|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

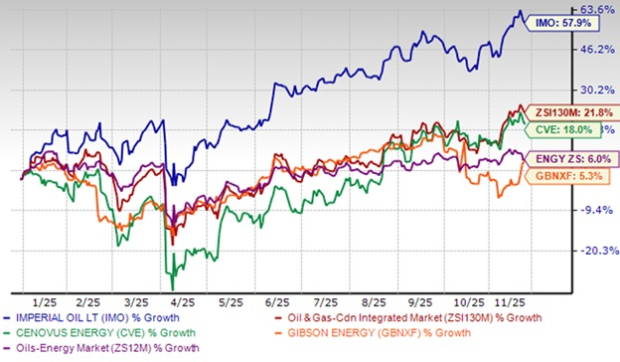

Imperial Oil Limited IMO has clearly outperformed all major peers and benchmarks in the year-to-date period. IMO stock has surged roughly 57.9%, far ahead of the Canadian Oil & Gas Exploration and Production (E&P) sub-industry (ZSI130M), which is up about 21.8%, and the broader Oils & Energy sector (ZS12M), which has gained only 6%. Among individual names, Cenovus Energy CVE trails sharply with a performance well below the sub-industry average, while Gibson Energy GBNXF shows only a modest 5.3% rise. Overall, the following chart highlights Imperial Oil’s dominant momentum relative to both its closest peers and the wider energy market.

Based in Calgary, Imperial Oil is involved in everything from pulling oil and gas out of the ground to refining it into gasoline and diesel, and then selling those products to customers. It also supplies a large share of Canada’s jet fuel and produces a lot of the asphalt used in the country. The company benefits from having ExxonMobil XOM as a major shareholder, which gives it access to global experience and advanced technology.

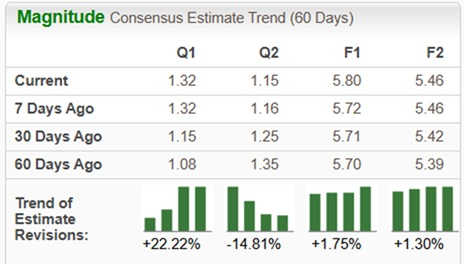

Over the past 60 days, the Zacks Consensus Estimate for IMO’s earnings per share has been revised up 1.75% for 2025 and up 1.30% for 2026, signaling improving analyst expectations.

With that context in place, the next question is what has actually supported its year-to-date performance. Let us look at the main factors behind the company’s recent strength and consider whether it can sustain this momentum going forward.

Record-Breaking Upstream Production: IMO achieved its highest quarterly crude production over 30 years during the third quarter of 2025, averaging 462,000 oil-equivalent barrels per day. This was driven significantly by the Kearl asset, which set an all-time quarterly record of 316,000 gross barrels per day. Such operational excellence demonstrates the company's ability to maximize value from its core assets, leading to higher sales volumes and reinforcing its strong market position in Canada's energy sector. This record output is a key indicator of efficient asset management and reliable operations.

Successful Ramp-Up of Lower Emission Projects: IMO is successfully executing its strategy to increase production from advantaged technologies. The Leming SAGD project is expected to see first oil imminently, and the Grand Rapids project is performing well. The company anticipates that more than 40% of its production at Cold Lake will come from these lower-emission intensity technologies by 2030, which aligns with global energy transition trends and potentially improves the social license to operate.

In contrast, Cenovus Energy’s progress on next-generation thermal and low-emission projects has been steady but not as advanced in terms of near-term contribution. Gibson Energy, with its infrastructure-focused model, lacks comparable emissions-cutting production technologies, highlighting Imperial Oil’s differentiated pathway.

Strategic Advantage From Relationship With ExxonMobil: Imperial Oil's unique relationship with its majority shareholder, ExxonMobil, provides a competitive edge that is difficult for peers to replicate. This partnership offers access to global technology centers, proprietary research and extensive operational benchmarking. The ongoing restructuring plan is explicitly designed to deepen this collaboration, allowing Imperial Oil to leverage ExxonMobil's global scale and expertise to drive further productivity improvements and cost reductions.

Neither Cenovus Energy nor Gibson Energy has access to a global partner with ExxonMobil’s scale, giving Imperial Oil a unique competitive advantage in technology adoption, benchmarking and operational efficiencies.

Resilient and Integrated Business Model: The company's structure, which integrates Upstream production with Downstream refining and chemicals, provides a natural hedge against market volatility. In the third quarter, weaker Upstream realizations were partially offset by stronger Downstream margins. This integration allows Imperial Oil to capture value across the entire hydrocarbon value chain, ensuring more stable cash flows and profitability through various commodity price environments compared with pure-play producers.

Challenging Conditions in the Chemical Business Segment: The Chemical segment reported a decline in earnings to C$21 million in the third quarter from C$28 million a year ago, caused by weaker polyethylene margins. The company acknowledged that challenging market conditions persist. This segment's underperformance acts as a drag on overall corporate earnings, demonstrating that not all parts of Imperial Oil's integrated model are currently firing on all cylinders.

While Cenovus Energy and Gibson Energy do not operate chemical businesses of similar scale, their absence of exposure in this segment means they avoid this earnings drag, putting relative pressure on Imperial Oil’s consolidated results.

Potential for Shareholder Returns to Slow in Early 2026: Management indicated that while the accelerated buyback will be completed by the end of 2025, the renewal of the Normal Course Issuer Bid is not until late June 2026. The ability to return cash in the first half of 2026 was stated to be dependent on commodity prices. This creates a potential for a slower pace of share repurchases in the interim if oil and refining markets soften, which could disappoint investors accustomed to very aggressive capital returns.

Long Gestation Period for Next-Generation Technology: The company's growth is partly pinned on new technologies like Enhanced Bitumen Recovery Technology (“EBRT”), with the pilot at Aspen not starting up until early 2027. The commercial deployment and material production contribution from such technologies are therefore many years away. This long timeline means investors must wait an extended period to see if these technological bets pay off, during which time market conditions or alternative energy solutions could evolve.

Significant Exposure to Volatile Commodity Prices: Imperial Oil's financial performance is heavily influenced by the price of crude oil, which experienced a year-over-year decline in the third quarter of 2025. West Texas Intermediate averaged $64.97 per barrel compared with $75.27 in the same period last year. This volatility directly impacts upstream profitability and cash flow, creating uncertainty in earnings and potentially affecting the company's ability to sustain its aggressive shareholder returns during prolonged periods of low prices.

IMO has delivered a strong performance, particularly in upstream production, achieving a record quarterly crude output driven by its Kearl asset. The company is also making progress with its lower-emission projects, aligning with global energy trends and the partnership with ExxonMobil offers a unique strategic advantage.

However, there are some challenges to consider, including weak earnings in the Chemical segment, potential slowdowns in shareholder returns due to reliance on commodity prices and a long timeline for new technologies like EBRT. Additionally, its performance remains sensitive to volatile crude oil prices, which could dampen future profitability.

Given this mix of strengths and potential challenges, investors should wait for a more opportune entry point instead of adding this Zacks Rank #3 (Hold) stock to their portfolios.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite