|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

CoreWeave (CRWV) and Amazon (AMZN) are major players in AI-focused cloud infrastructure, with the former specializing in GPU-optimized compute for AI workloads and the latter’s AWS offering large-scale AI and high-performance cloud services.

CoreWeave grew from a niche GPU provider into a leading AI cloud by buying large GPU inventories and carving out relationships with AI labs and companies that need lots of H100/Blackwell-class GPUs. Amazon also enjoys a dominant position in the cloud-computing market, particularly in the IaaS space, thanks to AWS, which is one of its high-margin generating businesses.

Per a report from Fortune Business Insights, the global cloud AI market is valued at $102.09 billion in 2025 and is estimated to reach $589.22 billion by 2032, at a CAGR of 28.5%. Cloud AI combines AI with cloud computing to improve how organizations work. By using AI tools like machine learning, natural language processing and computer vision through the cloud, companies can boost efficiency, streamline daily tasks and stay competitive.

So if you are willing to invest, which stock should you pick in terms of growth potential, fundamentals, valuation and risk tolerance? Let’s get to the core.

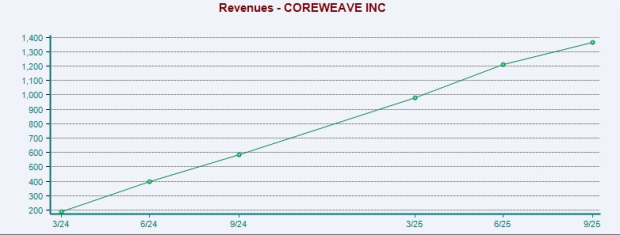

From hyperscalers to frontier AI labs, organizations racing to build the future of AI are turning to CoreWeave not only for raw GPU infrastructure, but for end-to-end high-performance cloud computing, networking and software services optimized specifically for AI. In the last reported quarter, the company crushed all estimations, posting record revenue (up 134%) and a nearly doubled revenue backlog that now exceeds $55 billion. This backlog includes remaining performance obligations and additional amounts that CRWV expects to convert into revenue in future periods, subject to service delivery requirements. This scale of contractual pipeline signals long-term stability and solid demand for CoreWeave's GPU-first cloud infrastructure in the era of AI.

CoreWeave is rapidly becoming the cloud infrastructure backbone for the world’s most advanced AI organizations, and the third quarter showcased major new partnerships and capacity expansions. It increased its active power footprint by 120 MW sequentially to about 590 MW and expanded contracted power capacity past 600 MW to 2.9 GW. This gives the company a strong pipeline for future growth, with more than 1 GW of contracted capacity still available to sell and expected to come online within the next year. It also signed major compute contracts with key customers, expanding existing partnerships while reducing reliance on any single client.

It signed a multi-year deal worth up to $14.2 billion with Meta, expanded its partnership with OpenAI through an additional deal of up to $6.5 billion (bringing total commitments to about $22.4 billion) and deepened its relationship with a leading hyperscaler, marking their sixth contract together. In addition to hyperscalers and AI labs, CoreWeave added notable enterprise and government clients, including Inference.net, Mizuho Bank, NASA JPL and Poolside. These partnerships affirm CoreWeave's shift from niche GPU cloud provider to a global AI infrastructure powerhouse reliant on purpose-built HPC networking and massive parallel compute environments.

A major force behind CoreWeave's momentum is its multi-billion-dollar agreements with NVIDIA Corporation (NVDA). Third-quarter highlights include being the first to deploy NVIDIA GB300 NVL72 systems for large-scale frontier AI workloads and the first to offer NVIDIA RTX PRO 6000 Blackwell Server Edition instances, giving CRWV an early lead in real-time AI and simulation workloads. Further, the company is on an acquisition spree to supplement inorganic growth. In October, it agreed to acquire Marimo Inc., maker of an AI-native Python notebook, strengthening its AI development infrastructure. This follows earlier acquisitions like OpenPipe and Weights & Biases.

However, its proposed $9 billion purchase of Core Scientific was canceled after stakeholders rejected the deal. Despite operating in a favorable demand environment, CRWV continues to face increasing supply chain pressures, where demand for its AI cloud platform greatly exceeds available capacity, limiting its ability to serve customers fully. Delays in powered-shell delivery from a data center provider are likely to negatively impact its performance in the fourth quarter. Although temporary and with the customer agreeing to adjust the schedule to retain full contract value, these setbacks have prompted management to lower its 2025 outlook. The company now expects revenue of $5.05–$5.15 billion, down from $5.15–$5.35 billion, and adjusted operating income of $690–$720 million, below the previous $800–$830 million range.

From AWS to e-commerce and Prime Video to Alexa, AI is driving efficiency, speed and customer engagement, helping power a strong quarter for Amazon even amid restructuring costs and a major legal settlement. AWS is gaining strong momentum as customers increasingly choose it for core and AI workloads due to its superior functionality, security and performance. Its broad and deep infrastructure capabilities spanning startups, enterprises and government needs make AWS the preferred platform for running production workloads. With more services, richer features and rapid innovation, AWS continues to lead the industry.

AWS revenues (18.3% of third quarter sales) rose 20.2% year over year to $33 billion, which beat the consensus mark by 2.01%. Owing to its strong capabilities, security, performance and customer focus, AWS continues to win most major enterprise and government cloud migrations. This makes AWS the primary home for company data and workloads, and a key reason many customers want to run their AI there. To support this demand, AWS has been rapidly expanding capacity, adding over 3.8 GW of power in the past year, more than any other cloud provider.

Amazon is rapidly expanding AWS’ power capacity, doubling what it had in 2022 and on track to double again by 2027. In the fourth quarter alone, it expects to add another 1 GW. The expansion includes power, data centers and chips like AWS’ Trainium and NVIDIA GPUs. AWS also launched Project Rainier, a large AI compute cluster with nearly 500,000 Trainium2 chips, now used by Anthropic to build and deploy Claude. Trainium2 demand is strong, fully subscribed and now a multibillion-dollar business growing 150% quarter over quarter.

Furthermore, its aggressive international expansion is driving long-term growth by tapping into high-potential e-commerce markets across Asia, Europe and Latin America. By strengthening its logistics network and improving delivery speeds, Amazon boosts customer satisfaction while reducing reliance on the mature North American market. As digital adoption and middle-class spending rise globally, Amazon’s proven model positions it to capture significant value across developing regions.

However, Amazon’s heavy spending on AI and data center expansion is pressuring its finances. AWS’ growing infrastructure needs require massive ongoing investment in chips, computing power and facilities, which is squeezing margins and reducing free cash flow. With uncertain returns and strong competition from Microsoft and Google, Amazon faces a prolonged period of high capital spending that may frustrate investors looking for better profitability and cash generation. Going ahead, it expects its cash CapEx to reach around $125 billion in 2025, with further increases planned for 2026. Heavy debt load limits its ambitious growth initiatives, creating financial inflexibility during escalated macroeconomic fluctuations.

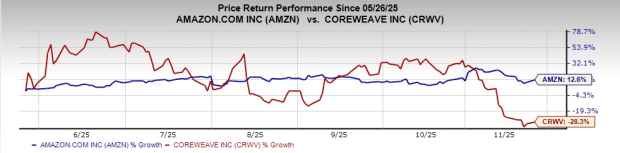

In the past six months, CRWV has declined 28.3% while AMZN is up 12.6%.

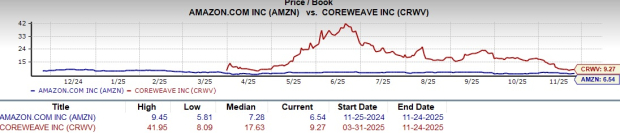

Valuation-wise, CoreWeave is overvalued, as suggested by the Value Score of D, while Amazon has a score of B.

In terms of Price/Book, CRWV shares are trading at 9.27X, compared with AMZN’s 6.54X.

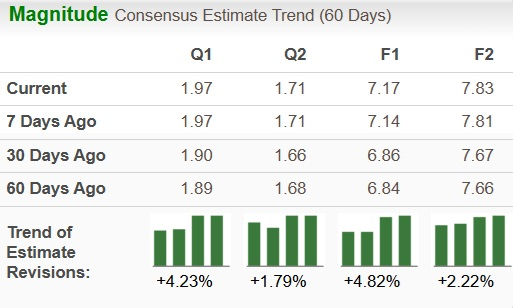

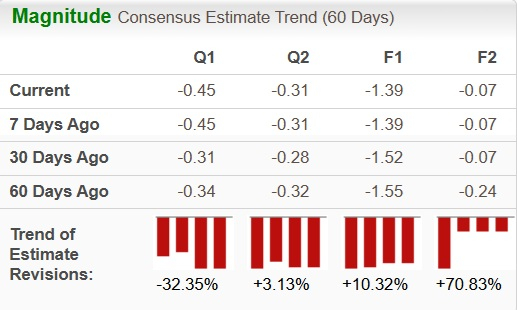

Analysts have kept their earnings estimates upward for AMZN's bottom line for the current year.

For CRWV, there is a 10.32% upward revision.

Amazon’s prospects are driven by fast-growing AWS demand for AI and custom silicon, supported by major infrastructure expansion set to double power capacity by 2027. Despite special charges weighing on income, the company plans to keep investing in AI, cloud and retail innovation, with advertising strength and new products fueling future growth. CoreWaeve is a fast-growing, GPU-heavy specialist riding explosive AI demand, with high growth potential. However, high capital needs, customer concentration and execution risk pose worries.

AMZN currently carries a Zacks Rank #2 (Buy) while CRWV has a Zacks Rank #3 (Hold). Consequently, in terms of Zacks Rank and valuation, AMZN seems to be a better pick at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 14 min | |

| 25 min | |

| 52 min | |

| 1 hour |

AI Stocks Reset In 2026. What's Next For Apple, Nvidia, Google And Microsoft?

NVDA AMZN

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite