|

|

|

|

|||||

|

|

AMD has witnessed meaningful success following the launch of its MI300 and MI400 series GPUs.

Intel's data center business has demonstrated inconsistent results.

AMD continues to win deals with hyperscalers, while Intel seeks to reinvent itself.

Perhaps the most important piece of technology powering generative AI development is an advanced chipset known as the graphics processing unit (GPU).

While Nvidia pioneered these chips, two of the company's cohorts in the semiconductor space -- Advanced Micro Devices (NASDAQ: AMD) and Intel (NASDAQ: INTC) -- are seeking to make inroads as investments in artificial intelligence (AI) infrastructure accelerate.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Let's break down the current picture between AMD and Intel, and assess which chipmaker is better positioned for the proliferation of the AI infrastructure era.

Image source: Getty Images.

The AI revolution has featured a number of different GPU series. For Nvidia, the company's Hopper architecture was once coveted as the best chips money could buy. But over the last couple of years, Nvidia has introduced successor chips -- namely, Blackwell and the upcoming Rubin architecture.

Similarly, AMD started to gain traction in the data center landscape through its Instinct MI300 accelerators, launched in the fourth quarter of 2023.

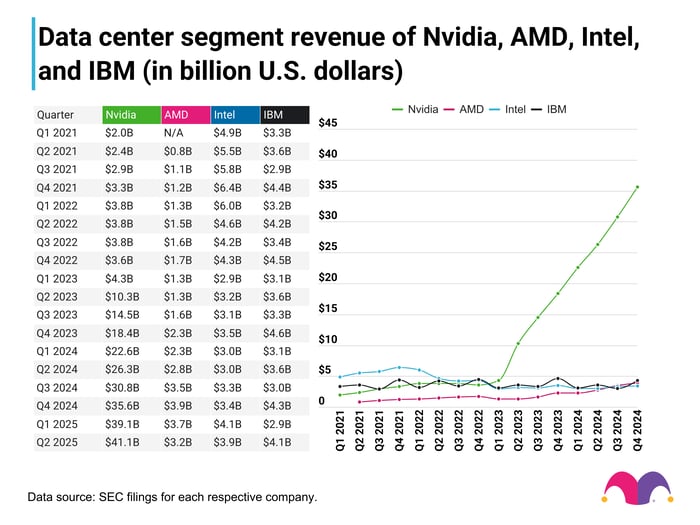

As the graphic below illustrates, AMD's data center business generated similar levels of revenue to Intel's within about six months following the Instinct release.

Image source: The Motley Fool.

During the third quarter of 2025, AMD's data center segment generated $4.3 billion in revenue -- rising by 22% year over year. By contrast, Intel's data center business reported $4.1 billion of sales -- a decline of 1% annually.

Intel is an extremely diversified business. In addition to its data center operations, the company also sells various hardware products, including microprocessors and other chips, as well as provides foundry services.

A couple of months ago, Nvidia agreed to invest $5 billion into Intel alongside additional funding commitments from the U.S. government and SoftBank. As part of the deal, Intel will be designing next-generation CPU architectures for Nvidia -- a potential catalyst for its data center segment.

As the image above illustrates, AMD's data center segment has consistently grown at double-digit rates. By contrast, Intel's growth has been rather inconsistent and appears to be decelerating in more recent quarters.

I believe the growth disparity between the two chipmakers stems from their differing approaches.

AMD offers a combination of hardware -- GPUs and CPUs -- as well as a software system called ROCm (Radeon Open Compute) -- providing developers with a comprehensive, full-stack suite. This approach is similar to that of Nvidia, which complements its GPUs with a custom software platform called CUDA.

By offering both hardware and software, AMD is able to create a lock-in effect with its developer base -- putting the company in a position to scale alongside its customers as they continue to invest capital in AI capex.

This strategy has already helped AMD win over the likes of Microsoft, Meta Platforms, Oracle, and OpenAI -- each of which is deploying large clusters of the company's Instinct accelerators.

Conversely, Intel has been struggling to execute on the innovation front. To further exacerbate its operational headaches, most of the hyperscalers now turn to Taiwan Semiconductor for its foundry services instead of Intel.

Throughout the AI revolution, TSMC has seen its market share in the foundry space expand from 56% to 68%. Meanwhile, Intel has lost ground -- now accounting for less than 1% of the market.

While Intel has some intriguing catalysts in the works, it's hard to know just how impactful its relationship with Nvidia will be. To me, Intel remains more of a turnaround story than a concrete winner of the AI infrastructure chapter.

For these reasons, I see AMD as the more strategically positioned data center business. The company's progress to date appears to be challenging an incumbent like Intel, and its current momentum on the backdrop of high-profile customer wins and secular themes of a multi-year, multi-trillion dollar infrastructure opportunity could further widen the gap.

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $562,536!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,096,510!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 187% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 17, 2025

Adam Spatacco has positions in Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, Meta Platforms, Microsoft, Nvidia, Oracle, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.

| 5 hours | |

| 6 hours | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite