|

|

|

|

|||||

|

|

Visa Inc. V and American Express Company AXP both turned in healthy earnings reports, but the forces propelling their growth continue to diverge in important ways. For investors evaluating which payment-network giant offers more durable momentum, it is not enough to simply compare headline beats. What matters now is the quality of that growth, the underlying trends shaping each business model, and how management expects the next phase of expansion to unfold.

Visa remains the world’s dominant card network, sitting at the center of global commerce and benefiting from long-running secular tailwinds such as digital payments, cross-border travel recovery and steady e-commerce adoption. American Express, meanwhile, continues to build on the strength of its premium customer base, leaning into strong credit metrics, high-spending cardholders and resilient fee income. With both companies navigating shifting spending patterns, investors want clarity on whose post-earnings trajectory looks stronger.

Let’s break down their latest quarterly performances, key operational drivers, capital deployment decisions and outlooks and estimates to see which stock appears better positioned after earnings.

Visa reported fourth-quarter fiscal 2025 EPS of $2.98, edging past the Zacks Consensus Estimate of $2.97 and rising 10% from the prior year. Performance continued to benefit from robust processed transactions, steady payment volume expansion and healthy cross-border travel trends. The strength wasn’t without costs, however. Operating expenses increased meaningfully, and client incentives, a contra-revenue item, jumped 17% year over year to $4.2 billion, partially offsetting the top-line momentum.

On a constant-dollar basis, Visa’s payments volume climbed 9% year over year in the fiscal fourth quarter, supported by strength across the United States, Europe, CEMEA and LAC markets. Processed transactions reached 67.7 billion, up 10% from a year ago. Cross-border volume remained a standout highlight, growing 12% year over year.

Visa Inc. price-consensus-eps-surprise-chart | Visa Inc. Quote

American Express delivered third-quarter 2025 EPS of $4.14, topping the Zacks Consensus Estimate by 4.6% and accelerating 19% year over year. The beat reflected continued spending strength from its premium customer base, rising revolving loan balances and continued card fee income growth. These tailwinds helped offset the impact of higher operating costs and increased customer engagement expenses, both of which have been trending upward.

Network volumes reached $479.2 billion, an increase of 9% year over year, propelled by elevated U.S. consumer activity. Total interest income advanced 8% year over year to $6.6 billion, surpassing estimates by 3.4%. AXP also saw a 5% decline in credit-loss provisions, benefiting from lower reserve build. Total expenses climbed 10% year over year to $13.3 billion, reflecting higher servicing costs and an elevated level of rewards and benefits activity.

American Express Company price-consensus-eps-surprise-chart | American Express Company Quote

Visa’s net revenues for fiscal 2026 are expected to witness low double-digit growth from $40 billion a year ago, on an adjusted nominal-dollar basis. Operating expenses are also expected to witness low double-digit growth. Management anticipates EPS will witness growth in the low double-digits. The Zacks Consensus Estimate for Visa’s fiscal 2026 EPS is pegged at $12.81, an 11.7% increase, followed by a 13.3% growth next year. Similarly, the consensus mark for fiscal 2026 and 2027 revenues suggests 11% and 10.6% increases, respectively.

American Express anticipates revenues to increase between 9% and 10% in 2025 from the 2024 level of $65.9 billion. Management now expects EPS in the range of $15.20-$15.50, above the previously projected band of $15-$15.50. The Zacks Consensus Estimate for AXP’s 2025 EPS is pegged at $15.39, a 15.3% increase, followed by a 14% growth next year. Similarly, the consensus mark for 2025 and 2026 revenues predicts 9.3% and 8.3% increases, respectively.

Visa exited the quarter with $17.2 billion in cash and cash equivalents, up from $12 billion at the end of fiscal 2024. Long-term debt fell to $19.6 billion from $20.8 billion. Operating cash flow came in at $6.2 billion for the quarter, down 6.4% year over year, though still comfortably strong. Importantly, Visa’s long-term debt-to-capital ratio of 34.08% remains far below both the industry average (37.94%) and AmEx’s 64.06%. Since Visa does not carry credit risk on its balance sheet, its capital structure naturally remains lighter and more flexible.

American Express ended the quarter with $54.7 billion in cash and equivalents, up from $40.6 billion at year-end 2024. Long-term debt increased to $57.8 billion from $49.7 billion. Operating cash flow reached $15.4 billion over the first nine months of 2025, up an impressive 85.7% year over year. While AmEx manages a more levered balance sheet by design, its liquidity profile remains solid and supported by its lending operations.

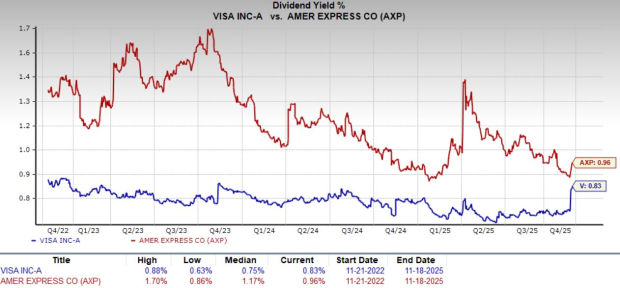

Visa returned $6.1 billion to shareholders during the quarter, $4.9 billion through buybacks and $1.2 billion via dividends. It still holds $24.9 billion in remaining buyback authorization. Visa’s dividend yield of 0.83% trails AmEx’s 0.96%, though Visa’s repurchase potential remains significantly larger. American Express repurchased 7 million shares for $2.3 billion and paid out $600 million in dividends.

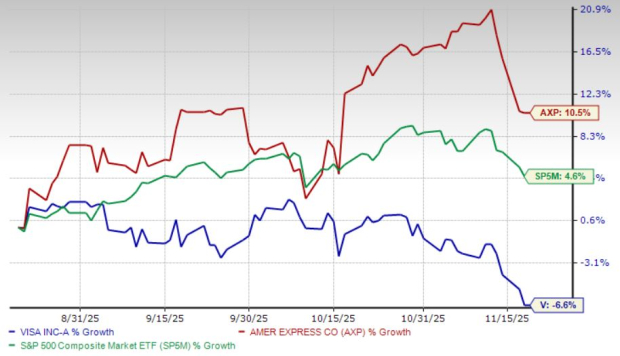

Over the past three months, shares of Visa have declined 6.6%, underperforming both AXP and the S&P 500 Index.

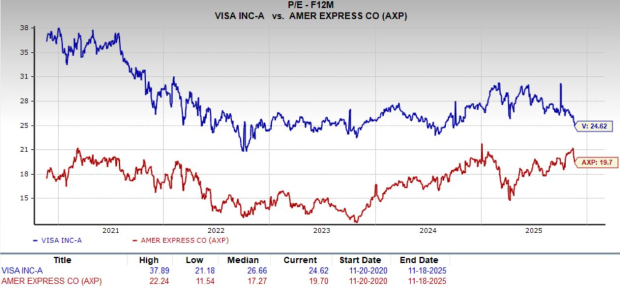

Visa is currently trading at 24.62X, which is below its five-year median of 26.66X. Meanwhile, AmEx is trading at 19.70X, above its five-year median of 17.27X. This suggests Visa holds more valuation-based upside.

Visa currently trades below its average analyst price target of $402.58, implying a potential 25.3% upside from current levels. The highest target of $450 and the lowest of $327 illustrate differing risk perspectives, but the consensus direction remains clearly positive. AmEx trades below its $353.98 average target as well, but with just 3.9% upside. The gap in expected return is significant.

Visa’s global scale, cleaner balance sheet, lower-risk model, steadier volume growth and more attractive valuation position it for more durable upside than AmEx. Price targets reinforce that view. While AXP benefits from affluent spending trends, Visa’s post-earnings pullback makes it the stronger near-term opportunity, despite both holding a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 33 min | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 5 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite