|

|

|

|

|||||

|

|

Lam Research LRCX and ASML Holding ASML are two of the biggest names in the semiconductor equipment industry. Both companies provide essential tools that are integral to the chipmaking process.

The two companies are playing a critical role in powering the artificial intelligence (AI)-driven boom in chip fabrication. As chipmakers rush to expand capacity for advanced nodes used in AI, 5G and high-performance computing, these two stocks have attracted significant attention.

While both benefit from the same industry tailwinds, their fundamentals, growth outlook and valuations offer different risk-reward profiles for investors considering semiconductor infrastructure exposure. Let’s see which stock is a better buy right now based on the abovementioned factors.

Lam Research is capitalizing on AI trends. It builds the tools chipmakers need to manufacture next-generation semiconductors, including high-bandwidth memory (HBM) and chips used in advanced packaging. These technologies are vital for powering AI and cloud data centers.

Lam Research’s products are not only critical but also innovative. For example, its ALTUS ALD tool uses molybdenum to improve speed and efficiency in chip production. Another product, the Aether platform, helps chipmakers achieve higher performance and density. These are essential capabilities as demand for advanced AI chips increases.

In 2024, Lam Research’s shipments for gate-all-around nodes and advanced packaging exceeded $1 billion, and management expects this figure to triple to more than $3 billion in 2025. Additionally, the industry’s migration to backside power distribution and dry-resist processing presents growth opportunities for LRCX’s cutting-edge fabrication solutions.

These trends are aiding Lam Research’s financial performance. The company has demonstrated consistent execution, maintaining more than $5 billion in quarterly revenues for the past two consecutive quarters, reflecting solid demand from leading chipmakers such as TSMC, Samsung and Micron. Lam Research’s strength lies in its leadership in etch and deposition equipment, which are essential for high-performance computing and AI chip production.

In the first quarter of fiscal 2026, the company reported revenues of $5.32 billion, up 28% year over year, and non-GAAP earnings per share (EPS) of $1.26, highlighting a 46.5% increase.

ASML Holding has a clear advantage in the chip equipment market. It is the only company capable of producing extreme ultraviolet (EUV) lithography machines at scale. These machines are needed to make chips at 5nm, 3nm and soon 2nm levels — key to powering artificial intelligence (AI) processors, mobile devices and data centers.

The company is already rolling out its next-generation High-NA EUV machines, which will be used for even smaller chips. As the demand for faster and more efficient chips rises, especially with the growth of AI, ASML Holding stands to benefit. Its machines are a necessary part of the chip supply chain, and its customers, including TSMC, Intel and Samsung, will rely on ASML’s technology for years to come.

Despite its technological superiority, the ongoing trade war between the United States and China is likely to continue hurting ASML Holding’s growth in the near term. U.S. pressure on the Dutch government has led to export restrictions on some of ASML’s most advanced equipment.

The company’s sales growth has already slowed down. In the last reported results for the third quarter of 2025, revenues increased by a mere 0.7% year over year, significantly lower than 23% in the second quarter and 46% in the first quarter. Similarly, earnings per share grew 3.8% year over year compared with 47% in the second quarter and 93% in the first quarter.

The company has previously stated that ongoing U.S.-China tariff discussions, including the Section 232 tariff review, are negatively impacting customer capital spending timelines. This hesitation may delay orders and revenue recognition in late 2025 and into 2026, casting doubt on near-term growth continuity.

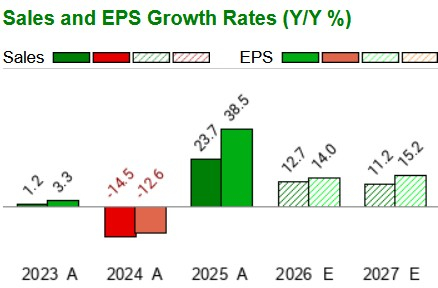

Looking at the Zacks Consensus Estimate for revenues and EPS, Lam Research has a steadier long-term growth profile than ASML Holding. The consensus mark for Lam Research’s fiscal 2026 and 2027 revenues indicates year-over-year growth of 12.7% and 11.2%, respectively. Non-GAAP EPS is expected to rise 14% in fiscal 2026 and 15.2% in fiscal 2027.

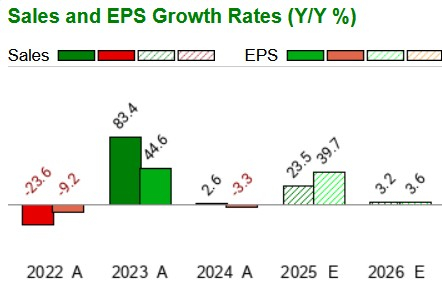

Estimates for ASML Holding’s revenues and EPS for 2025 suggest growth of 23.5% and 39.7%, respectively. However, this growth rate is anticipated to decelerate to 3.2% for revenues and 3.6% for EPS in 2026.

Year to date, shares of Lam Research and ASML Holding have surged 130.3% and 49.9%, respectively.

On the valuation front, Lam Research trades at 33.39 times forward earnings compared to 34.64 times for ASML Holding. While both companies are of high quality, LRCX looks more reasonably priced, especially considering its stronger near-term momentum.

Both Lam Research and ASML Holding are set to benefit from the AI-driven semiconductor investment cycle. However, Lam Research’s broader exposure to high-growth AI and memory markets, coupled with a lower valuation, gives it the edge for investors seeking stronger upside potential.

Currently, Lam Research sports a Zacks Rank #1 (Strong Buy), making the stock a must-pick compared to ASML Holding, which has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite