services from several well-capitalized rivals. Amazon AMZN Web Services continues to hold the leading position in cloud infrastructure with a 31% market share and reported accelerating growth of 20.2% year over year, reaching $33 billion in quarterly revenues. Amazon recently announced a massive $38 billion deal with OpenAI, demonstrating its commitment to capturing AI workload share. Amazon has added more than 3.8 gigawatts of power capacity over the past 12 months, exceeding any other cloud provider and positioning Amazon to capitalize on surging AI infrastructure demand.

Alphabet GOOGL-owned Google's custom Tensor Processing Units provide a differentiated infrastructure offering, with the recent multi-billion-dollar Anthropic partnership validating Google Cloud's AI capabilities. Google Cloud processes 7 billion tokens per minute through direct API usage, demonstrating scale in generative AI deployments. Google's operating margin improved to 23.5%, showing profitability momentum that enables aggressive competitive pricing and continued infrastructure investment.

Oracle ORCL projects cloud infrastructure revenues to surge from approximately $10 billion in fiscal 2025 to $144 billion by fiscal 2030, implying sustained 77% annual growth rates. Oracle's purpose-built AI data centers and multi-cloud partnerships with Amazon, Microsoft, and Google position Oracle uniquely in the market. Oracle's aggressive capital expenditure program, with fiscal 2025 spending exceeding $16 billion, signals its determination to capture market share in AI infrastructure despite trading at elevated valuation multiples.

Given Microsoft's premium valuation relative to industry peers, near-term capacity constraints, and intensifying competition, a hold recommendation appears most appropriate for current shareholders. The company's durable competitive advantages, including its installed base of enterprise customers, integrated product portfolio, and strategic AI partnerships, support confidence in long-term value creation. Microsoft's recurring revenue model and strong cash generation provide downside protection, while exposure to secular cloud and AI growth trends offers meaningful upside potential. Microsoft currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

10 Companies Churn Out A Whopping Third Of The S&P 500's Profit

MSFT GOOGL

Investor's Business Daily

|

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite