|

|

|

|

|||||

|

|

Intuitive Surgical’s ISRG third-quarter performance highlights a pivotal shift in its platform mix, with robotic bronchoscopy, formerly a peripheral initiative, rapidly emerging as a core growth engine. Ion platform procedures surged 52% year over year to just under 38,000, far outpacing the still-strong 19% growth of da Vinci procedures. While da Vinci remains the financial backbone, Ion’s accelerating adoption and expanding clinical validation signal a maturing segment with the potential to reshape ISRG’s future revenue stack.

Intuitive Surgical is expanding the platform’s clinical advantage, driven by AI-enabled planning, real-time navigation and multimodal imaging. ISRG reported FDA clearance of new Ion software featuring real-time AI airway navigation and tomosynthesis to improve precision, especially in facilities without cone-beam CT.

More importantly, new data from the Zurich randomized controlled trial may significantly boost Ion’s potential, as it demonstrated a diagnostic yield of 84.6% for Ion plus mobile cone-beam CT versus 23.1% for conventional bronchoscopy, despite nodules averaging only 11 mm. The study also showed a nearly 30-percentage-point jump in Stage 1A lung cancer detection after Ion adoption — exactly the type of upstream clinical impact that can structurally increase procedure volumes.

Lung cancer remains the world’s deadliest cancer, and earlier-stage detection is the single biggest driver of survival and cost-efficiency. Ion is positioned directly in this clinical gap. Although da Vinci’s installed base of nearly 10,800 systems remains far larger than Ion’s roughly 950 systems, Ion’s 14% utilization growth and its expanding AI-enabled capabilities suggest increasing throughput and more durable economics for pulmonary programs.

At present, Ion generates a much smaller portion of revenues than da Vinci’s leading instruments-and-accessories segment. But if the Zurich trial data catalyzes stronger adoption across global lung screening programs, Ion could transition from a high-growth adjunct to ISRG’s next scaled franchise — one capable of materially reshaping the company’s long-term growth runway.

Johnson & Johnson’s JNJ robotic-bronchoscopy platform, the MONARCH Platform, continues to advance significantly. J&J recently announced data from the TARGET study, which demonstrated that clinicians reached small, peripherally located lung nodules in 98.7% of cases and achieved an 83.2% diagnostic yield using the MONARCH system.

In March 2025, the company received FDA 510(k) clearance for the next-gen MONARCH QUEST upgrade, featuring AI-powered navigation (via NVIDIA RTX architecture) and integration with GE HealthCare OEC 3D mobile CBCT to enhance real-time targeting and precision. J&J has also secured regulatory clearance in China, making MONARCH the first minimally invasive robot-assisted lung procedure platform approved in that market. With these developments, J&J is positioning MONARCH as a frontrunner in enabling earlier lung lesion diagnosis and extending its procedural reach deeper into the lung periphery.

Medtronic plc’s MDT bronchoscopy strategy centers on its ILLUMISITE Platform, a fluoroscopic navigation system (not yet a full robotic bronchoscopy system) that employs digital tomosynthesis and real-time CT-to-body divergence correction. Clinical data for ILLUMISITE show a 79.3% diagnostic accuracy at 12-month follow-up versus 73.6% for CT-guided biopsy, and substantially fewer complications (5.8% vs. 31%).

The platform also demonstrated near parity in diagnostic yield compared with the competitive Ion robotic system in the RELIANT trial (75.5% vs. 77.8%). While Medtronic has not yet publicly launched a dedicated robotic bronchoscopy system, it is actively investing in its broader robotics and AI hub and developing next-wave solutions across surgery.

Thus, for Medtronic, ILLUMISITE serves as a strong stepping stone in bronchoscopic navigation with robotic ambitions in view.

Shares of ISRG have gained 4.8% in the year-to-date period compared with 0.2% growth for the industry.

From a valuation standpoint, Intuitive Surgical trades at a forward price-to-earnings ratio of 57.91, above the industry average. But, it is still lower than its five-year median of 71.53. ISRG carries a Value Score of D.

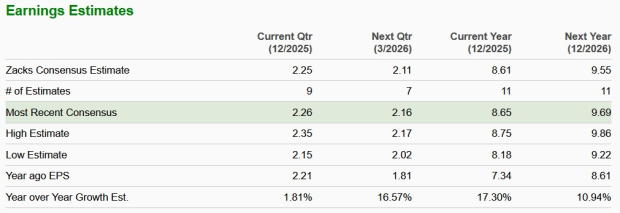

The Zacks Consensus Estimate for Intuitive Surgical’s 2025 earnings implies a 17.3% rise from the year-ago period’s level.

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Mar-08 | |

| Mar-08 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 |

Google Grabs Attention, But Funds Go Crazy For This 'Pick-And-Shovel' AI Stock

JNJ

Investor's Business Daily

|

| Mar-06 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite