|

|

|

|

|||||

|

|

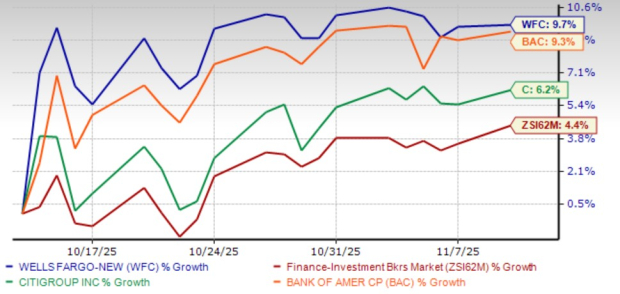

Wells Fargo & Company WFC shares have risen 9.7% in the past month, outperforming the industry’s 4.4% growth. It has also outpaced its close peers, Bank of America BAC and Citigroup, Inc. C rises of 9.3% and 6.2%, respectively, over the same time frame.

Price Performance

Given such a strength in its share price, many investors must be wondering whether to add the WFC stock to their portfolios now. Let us analyze the major factors at play and decide on the investment worthiness of the Wells Fargo stock.

Wells Fargo reached a pivotal moment in June 2025 as the Federal Reserve lifted the $1.95-trillion asset cap imposed in 2018, following its fake account scandal. The asset cap had restricted balance sheet growth, limiting the bank’s full potential. The removal of the growth restriction reflects the substantial progress that the bank has made in addressing its deficiencies and the fact that the bank has fulfilled the conditions required for the removal of the growth restriction.

With the elimination of the asset cap, WFC can now boost deposits, grow its loan portfolio and broaden its securities holdings. This will result in a rise in NII, a significant source of income for banks, since the balance sheet may include more interest-earning assets.

Furthermore, Wells Fargo will have more exposure to expand fee-generating activities like payment services, asset management and mortgage origination. The bank has significantly increased its trading-related assets, up about 50% since the end of 2023, and is accelerating growth in investment banking, wherein fees rose 19% in the first nine months of 2025.

Freed from prior balance sheet constraints, WFC is now re-engaging in deposit growth, focusing on expanding checking accounts through enhanced marketing and digital onboarding. Additionally, the bank is strengthening its credit card portfolio, with new accounts rising 9% in the first nine months of 2025, reflecting improved customer penetration and diversified fee income streams. These efforts will enhance the company’s profitability.

WFC financials are influenced by the Federal Reserve's rate-cutting trajectory. The Federal Reserve cut rates twice this year to 3.75-4%, following a 100-bps cut in 2024.

With relatively lower rates, lending activity will likely increase. Also, easing regulatory capital requirements will help channel excess capital into loan growth. Hence, Wells Fargo will likely witness a decent demand for loans, which will support NII expansion. Management expects Wells Fargo’s fourth-quarter 2025 NII to be $12.4-$12.5 billion, whereas it reported $11.8 billion a year ago.

Likewise, Bank of America and Citigroup are likely to demonstrate resilience and steady growth in NII in the upcoming period. For 2025, Citigroup expects NII (excluding Markets) to grow 5.5%. BAC projects a 5-7% year-over-year increase in NII for 2026, after similar growth this year.

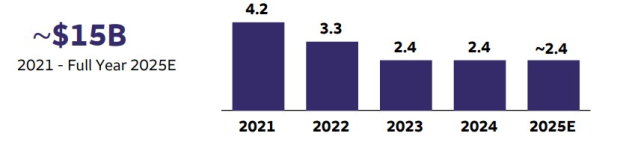

Wells Fargo has been making progress on various initiatives to achieve cost efficiency. The company is actively engaged in cost-cutting measures, including streamlining organizational structure, branch closure, and headcount reductions. Its non-interest expenses witnessed a negative compounded annual growth rate (CAGR) of 1.3% over the last four years (ended 2024). However, the trend reversed in the first nine months of 2025.

The company keeps investing in and optimizing its branch network to reduce costs. It is being more deliberate about branch location strategy, as the number of branches declined 2.1% year over year to 4,108 at the end of the third quarter of 2025. Its headcount was reduced by 4.3% year over year to 211 by the end of the third quarter of 2025.

These efforts, along with continued investments in digital infrastructure and process automation, are expected to generate sustained expense savings and enhance overall profitability. By the end of this year, WFC expects to achieve $15 billion of gross expense savings.

Gross Expense Savings

As of Sept. 30, 2025, Wells Fargo’s long-term debt was $177.8 billion. However, short-term borrowings were $230.6 billion. The company has a strong liquidity position, with a liquidity coverage ratio of 121% as of the third quarter of 2025, exceeding its regulatory minimum of 100%. Its liquid assets totaled $486.1 billion as of the same date.

Hence, WFC rewards shareholders handsomely. After clearing the Fed’s 2025 stress test, the company raised its third-quarter common stock dividend 12.5% to 45 cents per share. In the past five years, it has raised its dividend six times. It currently has a dividend yield of 2.1%.

Similarly, its peer Bank of America raised its dividends five times in the last five years. It has a dividend yield of 2.1%. Citigroup raised its dividends three times in the last five years. It has a dividend yield of 2.4%.

Coming back to WFC, it also has a share repurchase program in place. In April 2025, its board of directors authorized an additional $40-billion share repurchase program, following the $30-billion authorization announced in July 2023. As of Sept. 30, 2025, the company had remaining authority to repurchase up to $34.7 billion of common stock.

Given its robust capital position and ample liquidity, the company’s capital-deployment activities seem sustainable and will boost investor confidence in the stock.

Wells Fargo’s fundamentals are improving rapidly, making it one of the attractive bank stocks. The lifting of the Fed’s $1.95-trillion asset cap has unlocked long-awaited growth opportunities, enabling the bank to expand its loan book, grow deposits, and boost fee-based revenues. Further, easing interest rates and a resilient economy should support NII growth, while the bank’s ongoing cost-cutting and branch optimization efforts enhance efficiency.

For 2025 and 2026, the company’s earnings are expected to rise 16.8% and 10.8%, respectively. Over the past month, estimates for both years have been revised upward.

Estimate Revision Trend

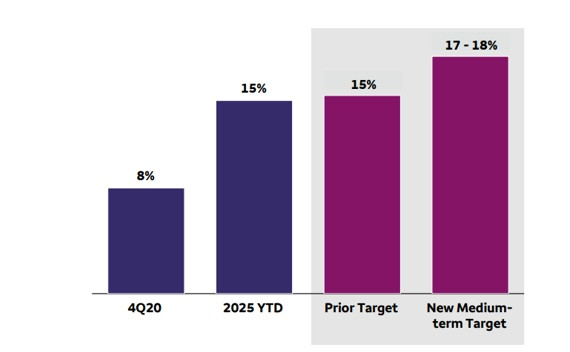

On the capital front, the bank plans to manage its common equity tier 1 (CET1) ratio down to 10-10.5% from more than 11% in each of the past nine quarters, thereby optimizing capital use and enhancing returns. As such, with disciplined cost management and improved revenue momentum, along with capital management, Wells Fargo anticipates meaningful margin expansion, positioning it well to achieve its return on tangible common equity (ROTCE) goal of 17-18% over the medium term.

ROTCE

Also, from a valuation standpoint, Wells Fargo appears somewhat inexpensive relative to the industry. The company is currently trading at a discount with a forward 12-month P/E multiple of 12.58X, below the industry average of 14.86X. C and BAC are trading at a forward P/E multiple of 10.59X and 12.53X, respectively.

Price-to-Earnings F12M

Hence, WFC offers an attractive entry point for investors seeking steady growth and income potential. At present, the WFC stock carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 6 hours | |

| 11 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite