|

|

|

|

|||||

|

|

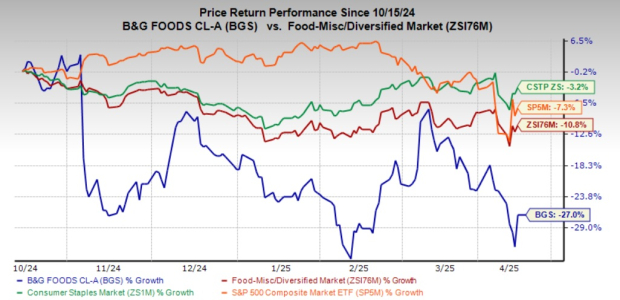

B&G Foods, Inc. BGS has seen its shares fall 27% over the past six months, underperforming the industry, the broader Zacks Consumer Staples sector and the S&P 500's 10.8%, 3.2% and 7.3% declines, respectively. This pullback reflects a challenging environment for both B&G Foods and the broader packaged food industry, as consumers continued to shift their purchasing behavior in response to persistent inflation and elevated prices for food and other essentials.

Closing the trading session at $6.22 on Friday, BGS stock remains below its 200-day and 50-day SMAs of $7.12 and $6.48, respectively, indicating a possible sustained downward trend.

Investors are debating whether BGS is poised for a rebound or stuck in a prolonged slump.

B&G Foods continues to grapple with soft sales, a trend that extended into the fourth quarter of fiscal 2024. Quarterly net sales declined 4.6% year over year to $551.6 million, reflecting several headwinds. The divestiture of the Green Giant U.S. shelf-stable product line in November 2023 significantly impacted results. Additionally, lower unit volumes and unfavorable foreign currency movements weighed on performance. Although elevated net pricing and an improved product mix provided some relief, these efforts were not enough to offset the broader pressures on revenues.

The Frozen & Vegetables segment was affected, with performance slipping during both the fourth quarter and the full fiscal year. The Green Giant divestiture alone accounted for a $110.1 million sales reduction, marking a 14.3% year-over-year decline. Beyond the divestiture, the segment faced additional challenges from lower pricing, weaker volumes and rising raw material costs, especially in core vegetable categories.

While input cost inflation has persisted across B&G Foods' basket of raw materials and factory operations, the overall increases have been relatively modest in 2024. However, certain categories such as black pepper, garlic, olive oil, tomatoes and core vegetables, continue to experience elevated costs, with inflationary pressures expected to remain throughout 2025.

As fiscal 2024 proved particularly difficult, especially due to foreign currency impacts, fiscal 2025 is expected to bring continued volume challenges in the first half, with gradual improvement and flat to modest volume gains anticipated in the second half. While the unfavorable U.S. dollar to Mexican peso exchange rate weighed heavily on costs in 2024, recent stabilization is expected to provide relief beginning in the second half.

Despite lingering challenges, B&G Foods has a strong history of acquisition-led growth, having added over 50 brands since 1996, including Crisco, Clabber Girl and Ortega. These acquisitions have expanded its portfolio and diversified offerings, and positioned the company for long-term growth despite ongoing challenges.

Apart from this, B&G Foods is reshaping its portfolio by divesting non-core assets, including the Green Giant U.S. shelf-stable line in November 2023 and Back to Nature in early 2023. These moves allow the company to focus on higher-margin core segments like Spices & Flavor Solutions and Meals.

A core strength for B&G Foods, the Spices & Flavor Solutions segment continued its strong performance in the fiscal fourth quarter, posting a 5% year-over-year increase in net sales. This growth reflects the segment’s ability to meet rising consumer demand, especially amid a shift toward fresh produce and protein-based diets. Adjusted EBITDA for the segment also rose 2.5%, driven by higher volumes, improved pricing and a favorable product mix.

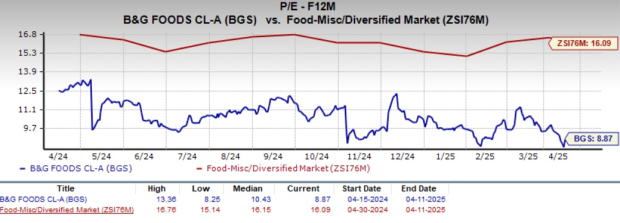

BGS is currently trading at a discount to its historical and industry benchmarks. The stock has a forward 12-month P/E ratio of 8.87, which is below the median level of 10.43 scaled in the past year. This compares with the forward 12-month P/E ratio of 16.09 for the industry.

While the lower valuation might initially suggest an attractive entry point, it may also reflect investor concerns or potential underlying challenges within the business.

With the recent stock decline, B&G Foods’ performance reflects multiple challenges, including shifting consumer behavior in response to persistent inflation and elevated food prices. However, the stock’s discounted valuation and the continued strength of its high-margin Spices & Flavor Solutions segment offer some appeal. For current investors, holding onto B&G Foods could make sense, while for new investors, it may be wise to wait for clearer growth catalysts before initiating a position. At present, BGS carries a Zacks Rank #3 (Hold).

United Natural Foods, Inc. UNFI distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. At present, United Natural carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus estimate for United Natural’s current financial-year sales and earnings implies growth of 1.9% and 485.7%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 408.7%, on average.

Post Holdings, Inc. POST operates as a consumer-packaged goods holding company in the United States and internationally. It presently carries a Zacks Rank of 2. POST delivered a trailing four-quarter earnings surprise of 22.3%, on average.

The Zacks Consensus Estimate for Post Holdings’ current financial-year sales and earnings indicates growth of 0.3% and 2.2%, respectively, from the year-ago numbers.

Utz Brands UTZ engages in the manufacture, marketing and distribution of snack foods in the United States. It presently carries a Zacks Rank of 2. UTZ delivered a trailing four-quarter earnings surprise of 8.8%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| Feb-24 | |

| Feb-23 | |

| Feb-18 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite