|

|

|

|

|||||

|

|

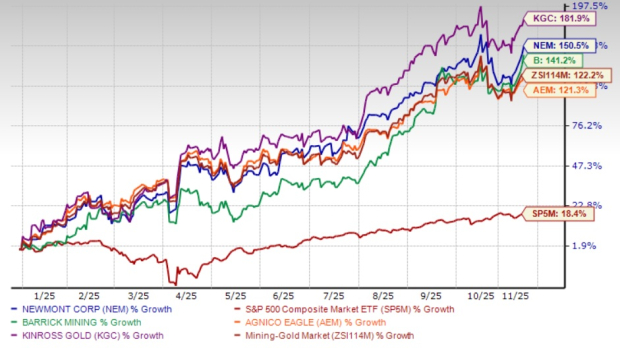

Newmont Corporation’s NEM shares have surged 150.5% year to date, courtesy of an upswing in gold prices to record highs. The company’s strong earnings performance, buoyed by its operational efficiency and the strength of its Tier 1 portfolio, also contributed to the rally.

NEM stock has outperformed the Zacks Mining – Gold industry’s 122.2% rise and the S&P 500’s increase of 18.4%. Among its gold mining peers, Barrick Mining Corporation B, Agnico Eagle Mines Limited AEM and Kinross Gold Corporation KGC have rallied 141.2%, 121.3% and 181.9%, respectively, over the same period.

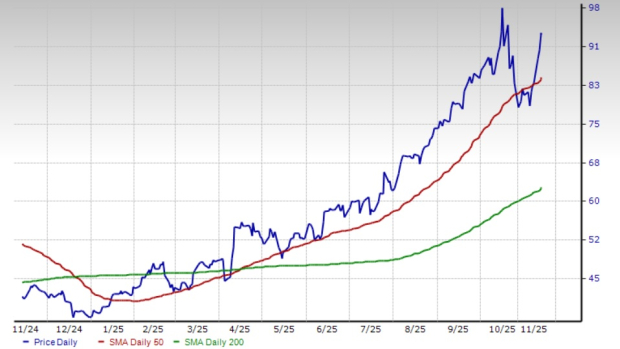

Technical indicators for NEM show bullish momentum. The NEM stock has been trading above its 200-day simple moving average (SMA) since April 9, 2025, suggesting a long-term uptrend. It is also currently trading above its 50 SMA. The 50-day SMA is also reading higher than the 200-day SMA, following a golden crossover on April 16, 2025, indicating a bullish trend.

Is the time right to buy NEM’s shares for potential upside? Let’s take a look at the stock’s fundamentals.

Newmont continues to invest in growth projects in a calculated manner. The company is pursuing several projects, including the Ahafo North expansion in Ghana and the Cadia Panel Caves and Tanami Expansion 2 in Australia. These projects should expand production capacity and extend mine life, driving revenues and profits.

NEM, last month, achieved a significant milestone at Ahafo North. It achieved commercial production at the project, which followed the first gold pour in September 2025. Ahafo North is expected to produce between 275,000 and 325,000 ounces of gold annually over an estimated mine life of 13 years. Production is expected to be 50,000 ounces this year, with a ramp-up to full capacity expected in 2026.

The acquisition of Newcrest Mining Limited has also created an industry-leading portfolio with a multi-decade gold and copper production profile in the most favorable mining jurisdictions globally. The combination of Newmont and Newcrest is expected to deliver significant value for its shareholders and generate meaningful synergies. NEM has achieved $500 million in annual run-rate synergies, following the Newcrest buyout.

Newmont has also divested non-core businesses as it shifts its strategic focus to Tier 1 assets. NEM completed its non-core divestiture program in April 2025, with the sale of its Akyem operation in Ghana and its Porcupine operation in Canada. NEM has executed agreements to sell its shares in Greatland Resources Limited and Discovery Silver Corp, for total cash proceeds of around $470 million after taxes and commissions.

Following the sale of these shares, the company anticipates generating $3 billion in after-tax cash proceeds from its 2025 divestiture program. These funds will support Newmont’s capital allocation strategy, which focuses on reinforcing its balance sheet and delivering returns to its shareholders.

Newmont has a strong liquidity position and generates substantial cash flows, which allow it to fund its growth projects, meet short-term debt obligations and drive shareholder value. At the end of the third quarter of 2025, Newmont had robust liquidity of $9.6 billion, including cash and cash equivalents of around $5.6 billion. Its free cash flow more than doubled year to year to record $1.6 billion, led by an increase in net cash from operating activities. Net cash from operating activities shot up 40% from the prior-year quarter to $2.3 billion.

NEM has distributed more than $5.7 billion to its shareholders through dividends and share repurchases over the past two years. It also remains committed to deleveraging, reducing debt by roughly $2 billion in the third quarter, resulting in a near-zero net debt position at the end of the quarter. Newmont has repurchased shares worth $2.1 billion this year, executing $3.3 billion from $6 billion of authorization.

Newmont stands to benefit from the strength in gold prices, which should drive its profitability and cash flow generation. Gold prices have seen a record-setting rally this year, mainly attributable to aggressive trade policies, including sweeping new import tariffs announced by President Donald Trump, which have intensified global trade tensions and heightened investor anxiety. Also, central banks worldwide have been accumulating gold reserves, led by risks arising from Trump’s policies.

Prices of the yellow metal have rocketed roughly 60% so far this year. The Federal Reserve’s interest rate reduction, prospects of more rate cuts amid concerns over the labor market, and worries of a protracted U.S. government shutdown triggered the recent rally, driving prices north of $4,000 per ton for the first time. Increased purchases by central banks, and geopolitical and trade tensions are factors expected to help the yellow metal sustain the upswing in gold prices.

NEM offers a dividend yield of 1.1% at the current stock price. Its payout ratio is 17% (a ratio below 60% is a good indicator that the dividend will be sustainable). Backed by strong cash flows and sound financial health, the company's dividend is perceived as safe and reliable.

Newmont’s earnings estimates for 2025 have been going up over the past 60 days. The Zacks Consensus Estimate for 2026 has also been revised higher over the same time frame.

The Zacks Consensus Estimate for 2025 earnings is currently pegged at $5.96, suggesting year-over-year growth of 71.3%. Earnings are expected to grow roughly 22.1% in 2026.

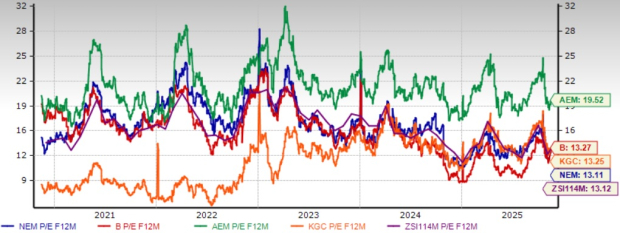

Newmont is currently trading at a forward price/earnings of 13.11X, roughly in line with the industry’s average of 13.12X. NEM is trading at a discount to Barrick, Agnico Eagle and Kinross Gold. Newmont and Agnico Eagle currently have a Value Score of C, each, while Barrick and Kinross Gold have a Value Score of B.

Newmont presents a compelling investment case, backed by a robust portfolio of growth projects, the strong performance of its Tier 1 assets and solid financial health. The asset streamlining rooted in Newmont’s objective to concentrate capital on high-return, long-life assets also underpins its long-term sustainability. Other positives include rising earnings estimates, attractive valuation and a healthy growth trajectory. The strength in bullion prices should also boost NEM’s profitability and drive cash flow generation. With a positive earnings outlook, Newmont looks poised to deliver attractive returns to its investors, making this Zacks Rank #1 (Strong Buy) stock a prudent choice to bet on for those looking to capitalize on the favorable gold market conditions.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 13 hours | |

| Feb-23 |

Trump's Tariffs Lift Gold Prices. These Mining Stocks Are Basing.

KGC +6.22% AEM +5.36% B NEM

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite