|

|

|

|

|||||

|

|

AppLovin Corporation APP delivered another impressive quarter, but the market’s response has been subdued. Despite posting robust financial results, the stock has declined about 5% since the earnings release.

Investors appear to be evaluating whether the company’s extraordinary momentum in gaming and advertising has already been factored into the share price. The inclusion of AppLovin in the S&P 500 reflects its growing influence in digital advertising. Still, with valuation running high and expectations lofty, the next leg of growth will depend on continued execution.

You might be questioning whether the stock remains a buy, hold, or sell after the latest quarter. Let's try to find out.

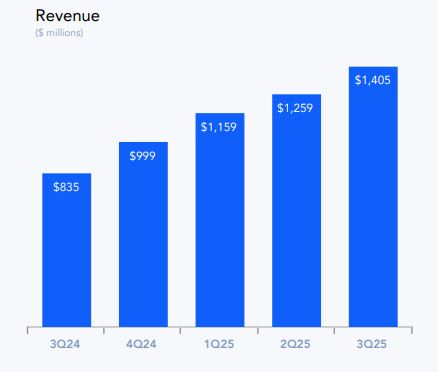

AppLovin’s third quarter showcased continued strength across its gaming advertising ecosystem and technology platforms. Revenues reached $1.41 billion, surpassing the Zacks Consensus Estimate by 4.1% and rising 68% year over year.

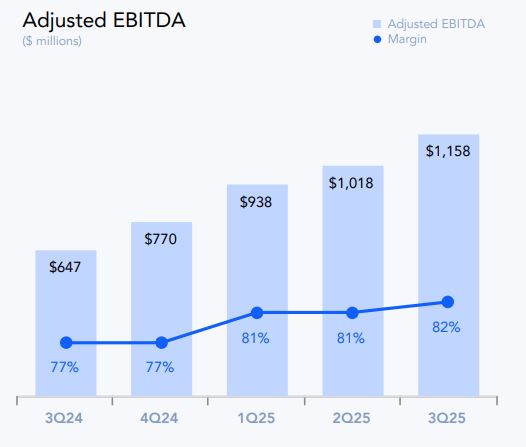

Adjusted EBITDA grew 79% to $1.16 billion, translating to an 82% margin. This reflected exceptional operational efficiency and scalability, with nearly all incremental revenue translating into higher profitability.

Free cash flow soared 92% year over year to $1.05 billion, emphasizing the company’s ability to generate substantial cash from its operations.

Growth was primarily fueled by enhancements to AppLovin’s core ad-serving and monetization models, which helped sustain the upward trajectory in gaming-related advertising. Its MAX supply-side platform continued to show solid expansion, reflecting both rising advertiser demand and improved campaign performance. These metrics underline the company’s strengthening position within the competitive app and gaming ecosystem.

Another positive highlight of the quarter was the early progress of AppLovin’s self-service advertising solution, launched in early October. Although still in its nascent stage, advertiser spending through this channel has been rising rapidly, suggesting a strong appetite among smaller and mid-sized marketers. This development reinforces AppLovin’s potential to scale its advertiser base beyond traditional gaming clients and into broader ad-tech categories.

AppLovin continues to lean heavily into artificial intelligence and automation to advance its technology roadmap. The company’s upcoming priorities include refining advertiser onboarding flows, integrating AI-powered support tools, testing generative AI-based ad creatives, and expanding marketing efforts for its Axon Ads platform. These initiatives are designed to simplify advertiser engagement, improve campaign performance, and attract a more diverse customer mix.

Such technology-driven upgrades highlight how AppLovin aims to evolve from a gaming-centric business into a broader digital advertising platform. By combining data-driven insights with machine learning models, the company expects to enhance ad targeting and efficiency, factors that could drive long-term revenue stability even amid cyclical ad spend fluctuations.

AppLovin’s disciplined execution and focus on performance marketing provide confidence in its ability to capture future opportunities. The long-term vision emphasizes scalable growth through AI innovation, suggesting that the company is well-positioned to strengthen its competitive advantage as the digital advertising landscape becomes increasingly automated.

AppLovin’s solid cash generation supports consistent capital returns to shareholders. During the quarter, the company repurchased and withheld about 1.3 million shares worth $571 million, funded entirely from free cash flow. Moreover, the board expanded the share repurchase authorization by an additional $3.2 billion, demonstrating confidence in the business’s financial durability and valuation.

Looking ahead, the company expects revenues between $1.57 billion and $1.6 billion in the fourth quarter, indicating 12% to 14% sequential growth, with adjusted EBITDA projected between $1.29 billion and $1.32 billion and margins expected in the 82% to 83% range. The guidance reflects continued optimism around recent model updates, expanding advertiser demand and seasonal strength during the holiday period.

Such consistency in both growth and profitability underscores AppLovin’s position as one of the most operationally efficient players in the ad-tech sector. However, the slight decline in share price after the earnings release suggests that investors are adopting a cautious approach, possibly awaiting signs of sustained progress in newer initiatives, such as self-service and e-commerce referral programs.

AppLovin’s financial performance leaves little doubt about its execution strength and strategic clarity. With expanding AI capabilities, rising advertiser engagement and powerful cash generation, the company remains well-equipped to navigate the evolving digital advertising environment. Its inclusion in the S&P 500 only reinforces its standing as a key player in the industry.

Still, after a strong rally earlier in the year, short-term consolidation was perhaps inevitable. The recent price dip can be viewed as the market balancing expectations following an exceptional performance run.

With a Zacks Rank #3 (Hold), the stock merits continued attention from investors looking to benefit from the growth of AI-powered advertising. While the near term may bring some volatility, the fundamentals remain sound. Hence, Investors may consider holding the stock while adopting a wait-and-watch approach.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Earnings Snapshots

Automatic Data Processing, Inc. ADP reported impressive first-quarter fiscal 2026 results, wherein earnings and revenues beat the Zacks Consensus Estimate.

ADP’s earnings per share of $2.49 beat the consensus estimate by 2% and increased 6.9% from the year-ago quarter. The top line amounted to $5.2 billion, which surpassed the consensus estimate by a slight margin and grew 7.2% from the year-ago quarter.

Equifax Inc. EFX reported impressive third-quarter 2025 results, wherein earnings and revenues surpassed the Zacks Consensus Estimate.

EFX’s adjusted earnings were $2.04 per share, outpacing the Zacks Consensus Estimate by 5.7% and increasing 10.3% from the year-ago quarter. The company registered revenues of $1.5 billion, beating the consensus estimate by 1.5% and increasing 6.9% on a year-over-year basis.

TransUnion TRU reported impressive third-quarter 2025 results, wherein earnings and revenues beat the Zacks Consensus Estimate.

TRU’s quarterly adjusted earnings of $1.10 per share surpassed the consensus mark by 5.8% and increased by the same margin year over year. Total revenues of $1.2 billion outpaced the consensus mark by 3.1% and increased 7.8% from the year-ago quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 16 min | |

| 8 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite