|

|

|

|

|||||

|

|

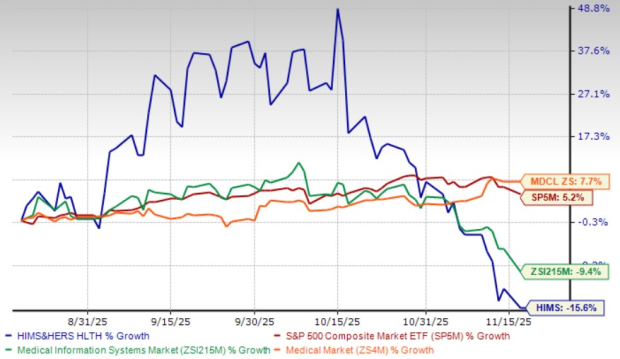

Hims & Hers Health, Inc.’s HIMS investors have been experiencing some short-term losses from the stock lately, despite its bumpy ride over recent months. The San Francisco, CA-based health and wellness platform’s stock lost 15.6% compared with the industry’s 9.4% decline in the past three months. It has also underperformed the sector and the S&P 500’s gain of 7.7% and 5.2%, respectively, in the same time frame.

Two major recent developments of HIMS include the launch of its in-depth testing experience, Labs, and the announcement of its third-quarter 2025 results (both in November).

Hims & Hers had recorded a robust improvement in the top line and strength in both revenue channels in third-quarter 2025. The increase in subscribers and monthly online revenue per average subscriber during the quarter was encouraging. However, HIMS’ dismal bottom-line results in the third quarter of 2025 were disappointing. The contraction of both margins during the quarter does not bode well for the stock.

Over the past three months, the stock’s performance has remained weak, underperforming its peers like Teladoc Health, Inc. TDOC. However, Hims & Hers has outperformed its other peer, American Well Corporation AMWL, popularly known as Amwell. Teladoc Health’s and Amwell’s shares have lost 8% and 44.2%, respectively, in the same time frame.

HIMS expects revenues for the fourth quarter of 2025 and the full year in the bands of $605 million to $625 million (reflecting an uptick of 26%-30% year over year) and $2.335 billion to $2.355 billion (representing growth of 58%-59% from 2024 levels), respectively. The Zacks Consensus Estimate for revenues for the fourth quarter and the full year is currently pegged at $619.9 million and $2.35 billion, respectively, while the same for earnings per share is currently pegged at 4 cents and 48 cents, respectively.

A key factor weighing on Hims & Hers is the expanding regulatory complexity tied to its growth into sterile compounding, peptide manufacturing and laboratory testing. These areas carry stringent compliance requirements and significant oversight from federal and state authorities. As operations broaden, so does the risk of inspections, enforcement actions and added compliance costs, creating a more challenging operational environment.

Another pressure for Hims & Hers comes from uncertainty surrounding compounded GLP-1 medications. With branded semaglutide shortages now resolved, the long-term permissibility of compounded alternatives is uncertain. Since weight-loss offerings are an important contributor to growth, any disruption in the ability to source or provide compounded GLP-1 treatments could impact demand trends and create volatility. This also ties into product-mix and pricing dynamics that may influence margins even as revenue continues to rise.

A third operational challenge is the strain associated with rapid expansion. Hims & Hers is scaling facilities, clinical capabilities and personnel at a steady pace, which increases the complexity of maintaining quality and efficiency. Introducing new specialties, expanding internationally and integrating newly acquired capabilities all require precise execution. Any shortcomings in operational coordination could affect customer experience, cost structures and HIMS’ ability to sustain its current trajectory.

One market-driven factor weighing on HIMS is intensifying competition. The telehealth and consumer-health landscape is becoming increasingly crowded with traditional healthcare providers, pharmacy chains, large digital-health platforms and niche startups. Many competitors possess strong payer relationships, broad clinical infrastructure or greater financial resources. As a result, customer acquisition and retention may become more expensive and less predictable, even though Hims & Hers continues to post strong top-line performance.

Another factor is the growing challenge of sustaining brand trust as Hims & Hers expands into sensitive categories such as testosterone, menopause, mental health and longevity. These areas require careful clinical execution and consistent patient outcomes to maintain credibility. Any gaps between product expectations and customer experience could weigh on engagement, especially as HIMS’ offerings become more complex. While recent financial results reinforce momentum, maintaining that trajectory depends on preserving confidence in the brand and the clinical quality that underpins its expanding portfolio.

A key fundamental catalyst for Hims & Hers is its deepening expansion into high-value clinical categories that attract durable, subscription-based demand. The launch of Labs brings a comprehensive, longitudinal testing platform that integrates biomarker tracking with personalized treatment pathways, strengthening HIMS’ ability to own the full continuum of preventive and chronic-care management. Parallel category expansions in women’s menopause care and men’s hormone health further broaden the platform’s reach, tapping into large, underserved populations with tailored, clinically backed offerings. These initiatives enhance customer lifetime value, reinforce cross-category engagement and support continued revenue scaling as newer verticals mature.

A second fundamental driver is Hims & Hers’ accelerated global and technological build-out, which meaningfully expands its addressable market. The acquisition of ZAVA and planned entries into major regions like Canada position the brand to replicate its U.S. care model across geographies with significant unmet need in weight loss, dermatology, sexual health and mental health. At the same time, strengthened investment in AI — supported by its large notes offering and the appointment of a seasoned AI-focused chief technology officer — enhances its diagnostic, routing and personalization capabilities, laying the groundwork for scalable, technology-enabled care delivery globally.

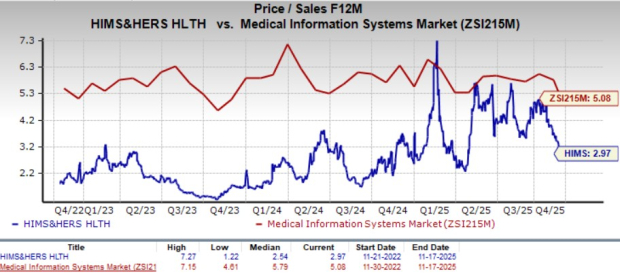

HIMS’ forward 12-month P/S of 2.9X is lower than the industry’s average of 5.1X but is higher than its three-year median of 2.5X.

Teladoc Health and Amwell’s forward 12-month P/S currently stand at 0.5X and 0.3X, respectively, in the same time frame.

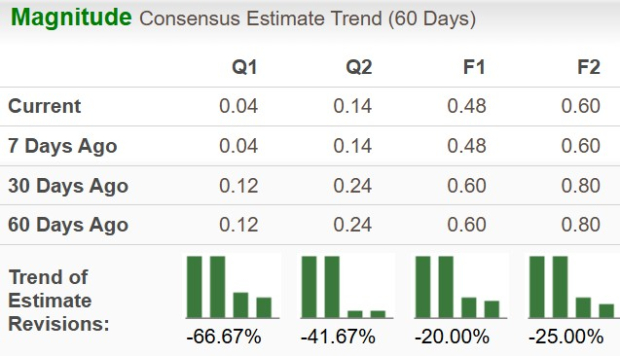

Estimates for Hims & Hers’ 2025 earnings have moved 20% south to 48 cents in the past 60 days.

Estimates for Teladoc Health’s 2025 loss per share have narrowed from $1.17 to $1.15 in the past 60 days.

Estimates for Amwell’s 2025 loss per share have widened from $6.13 to $6.15 in the past 60 days.

There is no denying that Hims & Hers is poised favorably in terms of core business strength, earnings prowess, robust financial footing and global opportunities. However, holding on to this Zacks Rank #4 (Sell) company at present does not seem to be prudent, despite the company’s strong growth prospects, which present a good reason for existing investors to retain shares for potential future gains.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Meanwhile, the valuation indicates superior performance expectations compared with its industry peers. It is still valued lower than the industry, which suggests potential room for growth if it can align more closely with overall market performance. The favorable Zacks Style Score with a Growth Score of A suggests turnaround potential for HIMS.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 5 hours | |

| 14 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite