|

|

|

|

|||||

|

|

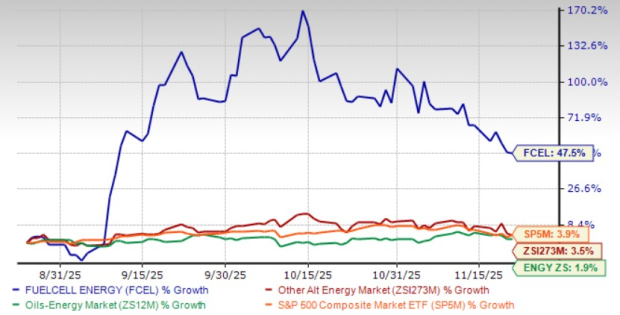

FuelCell Energy’s FCEL shares have gained 47.5% in the past three months, outperforming the Zacks Alternative Energy – Other industry’s rise of 3.5%. The company also outpaced the Zacks Oil-Energy sector and the Zacks S&P 500 composite in the same time frame.

FuelCell Energy has benefited from its strong presence in the South Korean fuel cell market, surging clean power demand from the data centers and long-term service agreements.

Like FuelCell Energy, another company providing combustion-free onsite electricity to its customers is Bloom Energy BE. Bloom Energy’s shares have gained 82.3% in the past three months. The company’s Energy Server platform provides efficient, dependable and low-emission power solutions for commercial users and utilities alike, which is boosting its performance.

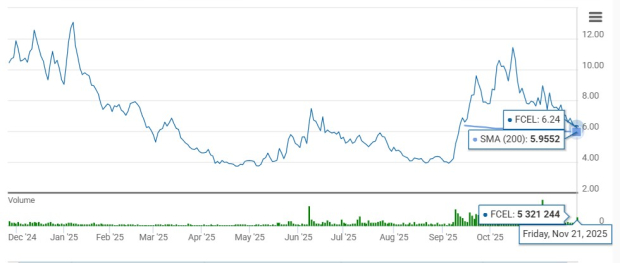

FuelCell Energy is trading above its 200-day simple moving average (“SMA”), signaling a bullish trend. The 200-day SMA is a key indicator for traders and analysts to identify support and resistance levels. It is considered particularly important as this is the first marker of a stock’s uptrend or downtrend.

Should you consider adding FCEL to your portfolio based on positive price movements? Let us delve deeper and find out the factors that can help investors decide whether it is a good entry point to add FCEL stock to their portfolio at the current price level.

FuelCell Energy is undertaking a global restructuring across operations in the United States, Canada and Germany to cut operating costs, refocus resources on its core technologies and strengthen competitive standing as clean-energy investment growth lags expectations.

FCEL continues to receive orders from its customers who need a 24X7 clean energy supply to efficiently run their operations. FuelCell Energy’s exposure to the South Korean fuel cell market provides a lot of opportunities. Currently, the company has a backlog of 108 megawatts (“MW”) in four projects. FuelCell Energy also signed a MOU with Inuverse to deploy 100 MW of fuel cell power at the AI Daegu Data Center in South Korea in a phased manner.

The company’s core carbonate technologies are well-suited to provide onsite combustion-free power to Data Centers. FCEL’s systems can also integrate with other existing power providers for the benefit of its customers. As market momentum is in favor of distributed power generation due to bottlenecks in the costly transmission and distribution lines, FuelCell Energy can play an important role in providing reliable 24x7 power to data centers.

FuelCell Energy also provides long-term service agreements to its customers for the proper maintenance and operation of the fuel cell power plants. These agreements consistently contribute to the top line as the duration of the agreements ranges from one to 20 years. In the last reported quarter, service agreements revenues increased to $3.1 million from $1.4 million in the year-ago quarter.

FuelCell Energy’s backlog as of July 31, 2025, was $1.24 billion, which reflects a 4% increase year over year. The majority of the backlog is from its Generation segment, an increase in the backlog indicates a steady demand for FuelCell Energy’s products.

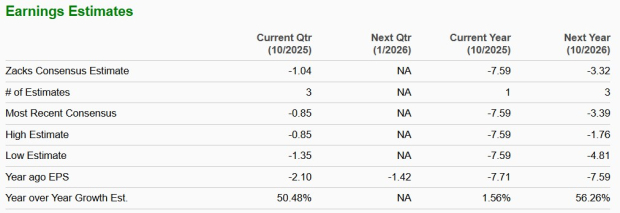

The Zacks Consensus Estimate for FCEL’s fiscal 2026 sales and earnings per share indicates year-over-year growth of 21.47% and 56.26%, respectively.

Another company operating in the same industry and providing clean electricity to customers is Ameresco AMRC. The Zacks Consensus Estimate for AMRC’s 2026 sales and earnings per share indicates year-over-year growth of 8.43% and 44.58%, respectively.

FuelCell Energy is utilizing lower debts compared with its industry peers to operate the business. The company’s current debt to capital is 19.4%, much lower than the industry average of 59.4%.

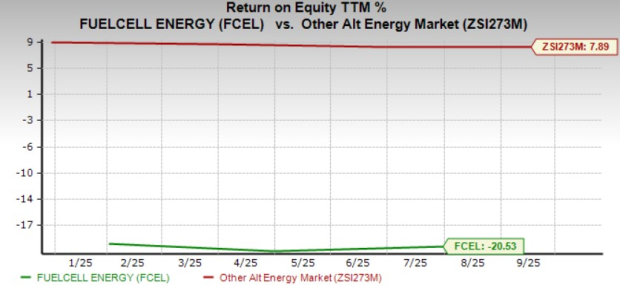

FuelCell Energy’s trailing 12-month return on equity (“ROE”) is negative 20.53%, much lower than the industry average of 7.89%. ROE is a financial ratio that measures how well a company uses its shareholders’ equity to generate profits.

FuelCell Energy will benefit from the increasing acceptance of fuel cell technology in the long term and increasing concern about rising emissions. The increasing backlog indicates an increase in demand. South Korean market exposure continues to add to the top line.

The improving estimates, lower debts than industry peers and increasing demand for fuel cell modules from data centers will create more opportunities for this Zacks Rank #2 (Buy) stock.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 min | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite