|

|

|

|

|||||

|

|

In recent years, demand for advanced air transport solutions such as electric vertical takeoff and landing (eVTOL) aircraft has risen sharply, driven by growing urban congestion and continued innovation in transportation technology. This surge in interest surrounding urban air mobility has strengthened investor confidence in companies like Archer Aviation ACHR and Joby Aviation JOBY, both of which are positioning themselves at the forefront of the eVTOL industry.

Archer Aviation is building a ride-sharing model focused on offering short-distance flights that link city centers with nearby airports or suburban hubs, supported by notable partnerships. Joby Aviation, on the other hand, is pursuing a vertically integrated strategy, overseeing both the design and future operation of its air taxi services, with backing from major strategic investors.

Given the significant potential of the global eVTOL market, it is worth taking a closer look to determine which eVTOL stock currently appears stronger — and, more importantly, which one might be the smarter investment at this stage.

JOBY is preparing to begin commercial operations in the near future. As part of the commercialization strategy for air taxi services, Joby Aviation recently completed its acquisition of Blade Air Mobility’s urban air mobility passenger business — a major milestone on the path to launching commercial operations.

This acquisition gives Joby Aviation access to Blade’s well-established network of terminals and its base of loyal passengers in key markets such as New York and Southern Europe. The deal could accelerate Joby Aviation’s entry into commercial service once its eVTOL aircraft receive certification. Furthermore, completing this buyout is likely to give Joby Aviation an early advantage over competitors like Archer Aviation.

In line with its expansion efforts, Joby Aviation recently announced the signing of a letter of intent with Alatau Advance Air Group (“AAAG”) for the potential sale of its eVTOL aircraft and related services valued at up to $250 million. The partnership aims to introduce cutting-edge air taxi services in Kazakhstan, marking a significant step in advancing sustainable aviation across Central Asia.

Moreover, earlier this month, Joby Aviation and the General Authority of Civil Aviation of Saudi Arabia announced plans for the deployment of an electric air taxi service. This builds on Joby Aviation’s agreement with Abdul Latif Jameel to explore the delivery of up to 200 of its aircraft in Saudi Arabia. Following the agreement, Saudi Arabia joins the United States, the United Kingdom, Japan, South Korea and the UAE as a key launch market for Joby Aviation's air taxi service.

Last month, JobyAviation tied up with NVIDIA NVDAto become the exclusive aviation launch partner for the newly introduced NVIDIA IGX Thor platform. Built on the powerful NVIDIA Blackwell architecture, this industrial-grade system is designed to drive the next generation of physical AI applications. The partnership will accelerate the development of Joby Aviation’s Superpilot autonomous flight technology across defense and commercial platforms. The alliance with a powerhouse like NVIDIA provides JOBY with technological credibility.

Archer Aviation continues to make significant progress in the eVTOL space through strategic partnerships, key milestones and expansion initiatives. In November 2025, Archer Aviation agreed to provide Anduril Industries and EDGE Group with its dual-use electric powertrain technology to help accelerate the development and large-scale production of Anduril’s newly introduced Omen Autonomous Air Vehicle system.

The company also signed definitive agreements to acquire Hawthorne Airport in Los Angeles for $126 million in cash. The 80-acre facility, known as Jack Northrop Field, includes terminal, office and hangar space and lies less than three miles from LAX. This acquisition will bolster Archer Aviation’s planned Los Angeles air taxi network and serve as an important testing ground for its AI-driven technologies.

In October 2025, Archer Aviation also reached an agreement with Korean Air to introduce its Midnight eVTOL aircraft in Korea, beginning with government applications. Under the deal, Korean Air intends to purchase up to 100 Midnight aircraft. This development is expected to strengthen ACHR’s global expansion efforts within the urban air mobility sector.

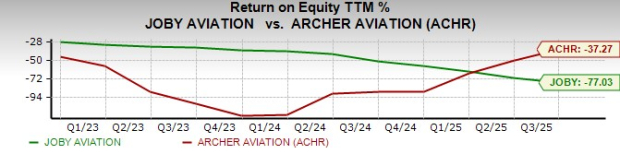

The negative return on equity for ACHR and JOBY, as shown in the figure below, suggests that neither of these eVTOL stocks is efficiently generating profits from its equity base.

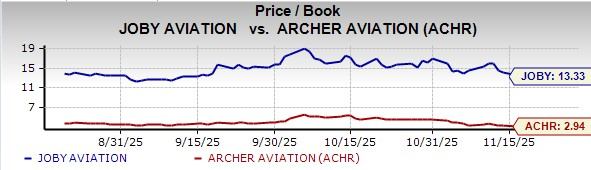

JOBY Aviation’s shares appear to be pricier than ACHR's. In terms of price-to-book value, JOBY is trading at 13.33X, much higher than Archer Aviation’s reading.

ACHR has a better track record than JOBY in this respect, having outshone the Zacks Consensus Estimate for earnings twice in the last four quarters and falling short of the consensus mark on the remaining occasions.

Archer Aviation price-eps-surprise | Archer Aviation Quote

On the other hand, JOBY’s earnings have failed to beat the Zacks Consensus Estimate in any of the past four quarters, missing the mark twice and reporting in-line earnings on the other occasions.

Joby Aviation, Inc. price-eps-surprise | Joby Aviation, Inc. Quote

While both Archer Aviation and Joby Aviation are making notable progress in the fast-evolving eVTOL space, challenges remain in terms of scalability and public acceptance. Only time will tell how the market and customer demand for eVTOLs will turn out. Public acceptance of eVTOLs as an alternative to traditional transport methods could face hurdles related to safety, noise and affordability concerns.

ACHR scores over Joby Aviation in terms of earnings surprise history. Archer Aviation’s valuation picture, too, is better than Joby Aviation’s. ACHR’s strategic airline partnerships and faster production ramp-up give it an edge in commercialization, whereas Joby Aviation’s vertically integrated model and certification milestones offer strong long-term potential.

Despite shared industry risks, like high costs and uncertain demand, Archer Aviation currently holds the edge over Joby Aviation, emerging as the stronger pick. While ACHR carries a Zacks Rank #2 (Buy), JOBY has a Zacks Rank #3 (Hold) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 11 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Dow Jones Futures: Stock Market Bounces Before Trump Speech, Nvidia Earnings

NVDA

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite