|

|

|

|

|||||

|

|

Both The Trade Desk, Inc (TTD) and Alphabet Inc (GOOGL) play pivotal roles in the programmatic advertising ecosystem. TTD operates a leading demand-side platform (“DSP”), which helps advertisers focus on data-driven ads. Alphabet, on the other hand, dominates the digital ad space through its massive ecosystem comprising Google Search, YouTube and more.

Since both firms have a massive exposure to the booming connected TV (“CTV”) and retail media trends, this makes for an intriguing comparison for investors.

So, which stock makes a better investment pick at present? Let us deep dive into the pros and cons for each company.

The Trade Desk has multiple tailwinds that could buoy its long-term growth. These include CTV, retail media, Kokai, UID2 and OpenPath.

One of the most compelling long-term opportunities for The Trade Desk is CTV, the fastest-growing segment of the digital ad market. On the last earnings call, management noted that the transition toward biddable CTV is gaining rapid momentum and it expects decision CTV to become the default buying model in the future. The benefits of decision-based buying (like greater flexibility, control and performance) compared with traditional programmatic guaranteed or insertion-order models, are rendering it the logical choice for advertisers. Deep partnerships with Disney, NBCU, Roku, Netflix, LG and Walmart, among others, bode well.

In the third quarter, video advertising, which includes CTV, represented more than 50% share of the total business. While video remains the largest share of its business, audio is emerging as a key driver of growth. On the last earnings call, management noted that audio represented around 5% of the business and it expects CTV and audio to increase as a percentage of the business mix due to the “premium authenticated nature of these channels.” TTD highlighted that audio is benefiting as consumers spend roughly three hours a day listening to music and podcasts, creating an expanding addressable market for digital audio ads.

The Trade Desk price-consensus-eps-surprise-chart | The Trade Desk Quote

Further, Kokai, the company’s AI-powered platform, which is used by 85% clients as their default experience, is strengthening its competitive moat. TTD highlighted that Kokai delivered (on average) 26% better cost per acquisition, 58% better cost per unique reach and 94% better click-through rate compared with Solimar. Embedding AI to enhance Kokai bodes well.

TTD’s OpenPath and OpenAds initiatives further strengthen its ecosystem by connecting advertisers directly to publishers, improving transparency and supply-chain efficiency. The Trade Desk’s strategy revolves around the open Internet, which is where price discovery and competition exist. Management noted that average consumers spend about two-thirds of their online time on the open Internet, but advertisers allocate far less than that proportion of their budgets.

While The Trade Desk remains a leading independent DSP, the competitive environment is intensifying. Walled gardens like Meta Platforms, Apple, Google and Amazon dominate this space as they control their inventory and first-party user data, allowing for highly targeted ad campaigns.

Though TTD is focusing on geographic expansion, executing well across disparate markets can be complex and risky. Regulatory and privacy-related changes like the deprecation of cookies and tightening data-privacy laws like Europe’s GDPR also pose ongoing challenges. Macro volatility and higher expenses remain additional concerns.

Alphabet dominates the digital ad space with its online ad platform. The main sources of its ad revenues are Google Search, YouTube ads, Google Network, Google AdSense and Google Ad Manager. The company’s ginormous ad technology infrastructure integrates both DSP and supply-side platforms, aids advertisers in reaching their target across the web, mobile apps and CTV. In the third quarter of 2025, Google's advertising revenues were up 12.6% year over year to $74.18 billion and accounted for 72.5% of total revenues.

Alphabet's strong advertising business performance underscores how AI is reshaping Search, YouTube and the broader ads ecosystem. Search and other revenues surged 14.5% year over year to $56.57 billion. Search and other revenues accounted for 55.3% of total revenues and 76.3% of Google Advertising revenues. The launch of AI Overviews and AI Mode has driven growth in overall queries, including commercial queries, leading to more opportunities for monetization.

A key highlight in Search monetization is AI Max, which launched globally in September. Google noted that AI Max is already being used by “hundreds of thousands of advertisers”, making it the making it the fastest adoption curve for any AI search ads product. Management added that advertisers were witnessing higher conversion value and expanded reach.

Alphabet Inc. price-consensus-eps-surprise-chart | Alphabet Inc. Quote

YouTube ads also delivered a strong quarter, with revenues growing 15% year over year to $10.3 billion, driven primarily by direct-response advertisers. Alphabet has added various AI-powered features that are helping creators offer better content on their channels.

The company also highlighted how AI is improving its internal operations. Sales teams are using “Gemini enriched with ads knowledge” to rationalize client interactions. This has resulted in increased productivity (up over 10%), while Gemini-powered customer support systems have already handled more than 40 million service sessions this year.

Strong ad business aside, momentum in cloud and AI bodes well. Google Cloud ended the reported quarter with $155 billion in backlog, up 82% year over year. In third-quarter 2025, revenues from products built on Alphabet’s generative AI models (Gemini, Imagen, Veo, Chirp and Lyria) jumped more than 200% year over year.

Stupendous financial resources also give it an edge over rivals. Alphabet generated $48.41 billion of cash from operations in the third quarter of 2025. Cash equivalents and marketable securities were $98.5 billion at the quarter-end.

Over the past month, TTD stock has lost 23.3% while GOOGL is up 11.1%.

Valuation-wise, both TTD and GOOGL are overvalued, as suggested by the Value Score of D.

In terms of the forward 12-month price/earnings ratio, TTD’s shares are trading at 19.55X, lower than GOOGL’s 26.14X.

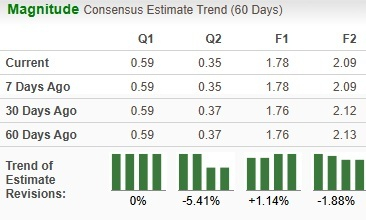

Analysts have made marginal revisions for TTD’s bottom line for the current year in the past 60 days.

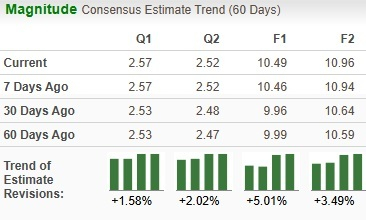

For GOOGL, there is a 5% upward revision.

TTD currently carries a Zacks Rank #3 (Hold), while GOOGL carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In terms of Zacks Rank, GOOGL emerges as a better pick right now.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite