|

|

|

|

|||||

|

|

Intel's stock has surged 83% recently, driven by developments in its foundry business.

Synopsys' challenges are partly linked to Intel's foundry performance and customer dynamics.

Recent investments and partnerships may benefit both Intel and Synopsys.

Intel (NASDAQ: INTC) stock has increased by 83% over the past three months. This is positive for semiconductor investors and could also help one of Intel's key partners, Synopsys (NASDAQ: SNPS). Intel is not just a Synopsys customer; the main weakness in Synopsys' business may have been tied to issues at Intel, which now appear to be improving as new investments and partnerships emerge. Here's what's happening.

Intel's business challenges are readily apparent. The table below breaks down operating income by segment. Intel Products, which encompasses the Client Computing Group (CCG) and Data Center and AI (DCAI), is performing well; however, the Intel Foundry segment is experiencing difficulties.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

The foundry business is central to Intel's growth plans. Instead of only designing and manufacturing its own chips, Intel is now offering its manufacturing services to outside customers, much like Taiwan Semiconductor Manufacturing operates its foundry model.

The business has faced significant challenges, leading Intel CEO Lip-Bu Tan to tell investors that Intel will be more careful moving forward. He said that the company "will grow our capacity based solely on the volume commitments and deploy capex [capital expenditures in] lockstep with the tangible milestones and not before."

Intel also has stopped manufacturing projects in Poland and Germany, slowed construction in Ohio, and moved its Costa Rica operations to facilities in Vietnam and Malaysia.

|

Intel |

Revenue |

Operating Income for First 9 Months of 2025 |

|---|---|---|

|

Client Computing Group (CCG)* |

$24,305 million |

$8,400 million |

|

Data Center and AI (DCAI)* |

$12,182 million |

$1,040 million |

|

Intel Foundry |

$13,319 million |

$(11,042) million |

|

Other |

$2,989 million |

$(211) million |

Data source: Intel SEC filings. *CCG and DCAI together make up the Intel Products segment.

While not named directly, Intel is probably the foundry customer Synopsys CEO Sassine Ghazi mentioned during a September call with analysts when discussing the weak results in the Design Intellectual Property (IP) business.

According to Ghazi, the IP business underperformed due to a combination of three factors: (1) the lingering impact of previous export restrictions on its products to China, (2) "challenges at a major foundry customer," and (3) "certain road map and resource decisions that did not yield their intended results."

The third issue is partly tied to the foundry customer that I think is Intel, as Synopsys invested in technology expecting revenue that will now not be realized in the second half of 2025.

This wasn't very pleasant for stakeholders, and Synopsys' stock is still down over 18% this year, despite the company completing its transformative acquisition of engineering simulation software firm Ansys in July.

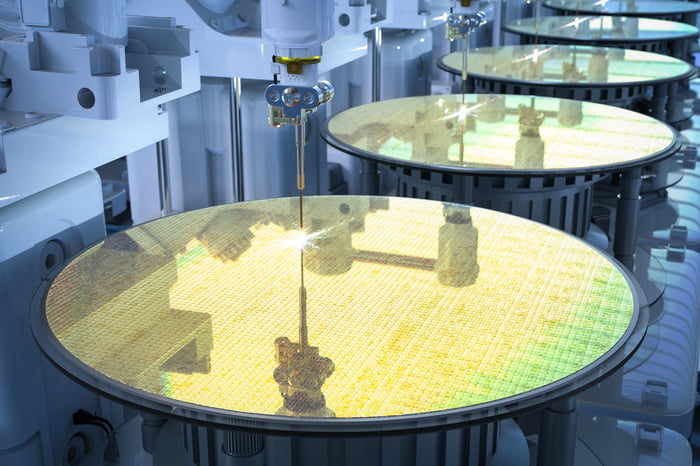

Image source: Getty Images.

Since the summer, many developments have been positive for Intel's foundry business.

These updates have strengthened Intel's foundry business, and the market has responded quickly. This is likely good news for Synopsys, too, since it has been a strategic partner of Intel's foundry services for a long time. Synopsys not only sells its main electronic design automation (EDA) tools for chip design, but its Design IP segment also offers IP blocks that work well with customers' designs, including Intel's.

So, whether or not Intel is the customer Ghazi mentioned, better prospects for Intel's foundry business are very likely to help Synopsys as well.

Image source: Getty Images.

Since the design IP business was the main challenge for Synopsys, and the early integration of Ansys into its Design Automation business seems to be going well, Synopsys' management could have a more positive outlook for its Design IP segment when it reports fourth-quarter earnings on Dec. 10. It's something to watch for.

Before you buy stock in Synopsys, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Synopsys wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 10, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Intel, Nvidia, Synopsys, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.

| 1 hour | |

| 1 hour | |

| 3 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite