|

|

|

|

|||||

|

|

CrowdStrike (CRWD) and Fortinet (FTNT) are both at the forefront of the cybersecurity space, playing key roles in guarding organizations from extensive cyberattacks. While CrowdStrike specializes in endpoint protection and extended detection and response (XDR), offering artificial intelligence (AI)-native cloud security through its Falcon platform, Fortinet is a global leader in network security and firewalls with a growing platform approach. Both players are taking active roles in enabling enterprises against cloud and endpoint security.

CrowdStrike and Fortinet are riding on the key industry trends, driven by the mounting incidents of credential theft, remote desktop protocol breaches and social engineering-based strikes by malicious actors. Per a Mordor Intelligence report, the cybersecurity space is expected to witness a CAGR of 12.45% from 2025 to 2030.

With this strong growth forecast for the cybersecurity market, the question remains: Which stock has more upside potential? Let’s break down their fundamentals, growth prospects, market challenges and valuation to determine which offers a more compelling investment case.

CrowdStrike provides its cybersecurity services mainly through its Falcon platform. CrowdStrike’s Falcon platform is renowned for being the industry’s first multi-tenant, cloud native, intelligent security solution. The Falcon platform helps secure workloads across on-premise, cloud-based and virtualized environments running on several endpoints, such as desktops, laptops, servers, virtual machines and IoT devices.

CrowdStrike’s cloud-based Falcon platform currently provides 29 cloud modules via a software-as-a-service (SaaS) subscription model that is categorized under three categories: Endpoint Security, Security & IT Operations and Threat Intelligence. The share of subscription-based sales to CrowdStrike’s total revenues grew from 72% in fiscal 2017 to 95% in fiscal 2025.

A key driver of CrowdStrike’s customer growth is its Falcon Flex subscription model, which streamlines security adoption with modular and scalable solutions. This flexibility fosters long-term customer commitments, fueling steady revenue growth and deeper platform integration. CrowdStrike’s subscription customers, who adopted six or more cloud modules, represented 48% of the total subscription customers at the end of the second quarter of fiscal 2026. Those with seven or more cloud modules accounted for 33%, and those with eight or more cloud modules represented 23% as of July 31, 2025.

In the second quarter, CrowdStrike added a record $221 million in net new annual recurring revenues (ARR). This pushed up CrowdStrike’s total ARR to $4.66 billion, representing an increase of 20% from last year. A big part of this growth came from CrowdStrike’s Falcon Flex subscription model. The company now has more than 1,000 Falcon Flex customers, and more than 100 have already signed follow-on re-Flex deals before their contracts ended. These re-Flex deals are important because they show that customers are expanding faster than expected, often boosting ARR by nearly 50%.

Many customers are also using Falcon Flex to replace several legacy tools and choosing to consolidate around CrowdStrike. One such example is a Fortune 500 software firm that signed an eight-figure re-Flex deal to modernize its security operations center, where the firm renewed its contract 18 months before the expiration of the initial Falcon Flex subscription.

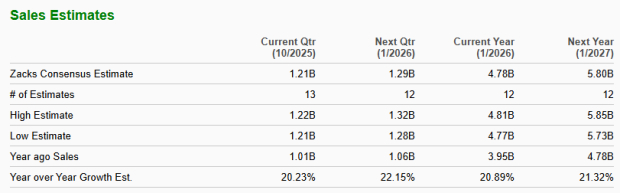

These factors are likely to continue driving growth while supporting CrowdStrike’s top-line growth. In the second quarter, CrowdStrike’s sales and non-GAAP EPS grew 21% and 5.7%, respectively, year over year. The Zacks Consensus Estimate for fiscal 2026 and 2027 revenues is pegged at $4.78 billion and $5.80 billion, respectively, both indicating a year-over-year increase of around 21%

Fortinet's third-quarter 2025 results demonstrated strong growth. The company's billings and revenues both grew 14% year over year. Additionally, the company achieved a record operating margin of 37%, which reflects that demand is steady and that the company continues to run its operations efficiently.

A key highlight during the quarter was the strong performance of Fortinet’s SASE business. Fortinet's Unified SASE billings grew 19%, and FortiSASE billings rose more than 100%. The strong demand was helped by the growing number of large customers that are adopting FortiSASE, as demonstrated by its rising usage, which grew more than 55% compared with last year. This shows that customers are responding well to Fortinet’s cloud-based security and networking model.

Fortinet’s firewall and networking products also did well. The company continues to lead the firewall market and benefits from its ASIC technology, which improves performance and reduces power use. Product revenues jumped 18%, supported by stronger hardware upgrades, software sales and higher demand for OT (operational technology) security. OT and critical infrastructure billings grew more than 30%.

However, Fortinet's service revenues grew only 13% during the third quarter, which is slower than the company’s product growth. Moreover, management expects service revenues to improve mainly in the second half of 2026, indicating some short-term pressure. Fortinet is also increasing its investments in cloud infrastructure and data centers, which raises near-term costs and could weigh on the company's margins in the upcoming quarters.

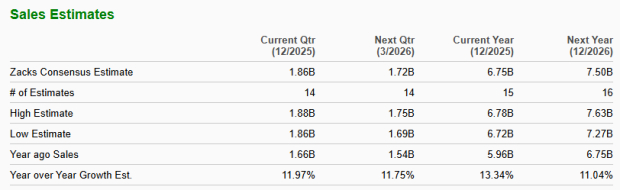

For the fourth quarter of 2025, Fortinet expects around 12% growth in billings and revenues. This is slightly lower than the company's third-quarter growth rate, which shows a more moderate outlook. The Zacks Consensus Estimate for full-year 2025 and 2026 revenues is pegged at $6.75 billion and $7.50 billion, respectively, indicating a year-over-year increase of around 13.3% and 11%, respectively.

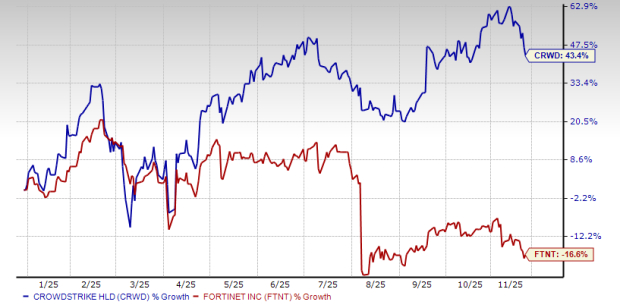

Year to date, CrowdStrike shares have appreciated 43.4%, while Fortinet shares have plunged 16.6%.

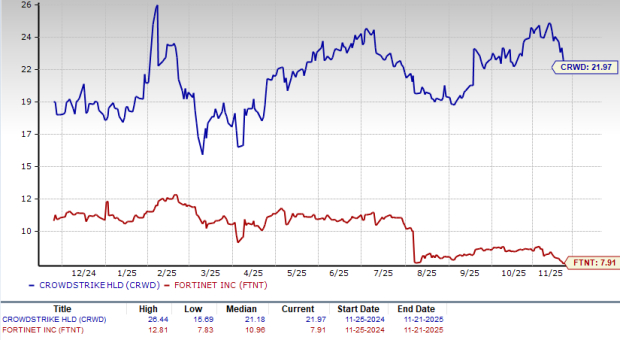

Fortinet is trading at a forward sales multiple of 7.91, below the Zacks security industry’s 11.97. CrowdStrike is trading at a forward sales multiple of 21.97. CrowdStrike does seem pricey compared to Fortinet. However, CrowdStrike’s valuations also reflect higher growth expectations for the company.

CrowdStrike’s leadership in the cybersecurity space provides strong revenue visibility for years to come. While the stock trades at a higher valuation than Fortinet, its explosive growth prospects and strong financial execution more than justify the price. Fortinet’s execution risks and slower growth trajectory suggest that investors should consider holding positions or waiting for more attractive entry points.

Currently, CrowdStrike sports a Zacks Rank #1 (Strong Buy), making the stock a must-pick compared to Fortinet, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite