|

|

|

|

|||||

|

|

Chipotle Mexican Grill, Inc. CMG is tightening its operational and pricing discipline as restaurant-level margins come under pressure from accelerating cost inflation. In the third quarter of 2025, the company’s restaurant-level margins contracted 100 basis points year over year to 24.5%. Management attributed the decline to a mix of rising beef prices, import tariffs and higher labor costs.

Chipotle anticipates continued margin pressure as inflationary trends persist into late 2025 and 2026. The company expects the cost of sales to remain around 30% of revenues in the fourth quarter, reflecting ongoing inflation in beef and chicken, the full-quarter impact of its premium Carne Asada limited-time offering, and roughly 30 basis points of tariff-related headwinds. Management projects tariffs to have a sustained 50-basis-point impact going forward, excluding items covered under the USMCA exemption for Mexican and Canadian imports. Labor costs rose to 25.2% of sales in the third quarter, up about 30 basis points year over year, as modest wage inflation and softer transaction volumes offset productivity gains. For the fourth quarter, labor expenses are expected to remain in the high-25% range, with wage inflation trending in the low-single-digit range.

While Chipotle’s value proposition remains a key differentiator, management has opted not to fully offset inflation through price increases. By deliberately absorbing a portion of rising input costs, the company is prioritizing price stability to reinforce its competitive positioning. Chipotle’s decision to maintain a 20-30% pricing discount relative to fast-casual peers reflects a disciplined approach to preserving value perception and customer retention. While this strategy will likely weigh on near-term margins, management views it as a calculated tradeoff to safeguard long-term brand equity and sustain traffic momentum amid a softer consumer spending environment.

Operationally, Chipotle continues to focus on efficiency and consistency as levers to stabilize profitability. The rollout of its high-efficiency equipment package — featuring dual-sided planchas and upgraded prep systems — has shown promising early results, improving throughput, food quality and labor utilization. These initiatives, alongside menu innovation, such as the successful Adobo Ranch and Red Chimichurri launches, are designed to reignite transaction growth in 2026. The company is also refining its digital rewards ecosystem and retraining field teams to improve order accuracy and enhance the in-store experience.

Despite near-term margin pressure, Chipotle highlighted several structural initiatives as longer-term stabilizers. Programs such as the high-efficiency equipment rollout, expanded menu innovation pipeline and digital engagement enhancements are designed to improve operational productivity, offset cost inflation and deepen customer loyalty. These efforts aim to create an efficient, scalable restaurant model with lower labor intensity and stronger unit economics. While restaurant-level margins remain constrained by rising input costs and sustained inflation, management framed these investments as the groundwork for sustainable, margin-accretive growth in the years ahead.

Shares of Chipotle have plunged 50.6% so far this year compared with the industry’s fall of 11.3%. In the same time frame, other industry players like Starbucks Corporation SBUX, Sweetgreen, Inc. SG and CAVA Group, Inc. CAVA have declined 5.3%, 83.7% and 56.4%, respectively.

From a valuation standpoint, CMG trades at a forward price-to-sales (P/S) multiple of 3.03, below the industry’s average of 3.35. Conversely, industry players, such as Starbucks, Sweetgreen and CAVA, have P/S multiples of 2.52, 0.75 and 4.12, respectively.

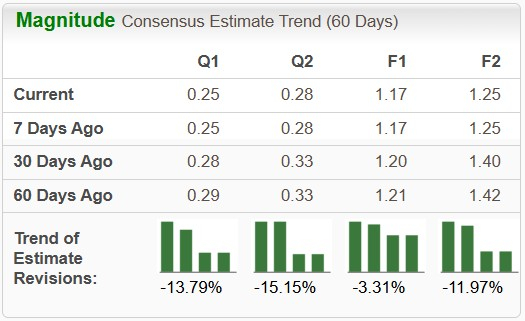

The Zacks Consensus Estimate for CMG’s 2026 earnings per share has declined 12% to $1.25 in the past 60 days.

The company is likely to report strong earnings, with projections indicating a 7% rise in 2026. Conversely, industry players like Sweetgreen and CAVA are likely to witness an increase of 24.8% and 11.6%, respectively, year over year, in 2026 earnings. Meanwhile, Starbucks' fiscal 2026 earnings are likely to witness a rise of 16.9%, year over year.

CMG stock currently has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 15 hours | |

| 18 hours | |

| 19 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite