|

|

|

|

|||||

|

|

The demand for clean electricity is accelerating worldwide, supported by a combination of long-term structural trends and rapid technological advances. As this need intensifies, utility companies like GE Vernova GEV and AES Corporation AES are becoming increasingly attractive investment opportunities due to their strong positioning in the energy transition.

A major catalyst is the rapid expansion of large, artificial intelligence-powered data centers. These facilities require enormous and steady electricity loads to power advanced computing systems and maintain continuous cooling, significantly increasing overall grid demand. At the same time, rising global temperatures are driving higher consumption of air conditioning and cooling technologies, further straining electricity systems in many regions.

Government policies are reinforcing these trends. Decarbonization targets, emissions regulations, and clean-energy mandates are compelling utilities and corporations to accelerate their shift toward renewable energy sources such as wind, solar and hydropower. Complementing this shift, grid modernization efforts, including upgrades to transmission infrastructure, expansion of smart-grid technologies, and integration of distributed energy resources, are gaining momentum to support reliability as more intermittent renewables come online.

All things considered, these combined forces are generating demand and creating a long-term investment environment for utilities.

GE Vernova is a pure-play energy company with a dedicated focus on grid modernization, renewable power and decarbonization technologies. The company benefits from its diversified business across Power, Wind, and Electrification, which allows it to provide customers with a full suite of solutions, from gas and nuclear to wind energy and grid technology. Because of its flexibility, the business appeals to a broad range of customers and remains resilient to market changes.

GEV is acquiring the remaining 50% stake in Prolec GE, giving it full ownership of the grid-equipment manufacturer and strengthening its leadership in the expanding global grid infrastructure market. The acquisition is expected to accelerate growth in GE Vernova’s fast-growing Electrification segment by broadening its manufacturing capabilities and product offerings, especially in North America, where demand for grid technologies is surging due to rising electrification, AI-driven data centers, renewables expansion and grid-resilience needs. The move also enhances the company’s global reach, positioning GE Vernova to capture increasing opportunities as electricity demand grows worldwide.

AES is capitalizing on the global transition to renewable energy by making strategic investments in clean energy solutions, including energy storage and utility-scale renewables, which provide attractive long-term growth opportunities. Along with leveraging innovation and AI to accelerate clean energy advancements, the company is also benefiting from its global diversification, which may lead to more stable revenues and an operational recovery.

AES is well-positioned to capitalize on the growing electricity demand from data centers through its significant power purchase agreements (PPAs). The company currently has about 4.2 gigawatt (GW) of data center PPAs in operation and a total of 8.2 GW in signed agreements.

Let’s compare the two stocks’ fundamentals to determine which one is the better investment option at present.

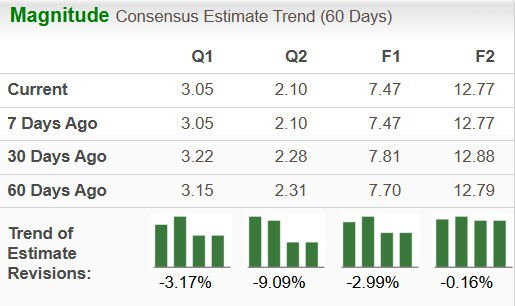

The Zacks Consensus Estimate for GE Vernova’s 2025 and 2026 earnings per share (EPS) has declined 2.99% and 0.16%, respectively, in the past 60 days.

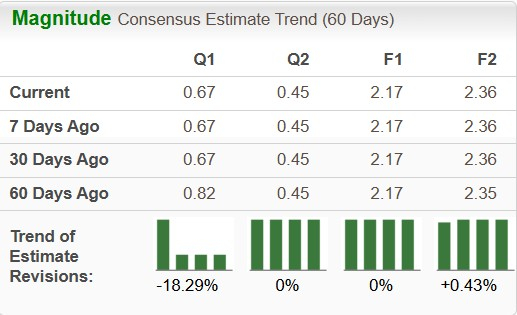

The Zacks Consensus Estimate for AES’ EPS has remained unchanged for 2025 and has increased 0.43% for 2026 over the past 60 days.

GE Vernova’s cash and cash equivalents as of Sept. 30, 2025, totaled $7.95 billion, while both the current and long-term debt values were nil. A comparative analysis of these figures indicates that GE Vernova has a strong solvency position and the capacity to reliably fund its ongoing operations and future growth plans.

AES had a long-term debt of $26.46 billion as of Sept. 30, 2025, while its current debt was $4.39 billion. The company’s cash equivalents, worth $1.76 billion (as of Sept. 30, 2025), remained much lower than its long-term and current debt levels. A comparative analysis of these figures implies that AES has a weak solvency position.

GEV shares trade at a forward 12-month Price/Sales (P/S F12M) multiple of 3.65X compared with AES’ P/S F12M of 0.72X, making AES relatively more attractive from a valuation standpoint.

ROE measures how efficiently a company is utilizing its shareholders’ funds to generate profits. GE Vernova’s current ROE is 17.07% compared with AES’ 18.83%.

In the past year, shares of GE Vernova and AES have increased 69% and 4.5%, respectively.

GE Vernova, active in power generation, has the added advantage of a robust grid technologies business, giving it a more integrated presence across both the generation and transmission segments of the energy value chain.

AES operates as a global utility and power generation company with a pure-power model focused on electricity generation, clean energy solutions and supporting infrastructure.

However, our choice at the moment is GE Vernova, given its better financial stability and price performance. Both GEV and AES stocks carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours | |

| 7 hours | |

| 9 hours | |

| 11 hours | |

| 11 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite