|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

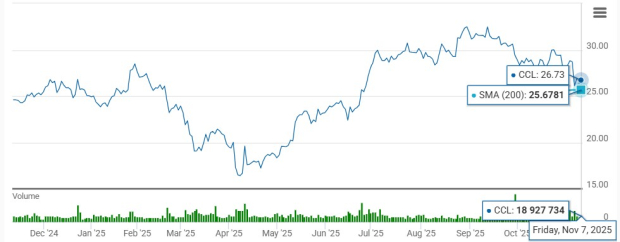

Shares of Carnival Corporation & plc CCL have rallied 20.8% in the past six months against the Zacks Leisure and Recreation Services industry’s fall of 0.2%. Over the same timeframe, the stock has outperformed the S&P 500’s growth of 17.7%.

This impressive run reflects strengthening fundamentals. Carnival’s momentum has been fueled by robust booking trends, sustained yield growth and disciplined operational execution across its global portfolio. The successful launch of Celebration Key, coupled with solid close-in demand and elevated onboard spending, has reinforced the company’s pricing power and guest engagement.

At the same time, cost management initiatives, efficiency improvements and steady deleveraging have fortified the balance sheet, laying a strong foundation for long-term growth. With improving returns, limited capacity expansion and potential shareholder return reinstatements on the horizon, Carnival’s strategic execution continues to enhance profitability and earnings visibility.

As of Friday, Carnival stock is trading 18.5% below its 52-week high of $32.80 (attained on Sept. 11, 2025). So, should investors pour more capital into CCL now? Let us take a closer look.

Carnival’s recent outperformance is underpinned by resilient global demand and firm pricing momentum across its markets. The company continues to report record booking volumes, with advance reservations outpacing capacity growth and pricing strength evident in both North American and European regions.

Strong onboard spending and rising demand for premium, experience-driven offerings have further supported yield expansion and margin improvement across its portfolio. At the same time, Carnival’s exclusive destinations continue to serve as a key differentiator in a competitive market. The successful debut of Celebration Key and planned enhancements to Half Moon Cay are expanding the company’s network of high-value destinations — allowing for premium pricing, enhanced guest engagement and deeper brand loyalty.

In addition, ongoing modernization efforts, including AIDA’s Evolution initiative, are improving fleet efficiency, elevating the guest experience and unlocking incremental returns from existing assets. Together, these initiatives reflect a clear focus on operational excellence and long-term value creation.

Operational efficiency remains a cornerstone of Carnival’s growth strategy. The company continues to drive cost reductions through energy optimization, scale leverage and disciplined expense management. Limited capacity expansion has helped preserve pricing power, while targeted investments in technology and process automation are bolstering margins and enhancing resilience across operations.

Carnival’s balance sheet strength has also improved meaningfully. Ongoing deleveraging efforts and credit-quality improvements have moved the company closer to investment-grade leverage levels, reflecting prudent financial stewardship. Strong cash flow generation provides flexibility to pursue strategic investments while paving the way for the resumption of shareholder returns.

Collectively, these operational and financial advancements demonstrate Carnival’s successful evolution from a post-pandemic recovery story to one defined by sustained, fundamentals-driven growth and expanding profitability.

The company raised its guidance for fiscal 2025. It now anticipates adjusted EBITDA to be approximately $7.05 billion (up from the previous expectation of about $6.9 billion), indicating more than 15% growth year over year. Adjusted net income is now anticipated to be about $2.925 billion, up from the previously expected value of $2.69 billion. CCL now expects adjusted EPS to be approximately $2.14, up from $1.97 expected earlier.

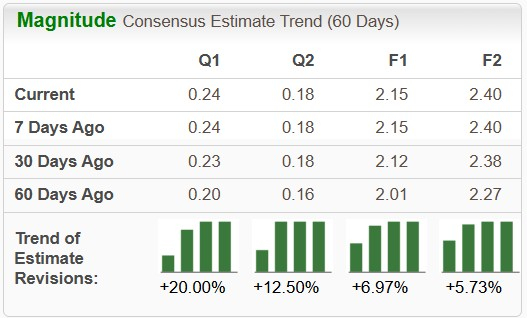

This upgraded outlook reflects continued strength in bookings, sustained pricing power and enhanced cost efficiencies across brands. Over the past 60 days, the Zacks Consensus Estimate for Carnival’s fiscal 2025 EPS has been revised upward, increasing from $2.01 to $2.15. This upward trend reflects strong analyst confidence in the stock’s near-term prospects.

The 60-day earnings estimate growth trend for CCL remains higher for 2025 compared with other industry players, including Royal Caribbean Cruises Ltd. RCL, Norwegian Cruise Line Holdings Ltd. NCLH and OneSpaWorld Holdings Limited OSW. Over the past 60 days, earnings estimates for 2025 for RCL, NCLH and OSW have increased 0.1%, 3.5% and 1% respectively, in the same time frame.

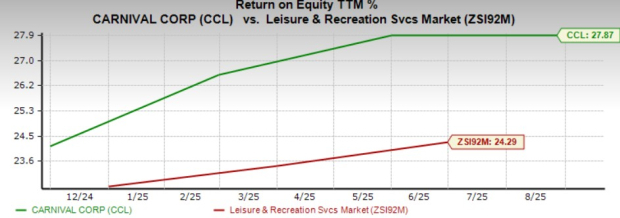

CCL has shown impressive profitability, with a trailing 12-month return on equity of 27.87%, significantly higher than the industry average of 24.29%. This metric suggests that the company is efficiently using shareholders’ funds to generate returns, which can be a positive sign for long-term investors.

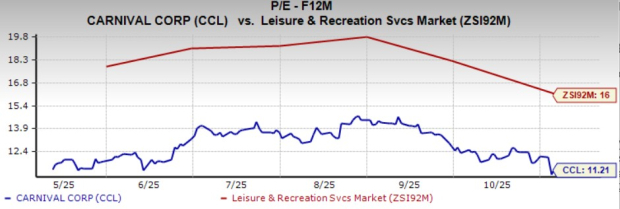

Carnival stock is currently trading at a discount. It is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 11.21, well below the industry average of 16, reflecting an attractive investment opportunity. Other industry players, such as Royal Caribbean, Norwegian Cruise and OneSpaWorld, have P/E ratios of 14.61, 7.33 and 19.07, respectively.

From a technical perspective, CCL is currently trading above its 200-day moving average, indicating strong upward momentum and price stability.

While Carnival’s recent rally underscores growing investor confidence, its core fundamentals suggest further upside potential. Record booking volumes, strong onboard spending and expanding destination offerings are reinforcing pricing strength and earnings visibility into 2026 and beyond. Coupled with widening margins, upgraded fiscal 2025 guidance and consistent balance sheet improvement, the company’s growth trajectory remains solid.

Despite rising estimates and accelerating demand, CCL stock continues to trade below its intrinsic value, creating an attractive entry point. Analysts expect continued profitability gains as management executes on operational efficiencies and capital discipline.

For investors looking to participate in this momentum, Carnival offers a compelling opportunity. The combination of robust fundamentals, steady execution and an appealing valuation makes this Zacks Rank #1 (Strong Buy) stock a timely pick in the travel and leisure space. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 28 min | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite