|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Investors were waiting to see how the market would respond to Arm Holdings plc’s ARM impressive second-quarter fiscal 2026 earnings and the reaction has been cautious.

Despite reporting another record-breaking quarter, the stock has slipped about 7% since the results were announced. The decline suggests that while ARM’s performance remains strong, investor enthusiasm is tempered by concerns over valuation, spending, and the pace of AI-driven adoption.

Let’s try to find out if ARM’s growth story still justifies holding the shares, or is it time to step aside?

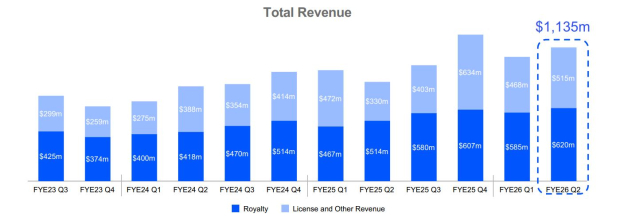

Arm Holdings continued fiscal 2026 with accelerating momentum across every level of AI computing, from milliwatt-powered edge devices to megawatt-scale hyperscale data centers. The company reported its best-ever second quarter, generating $1.14 billion in revenues, up 34% year over year, beating the Zacks Consensus Estimate by 6.5%. It is the third consecutive billion-dollar quarter. The results underscored ARM’s growing importance in the AI ecosystem, where its designs are increasingly at the core of data centers, smartphones, automobiles and connected devices.

Royalty revenues surged 21% year over year to a record $620 million, driven by market-wide adoption of the company’s architecture. Data center royalties doubled as hyperscale clients expanded their use of Arm-based chips in custom silicon projects. The proliferation of Arm’s Neoverse compute platform — now surpassing one billion CPUs deployed — exemplifies the rising preference for ARM’s energy-efficient performance in AI-heavy workloads.

Licensing revenues also impressed, climbing 56% to $515 million, as more companies adopted Arm’s designs to power their next-generation AI chips and systems. This consistent growth in both royalty and licensing segments reinforces Arm Holdings’ strategic position as a critical enabler of AI across industries.

The company’s growing presence in high-performance computing, smartphones, and automotive reflects a unified platform strategy: AI everywhere. By enabling efficient compute performance across multiple environments, Arm Holdings has effectively positioned itself as the backbone of modern intelligent systems.

Beyond quarterly numbers, ARM’s expanding ecosystem continues to strengthen its competitive moat. The company recently formed a strategic partnership with Meta Platforms META to scale AI efficiency across the entire compute stack, from AI-enabled wearables to large data centers. This collaboration combines Arm’s expertise in energy-efficient computing with Meta’s AI infrastructure innovation, aiming to deliver smarter, more power-efficient AI experiences globally.

ARM’s compute platforms have also become integral to the world’s largest technology companies. From NVIDIA’s NVDA Grace and AWS’ Graviton to Google’s Axion and Microsoft’s MSFT Cobalt, leading hyperscalers are building their custom silicon using Arm Holdings’ architecture. These platforms demonstrate significant performance and energy efficiency gains. Google’s Axion, for instance, offers up to 65% better price performance while using 60% less energy.

At the same time, the company’s Compute Subsystem (CSS) designs are transforming chip development cycles by helping customers reduce risk and time to market. The company added new CSS licenses this quarter, extending its reach across smartphones, tablets and data centers. Leading Android manufacturers have begun shipping CSS-powered devices, confirming that this technology has quickly become a preferred choice for next-generation chip design.

The launch of Lumex CSS, Arm Holdings’ most advanced mobile compute platform to date, further strengthens its foothold in mobile AI. Lumex enables real-time translation, image enhancement, and on-device AI experiences, capabilities that flagship models from OPPO and vivo are expected to showcase later this year. Together, these developments highlight ARM’s role as the architectural foundation for the next wave of AI innovation across every tier of computing.

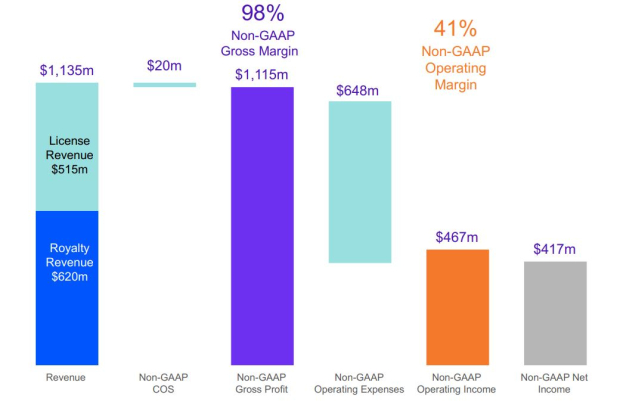

While the results demonstrate strong revenue expansion, they also underscore the costs of sustaining innovation. Arm’s non-GAAP operating income reached $467 million, up 43% year over year, resulting in a 41.1% operating margin, an improvement from last year’s 38.6%.

Non-GAAP EPS came in at 39 cents, 6 cents above the midpoint of guidance as well as the Zacks Consensus estimate and reflecting both higher revenue and controlled operating expenses. However, R&D investments rose 31% year over year to $648 million, as Arm accelerates engineering expansion to support next-generation architectures, compute subsystems, and chiplet designs. While such spending is essential to maintain leadership, it could pressure near-term margins if top-line growth slows.

Looking ahead, Arm Holdings expects third-quarter fiscal 2026 revenues between $1.175 billion and $1.275 billion, implying about 25% year-over-year growth, with licensing expected to rise 25% to 30% and royalties to increase just over 20%. Though the guidance reflects confidence in sustained demand for AI compute, the market’s lukewarm reaction signals that investors may be seeking clearer signs of sustainable profit expansion amid rising competition and capital intensity.

ARM’s record quarter once again demonstrated its central role in the AI computing revolution. Its technology is embedded across industries, its licensing and royalty models are performing exceptionally well, and its partnerships with global tech leaders reinforce its long-term relevance. Yet, the post-earnings share price drop and a Zacks Rank #4 (Sell) rating suggest that near-term upside may be limited for the stock.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The company’s growth story remains compelling, but its valuation and heavy reinvestment cycle may restrict short-term returns. ARM trades at a forward price-to-sales ratio of 28.52, well above the industry’s 7.78. For now, the company appears to be a high-quality business in a high-expectation phase, one where execution excellence is already priced in. Investors may prefer to wait for a better entry point or signs of margin stabilization before re-engaging.

In conclusion, while Arm Holdings continues to power the AI era from devices to data centers, the current setup favors caution over conviction. Given the stretched valuation and near-term uncertainties, Arm Holdings is best viewed as a Sell-rated stock for now, with potential reentry opportunities once growth and profitability realign.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 12 hours | |

| 12 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite