|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

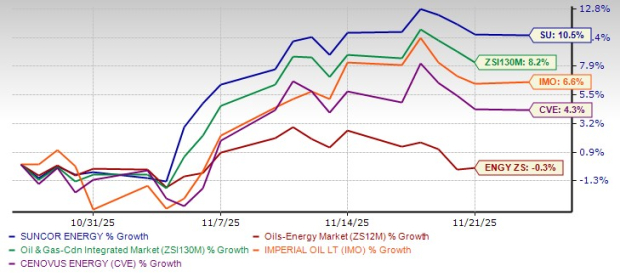

Suncor Energy Inc. SU has posted an impressive performance over the past month, with its shares rising 10.5%. This gain outperformed the Oil & Gas Drilling sub-industry’s 8.2% growth and stood in sharp contrast to the broader energy sector’s decline of 0.3% in the same time frame. When compared with peers like Imperial Oil Limited IMO and Cenovus Energy Inc. CVE — up 6.6% and 4.3%, respectively — Suncor’s stronger upward momentum reflects greater investor confidence and more consistent resilience.

As one of Canada’s top integrated energy players, Suncor maintains a diversified portfolio that covers oil sands development, offshore and conventional production, refining operations and fuel marketing. Its substantial oil sands presence in Alberta positions the company in a region with reserves rivaling those of Saudi Arabia. Suncor’s operations span three main divisions: Oil Sands, Exploration & Production, and Refining & Marketing, each contributing to a highly interconnected business model that captures value across the entire energy chain.

This integration — stretching from extraction through to retail — allows the company to remain competitive even in volatile market environments. With rising performance indicators, it’s worth exploring the factors behind Suncor’s recent strength and what they mean for its near-term outlook.

Record Operational Performance: Suncor delivered record-breaking performance in the third quarter of 2025 with upstream production of 870,000 barrels per day and refining throughput of 492,000 barrels per day — both the highest in company history. This demonstrates the success of its integration strategy and continuous operational optimization. Such record outputs at lower maintenance costs show sustained efficiency gains and provide resilience even amid moderate commodity prices. Both its competitors, Imperial Oil and Cenovus Energy, have also delivered resilient operational performance by reporting higher upstream production at lower costs.

Robust Shareholder Returns and Capital Discipline: Suncor continues to demonstrate shareholder-friendly policies, as it returned C$1.4 billion in the third quarter alone through dividends and share buybacks. The company’s monthly repurchase program — consistent even in weaker oil price environments — underscores management’s confidence in long-term value. This 5% dividend hike to C$2.40 annually signals growing financial strength and a commitment to sustainable cash returns. Peer comparison further highlights strength as Suncor provides a robust dividend yield of 3.74%, higher than the peer companies like Imperial Oil (2.15%) and Cenovus Energy (3.26%).

Integrated Business Model Enhancing Margins: Suncor’s ability to capture value across its entire chain — from oil sands extraction to retail fuel sales — drives superior margins. During the third quarter, it sold oil sands barrels at 96% of WTI and achieved 92% downstream margin capture. The company’s refining and marketing segments act as natural hedges against oil volatility, providing stable earnings when crude prices decline and reinforcing its reputation for great margins.

Upgraded Corporate Guidance: Suncor raised its 2025 guidance for upstream production and refinery throughput. This upward revision reflects improved operational execution, robust asset performance and confidence in delivering consistent results. Higher production guidance also signals sustained momentum into 2026, providing investors with visibility into earnings stability.

Commodity Price Sensitivity: While integration provides some insulation, earnings still correlate with oil prices. A sustained drop in WTI below $60 could pressure cash flows, limit buybacks and strain future dividend growth. The company’s impressive results in 2025 were achieved under a $65/barrel environment — lower realizations or refining margin compression could sharply affect profitability.

Limited Dividend Growth Despite Strong Cash Flow: Investors seeking income growth may find Suncor’s dividend increases modest compared to peers. Despite record free fund flow, dividend growth remains cautious, lagging competitors like Imperial Oil and Cenovus Energy. Management’s preference for buybacks over higher dividends could be viewed unfavorably by long-term income investors prioritizing dividend income.

High Environmental and Regulatory Exposure: Operating primarily in Canada’s oil sands subjects Suncor to intense regulatory scrutiny, high emissions and carbon compliance costs. Potential tightening of environmental regulations or increased carbon tax rates could significantly raise operating expenses. Moreover, reputational risks linked to high emissions intensity may deter ESG-focused investors, affecting long-term valuation.

Capital Intensity and Maintenance Needs: Although maintenance intervals have improved, Suncor remains a capital-intensive business. Sustaining high throughput and reliability across oil sands and refineries requires continued capital reinvestment. This high capital requirement may constrain flexibility in allocating cash to shareholders during weaker price environments.

The Zacks Consensus Estimate for SU’s 2025 earnings has been revised 14.8% upward in the past 30 days, indicating a positive trajectory for the company.

The Zacks Rank #3 (Hold) company presents a mixed investment case where the positives and challenges offset each other. On the one hand, its strong integrated model, record 2025 operational performance and disciplined capital returns provide stability, even in a volatile energy environment. Upgraded production guidance and resilient margins support steady earnings, while consistent buybacks and dividends enhance shareholder value. However, exposure to commodity price swings, carbon-intensive operations and ongoing capital needs limits upside potential. Given this balanced risk-reward profile, holding the stock remains the most prudent stance.

In this context, investors should consider adopting a hold strategy for now to monitor Suncor’s operational performance, carbon-intensive operations and capital return policy while avoiding premature exit before these initiatives potentially translate into shareholder value.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite