|

|

|

|

|||||

|

|

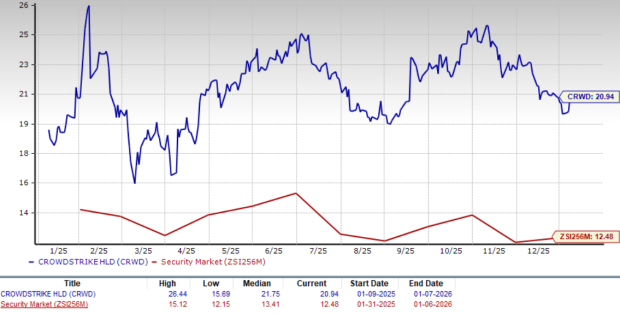

CrowdStrike Holdings CRWD is currently trading at a high price-to-sales (P/S) multiple, far above the Zacks Security industry. CrowdStrike’s forward 12-month P/S ratio sits at 20.94X, significantly higher than the Zacks Security industry’s forward 12-month P/S ratio of 12.48X. The Zacks Value Score of F also suggests that CRWD stock is overvalued.

The stock trades at a premium valuation to other industry peers as well, including CyberArk CYBR, Okta and Palo Alto Networks. At present, CyberArk, Okta and Palo Alto Networks have P/S multiples of 14.84X, 5.28X and 13.14X, respectively.

While this elevated valuation reflects investor confidence in the company’s long-term potential, it also raises concerns about whether the stock can justify such lofty multiples, especially amid near-term challenges.

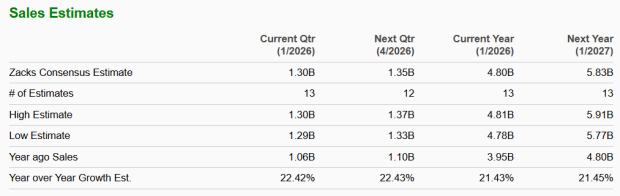

Although CrowdStrike has experienced impressive growth since its IPO, recent quarterly reports have shown a deceleration in its growth rate. The company's revenue growth, while still robust, is not as explosive as in previous years.

CrowdStrike had enjoyed more than 35% year-over-year top-line growth till fiscal 2024. However, the growth rate decelerated in fiscal 2025 to 29%. This trend is expected to continue in fiscal 2026.

For fiscal 2026, CrowdStrike expects total revenues to be in the range of $4.797 billion to $4.807 billion, reflecting a year-over-year increase of 21% to 22%. The Zacks Consensus Estimate for fiscal 2026 and 2027 suggests that the top-line growth will further decelerate to around 21%.

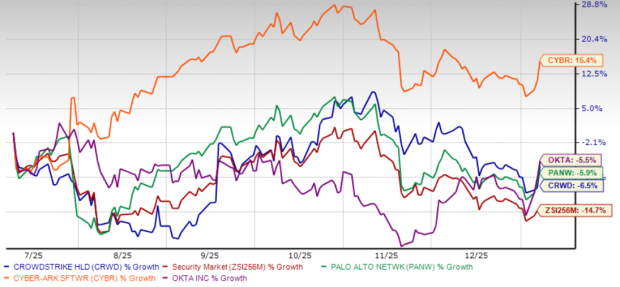

CrowdStrike’s decelerating sales growth has weighed on investors’ sentiments as reflected in a decline in its share price over the past six months. CRWD stock has declined 6.5% over the past six months and has underperformed industry peers, including CyberArk, Okta and Palo Alto Networks. Shares of CyberArk have rallied 15.4%, while shares of Okta and Palo Alto Networks have lost 5.5% and 5.9%, respectively.

Despite short-term concerns, the growing adoption of the Falcon Flex subscription model is anticipated to boost CrowdStrike's prospects in the coming quarters.

CrowdStrike’s Falcon Flex subscription model is becoming a key driver of the company’s growth. In the third quarter of fiscal 2026, management said that more customers are choosing Flex as their main way to buy and expand across the Falcon platform. Annual recurring revenue (ARR) from Flex accounts crossed $1.35 billion, growing more than 200% year over year during the third quarter, showing strong adoption across enterprise customers.

Falcon Flex helps customers adopt new modules without long contract steps, which leads to faster platform usage. This structure is leading to larger deals. During the third quarter, CrowdStrike highlighted several Falcon Flex expansion deals. One example was a large European bank that renewed more than 500,000 workload endpoint deployments and added Next-Gen SIEM, Onum, and Charlotte AI in a large eight-figure deal. Another example was a global healthcare customer that signed an eight-figure Falcon Flex contract, with Charlotte AI playing a central role in its security operations transformation.

Re-Flex activity is also increasing. These deals happen when customers finish deploying their initial Flex contract and return to sign a new one. Management said the number of re-Flex customers more than doubled sequentially, with 10 customers signing re-Flex deals at more than twice their original spend. This shows customers are expanding usage after seeing value from the platform.

Overall, Falcon Flex is supporting CrowdStrike’s broader growth. Total ARR reached $4.92 billion, up 23% year over year, with record net new ARR of $265 million. As Flex adoption and re-Flex activity continue, Falcon Flex is likely to remain a key driver of CrowdStrike’s ARR growth in the coming periods.

CrowdStrike is using partnerships to support growth and expand its reach. In the third quarter of fiscal 2026, management highlighted several partnerships, including Amazon’s AMZN Amazon Web Services, EY, Deloitte, Wipro and F5, Inc. FFIV, that are helping the company find new customers, close larger deals, and speed up adoption of the Falcon platform.

During the third quarter, CrowdStrike expanded its partnership with Amazon Web Services. CrowdStrike’s Falcon Next-Generation SIEM is now available directly inside AWS Security Hub. This means Amazon Web Services customers can start using Falcon SIEM more easily, without extra setup. The management believes that this creates a larger pool of potential users and gives CrowdStrike more chances to turn usage into paid subscriptions, often through the Falcon Flex model.

CrowdStrike is also working closely with global system integrators, such as EY, Deloitte, and Wipro. These partners are using the Falcon platform as their main tool for SIEM and SOC work. This helps CrowdStrike win large enterprise customers that want to replace older security tools and move to one platform.

Other partnerships are helping CrowdStrike enter new areas. The F5 partnership allows Falcon to run on F5 appliances, opening a new way to protect infrastructure that was harder to secure before. The Kroll partnership involves moving close to 500,000 endpoints to Falcon and shows how service and MSSP partners can bring CrowdStrike into new mid-market customer segments.

While CrowdStrike’s near-term growth may be slowing, its robust long-term potential remains compelling. The company’s subscription-based model and recurring revenue streams, along with its strong partner base, should provide stability and gradual growth, even amid ongoing macroeconomic challenges and geopolitical issues.

However, the company’s premium valuation and slowing sales growth warrant a cautious approach to the stock.

CrowdStrike currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 53 min | |

| 57 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite