|

|

|

|

|||||

|

|

Baidu BIDU is slated to report third-quarter 2025 results on Nov. 18.

For the third quarter, the Zacks Consensus Estimate for revenues is pegged at $4.31 billion, indicating a decline of 9.96% from the year-ago quarter’s reported figure.

The consensus mark for earnings is pegged at $1.2 per share, suggesting a 49.37% decline from the prior-year quarter’s reported figure. The estimates have plunged by 9.1% over the past 30 days.

In the last reported quarter, the company delivered an earnings surprise of 9.2%. The company’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 21.98%.

Baidu, Inc. price-consensus-eps-surprise-chart | Baidu, Inc. Quote

Apollo Go’s global scale-up is expected to remain a central catalyst during the quarter. The July integration with Uber and the August partnership with Lyft broadened its international reach, while September’s approval of Dubai’s first autonomous-driving trial permit and the issuance of 50 test licences marked a major regulatory breakthrough. The clearance allowed Apollo Go to begin open-road testing in designated zones, positioning the service for eventual commercial rollout in the Middle East. These developments are expected to have supported another quarter of strong ride-volume growth on top of the 2.2 million fully driverless rides recorded in the second quarter. However, rapid expansion into new markets likely added to deployment, validation and operating costs.

Baidu’s model ecosystem is expected to have advanced meaningfully during the quarter as the ERNIE platform scaled across more workloads. The open-sourcing of ERNIE 4.5 and the release of lighter, higher-efficiency variants appear to have accelerated developer uptake and lifted inference demand. MuseSteamer may have added another catalyst, giving enterprises a streamlined path for AI-generated video and widening AIGC use cases across Baidu’s stack. These developments are expected to have driven higher API-call volumes and deeper integration of ERNIE capabilities into customer applications, keeping AI Cloud positioned as Baidu’s most stable growth engine in the third quarter.

However, China’s uneven macro backdrop is expected to have continued weighing on Baidu’s online-marketing revenues, with advertiser spending likely remaining cautious and the AI-first overhaul of Baidu Search prioritizing user experience over immediate monetization. These factors may have kept core search growth muted through the quarter, even as non-online marketing streams showed firmer momentum. At the same time, heavier infrastructure, model-training and autonomous-mobility investments are expected to have added margin pressure, leaving the quarter shaped by persistent advertising softness offset by steady gains across Baidu’s AI-driven businesses.

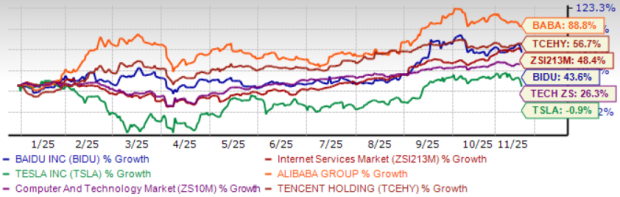

Baidu shares have appreciated 43.6% in the year-to-date period (YTD), while the Zacks Internet – Services industry has climbed 48.4% and the Zacks Computer and Technology sector has increased 26.3% increase.

Peers such as Alibaba BABA and Tencent TCEHY have outperformed Baidu during the same period. Shares of Alibaba and Tencent have appreciated 88.8% and 56.7%, respectively. While Baidu’s shares have outperformed Tesla’sTSLA share price movement, Tesla’s shares declined 0.9% during the same period.

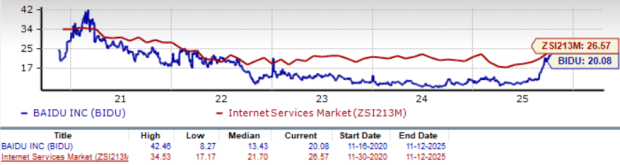

Baidu trades at a forward twelve-month price-to-earnings (P/E) of 20.08X, representing a discount to the sub-industry average of 26.57X, indicating that the market may still be undervaluing the company’s long-term AI potential and expanding autonomous-mobility exposure. This valuation gap becomes clearer when compared with peers. Alibaba trades at 19.93X forward earnings, while Tencent commands a higher 24.37X multiple, both reflecting stronger market confidence as they scale enterprise AI and digital-services revenue. The contrast is further amplified by Tesla’s 235X forward P/E, which captures global investor enthusiasm for autonomous and AI-driven mobility, whereas Baidu’s fully driverless progress remains priced far more conservatively despite accelerating commercialisation. With a Zacks Value Score of B, the stock screens relatively cheap.

Baidu heads into its third-quarter print with strengthening AI Cloud traction, accelerating autonomous-mobility momentum and a valuation that still screens discounted relative to the sub-industry and key peers, yet the near-term setup remains clouded by China’s muted advertising environment, elevated AI infrastructure spend and a search transition that is prioritizing engagement over monetization. Execution across ERNIE adoption, Apollo Go’s international rollout and stabilization in online-marketing trends will be central to restoring investor confidence, but meaningful earnings volatility may persist until these drivers begin translating into steadier revenue growth and margin leverage. Given this mix of structural upside and cyclical pressure, a patient approach could be prudent, with potential re-entry as fundamentals show clearer signs of inflection.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 14 min | |

| 33 min | |

| 36 min | |

| 47 min | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite