|

|

|

|

|||||

|

|

International Business Machines Corporation IBM recently unveiled IBM Quantum Nighthawk – the most advanced quantum processor developed to date. With an architecture that complements high-performing quantum software, IBM Quantum Nighthawk boasts superior qubit connectivity that enables users to execute circuits with 30% more complexity than its predecessors.

The quantum processor brings a new dimension to the realm of quantum computing by enabling users to increase the complexity of algorithms in the quantum hardware. As users seek to achieve quantum advantage — where quantum computers outperform the classical ones — the new quantum processor could pave the way for technological innovations across the quantum ecosystem, with future reiterations far exceeding the current performance.

As IBM continues to push the boundaries of quantum technology with its latest advancements, it is working on improving Qiskit, its widely used quantum software platform. Launched in 2017, Qiskit has grown from a simple software development kit (SDK) to a comprehensive quantum software stack. This evolution is designed to maximize the performance of IBM's quantum hardware, allowing users to run increasingly complex quantum circuits.

The latest version has scaled dynamic circuit capabilities to deliver a 24% increase in accuracy at the scale of 100+ qubits, giving developers more control than ever before. IBM is also extending Qiskit with a new execution model that enables fine-grained control with accelerated error mitigation capabilities that significantly reduce the cost of extracting accurate results.

IBM has surged 50.7% over the past year compared with the industry’s growth of 75.8%, outperforming peers like Amazon.com, Inc. AMZN and Microsoft Corporation MSFT. While Amazon was up 15.5%, Microsoft gained 19.8% over this period.

IBM is poised to benefit from healthy demand trends for hybrid cloud and AI, which are driving the Software and Consulting segments. The company’s growth is expected to be aided by analytics, cloud computing and security in the long term. IBM is likely to benefit from a better business mix, improved operating leverage and higher investments in growth opportunities.

One-Year IBM Stock Price Performance

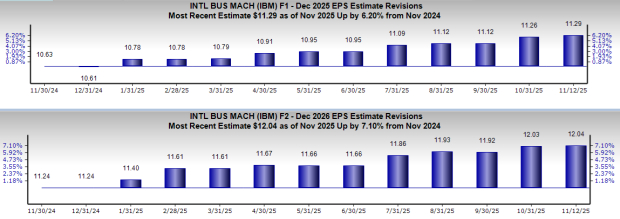

IBM is currently witnessing an uptrend in estimate revisions. Earnings estimates for IBM for 2025 have moved up 6.2% to $11.29 over the past year, while the same for 2026 has increased 7.1% to $12.04. The positive estimate revision portrays bullish sentiments about the stock’s growth potential.

Despite solid hybrid cloud and AI traction, IBM is facing stiff competition from Amazon Web Services and Microsoft Azure. Increasing pricing pressure is eroding margins, and profitability has trended down over the years, barring occasional spikes. The company’s ongoing, heavily time-consuming business model transition to the cloud is a challenging task. Weakness in its traditional business and foreign exchange volatility remain significant concerns.

IBM is resorting to massive job cuts to reduce operating costs. A significant part of these jobs is slated to be shifted to India under a “resource action” plan, an ongoing corporate strategy to tap the vast talent pool of the subcontinent at lower operating costs. Although the company spokesperson has refused to comment on the grapevines and commit an exact figure for the layoffs, various unidentified sources have confirmed that the action has already started, impacting employees from consulting, corporate social responsibility, cloud infrastructure, sales and internal systems teams.

With solid fundamentals and healthy revenue-generating potential driven by robust demand trends, IBM is witnessing a steady growth curve. A strong emphasis on hybrid cloud, diligent execution of operational plans and an AI focus are driving value for customers. With improving earnings estimates, the stock is witnessing a positive investor perception.

However, IBM’s growth is dented by high operating costs and stiff competition that reduce its profitability. With a Zacks Rank #3 (Hold), IBM appears to be treading in the middle of the road, and new investors can be better off if they trade with caution. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 56 min | |

| 1 hour |

Stock Market Today: Dow, Tech Futures Slide; Nvidia, Palantir, Tesla Extend Losses (Live Coverage)

IBM

Investor's Business Daily

|

| 1 hour | |

| 2 hours |

AI Stocks Reset In 2026 Amid Software Reckoning, Hyperscaler Capex Boom

AMZN

Investor's Business Daily

|

| 2 hours |

AI Stocks Reset In 2026 Amid Software Reckoning, Hyperscaler Capex Boom

MSFT

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite