|

|

|

|

|||||

|

|

Dillard's Inc. DDS posted third-quarter fiscal 2025 results, wherein both the top and bottom lines surpassed the Zacks Consensus Estimate and increased year over year.

Earnings per share (EPS) of $8.31 surpassed the Zacks Consensus Estimate of $6.43. The bottom line rose 7.5% from $7.73 in the year-ago quarter.

Dillard's, Inc. price-consensus-eps-surprise-chart | Dillard's, Inc. Quote

Net sales of $1.469 billion rose 2.9% from the prior-year quarter and beat the consensus estimate of $1.425 billion. Including service charges and other income, the company reported sales of $1.491 million, up 2.8% year over year.

Dillard’s shares jumped about 10% yesterday, following better-than-expected earnings results for third-quarter fiscal 2025. The positive reaction reflected investor confidence in the company’s stronger-than-anticipated performance and improving sales momentum.

Total retail sales (excluding CDI Contractors, LLC) increased 3.3% year over year to $1.401 billion. On a 13-week comparison basis, total retail sales rose 3% year over year while comps increased 3%. Category performance was mixed, with certain areas showing notable strength while others posted more modest gains. Sales in ladies’ accessories and lingerie, juniors’ and children’s apparel, and ladies’ apparel increased significantly compared to the prior-year quarter, highlighting strong momentum in key fashion categories. Shoes registered a moderate increase, while home and furniture, men’s apparel and accessories, and cosmetics experienced slight growth. Our model had predicted comps growth of 0.6% for the fiscal third quarter.

The consolidated gross margin expanded 80 basis points (bps) year over year to 43.4%. The retail gross margin of 45.3% reflected a year-over-year increase of 80 bps as the metric retail margin increased moderately in ladies’ accessories and lingerie and in shoes, rose slightly in home and furniture and men’s apparel and accessories, and remained unchanged in juniors’ and children’s apparel, cosmetics, and ladies’ apparel. We had expected a gross margin of 41.9%, down 70 bps year over year.

Dillard's consolidated selling, general and administrative expenses (SG&A) as a percentage of sales were 30%, up 60 bps from the prior-year quarter. In dollar terms, SG&A expenses (operating expenses) increased 5.1% year over year to $440.4 million. The slight year-over-year increase in dollars was largely caused by higher payroll and payroll-related expenses, which represented the primary contributor to the overall rise in operating costs.

Our model had predicted SG&A expense (as a percentage of sales) to be 29.9%, up 100 bps. In dollar terms, we expected SG&A expenses to rise 3.9% year over year to $435.3 million.

DDS ended third-quarter fiscal 2025 with cash and cash equivalents of $1,149 million, long-term debt of $225.7 million and a total shareholders' equity of $2.045 billion. The company provided $505.8 million of net cash from operating activities as of Nov. 1, 2025. Inventory climbed 2% year over year as of the same date.

In the third quarter of fiscal 2025, DDS repurchased 30000 shares for $107.8 million, reflecting an average price of $359.16 per share. As of Nov. 1, 2025, it had $165.2 million remaining under its current share repurchase authorization announced in May 2023. Total shares outstanding (Class A and Class B Common Stock) on Nov. 1, 2025, and Nov. 2, 2024, were 15.6 million and 15.9 million, respectively.

The company forecasts capital expenditure of $100 million for fiscal 2025, suggesting a decrease from the $105 million reported in fiscal 2024.

As of Nov. 1, 2025, DDS operated 272 Dillard’s stores, including 28 clearance stores across 30 states and an online store at dillards.com.

For fiscal 2025, Dillard’s continues to expect depreciation and amortization expenses of $180 million compared with $178 million recorded last fiscal. The company projects interest and debt income of $7 million compared with $14 million in fiscal 2024. It still anticipates rentals of $20 million compared with $21 million reported in fiscal 2024.

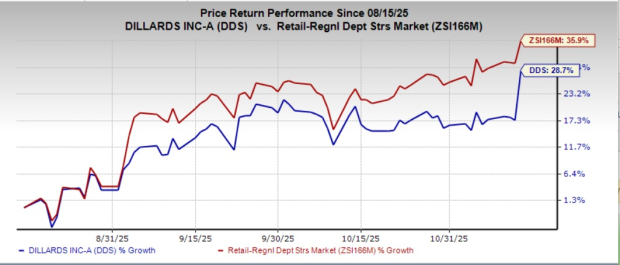

Shares of the Zacks Rank #4 (Strong Sell) company have gained 28.7% in the past three months compared with the industry's 35.9% rise.

Boot Barn Inc. BOOT operates specialty retail stores in the United States and internationally. At present, Boot Barn sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Boot Barn’s current fiscal-year sales and earnings implies growth of 16.2% and 20.5%, respectively, from the year-ago figures. BOOT delivered a trailing four-quarter earnings surprise of 5.4%, on average.

Amazon.com Inc. AMZN engages in the retail sale of consumer products, advertising and subscription services through online and physical stores in North America and internationally. Currently, Amazon holds a Zacks Rank of 2 (Buy).

The consensus estimate for Amazon’s current fiscal-year sales and earnings implies growth of 11.8% and 29.3%, respectively, from the year-ago figures. AMZN delivered a trailing four-quarter earnings surprise of 22.5%, on average.

Casey’s General Stores CASY operates convenience stores under the Casey's and Casey's General Store names in the United States. Casey’s General Stores holds a Zacks Rank of 2 at present.

The consensus estimate for CASY’s current fiscal-year sales and earnings implies growth of 9.6% and 10.5%, respectively, from the year-ago figures. CASY delivered a trailing four-quarter earnings surprise of 24.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours |

Berkshire Hathaway Takes Stake In New York Times, Cuts Apple, Amazon Holdings

AMZN

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite