|

|

|

|

|||||

|

|

CoreWeave, Inc.’s CRWV third-quarter 2025 performance highlights its remarkable ascent in the booming AI cloud industry. The company reported record revenues of $1.36 billion, up 134% year over year, and a massive $55.6 billion revenue backlog, nearly doubling within a single quarter. The company’s role as the go-to cloud for AI is more solid than ever, as it continues to fuel growth through focus and innovation to enable the next generation of AI.

In the third quarter, CoreWeave achieved strong momentum, driven by major customer wins across AI labs, hyperscalers and enterprises. The company entered into a multi-year deal worth up to approximately $14.2 billion with Meta to power next-generation workloads. It expanded its partnership with OpenAI through a deal of up to $6.5 billion, bringing total commitments to about $22.4 billion. CoreWeave also deepened ties with a leading hyperscaler, marking their sixth contract, and continued to serve as the preferred partner for innovators, such as Inference.net, Mizuho Bank, NASA JPL and Poolside.

Moreover, the company is rapidly expanding its data centers to drive growth. In the last reported quarter, CoreWeave added eight new U.S. data centers and advanced European expansion, including a major Scotland site with the U.K. government. It also launched self-build projects to speed up growth and enhance operational control. The company is rapidly scaling its purpose-built AI infrastructure, adding around 120 megawatts (MW) of active power to reach approximately 590 MW in total and expanding contracted power to 2.9 gigawatts in the third quarter. The company’s key technology included becoming the first to deploy NVIDIA GB300 NVL72 systems and offer NVIDIA RTX PRO 6000 Blackwell Server Edition instances, alongside the acquisition of OpenPipe to strengthen AI training capabilities.

However, despite the unrelenting demand for its platform, the entire data center industry continues to face severe supply chain pressures. The company is experiencing temporary delays due to a third-party data center developer falling behind schedule. This has affected its fourth-quarter expectations. CRWV expects full-year 2025 revenues to be between $5.05 billion and $5.15 billion compared with $5.15 billion to $5.35 billion projected earlier. Adjusted operating income is forecasted to be between $690 million and $720 million compared with $800 million-$830 million anticipated earlier.

Moreover, heavy capital expenditures, rising interest costs and delays are added concerns. For 2025, it expects interest expenses to be between $1.21 billion and $1.25 billion, owing to high leverage. CoreWeave also faces intense competition in the AI cloud infrastructure space, such as Microsoft Corporation MSFT and Nebius Group N.V. NBIS.

Microsoft is gaining from its AI strength. Recently, Microsoft announced plans to increase total AI capacity by more than 80% in 2025 and roughly double the total data center footprint over the next two years. The company unveiled Fairwater in Wisconsin as the world's most powerful AI data center, which will scale to two gigawatts and go online next year. Microsoft deployed the world's first large-scale cluster of NVIDIA GB300s and is building a fungible fleet that spans all stages of the AI lifecycle, from pre-training to post-training, synthetic data generation and inference. For the second quarter of fiscal 2026, Microsoft expects total company revenues between $79.5 billion and $80.6 billion, implying growth of 14% to 16%.

Nebius is another hypergrowth AI infrastructure-focused company. It recently announced a new agreement with Meta to deliver AI infrastructure valued at approximately $3 billion over the next five years. The company’s mega-deals with Microsoft and Meta are expected to begin contributing late in the quarter, with the majority of related revenue ramping up throughout 2026. Nebius has revised its full-year group revenue outlook to a range of $500 million to $550 million from the previous guidance of $450 million to $630 million. Nebius is on track to achieve its ARR guidance of $900 million to $1.1 billion by the end of 2025, setting the foundation for substantial growth in 2026 and beyond.

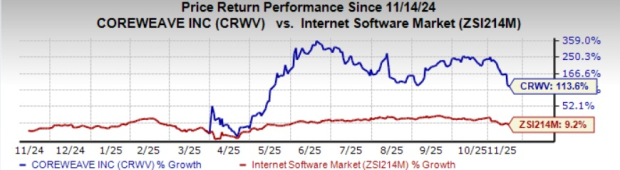

Shares of CoreWeave have gained 113.6% in the past year compared with the Internet Software industry’s growth of 9.2%.

In terms of Price/Book, CRWV’s shares are trading at 15.71X, way higher than the Internet Software Services industry’s 6X.

The Zacks Consensus Estimate for CRWV’s earnings for 2025 has remained unchanged over the past 60 days.

CRWV currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 9 hours | |

| 11 hours |

Workers Are Afraid AI Will Take Their Jobs. Theyre Missing the Bigger Danger.

MSFT

The Wall Street Journal

|

| 11 hours | |

| 12 hours | |

| 14 hours | |

| 15 hours | |

| 15 hours | |

| 17 hours | |

| 18 hours | |

| Feb-14 |

Phonographs, Player Pianos and Betamax: The Inventions That Transformed Entertainment

MSFT

The Wall Street Journal

|

| Feb-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite