|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Costco Wholesale Corporation COST and BJ's Wholesale Club Holdings, Inc. BJ operate in the warehouse retail space. Costco, which boasts a market capitalization of about $396.6 billion, runs a membership-based warehouse model that focuses on selling goods at discounted prices across myriad categories, including groceries, electronics and household essentials. Its footprint spans 918 warehouses worldwide, including 632 in the United States and Puerto Rico and 111 in Canada.

On the other hand, BJ’s Wholesale has a market capitalization of roughly $11.8 billion and a more regionally concentrated presence with 257 warehouse clubs and 194 BJ's Gas locations. BJ’s emphasizes curated assortments, private-label products, digital integration and a membership program designed to appeal to value-conscious shoppers.

Both Costco and BJ’s Wholesale are operating in a difficult consumer environment characterized by tighter budgets. While Costco leverages its global scale, pricing power and loyal membership base to drive steady traffic, BJ’s relies on operational efficiency, market-specific execution and differentiated offerings to stay competitive. The key question for investors is: Which warehouse retailer stands out as the stronger stock today?

Costco’s strength is its resilient membership-based business model, which acts as a growth engine. This provides a steady and predictable revenue stream from annual fees, setting Costco apart from traditional retailers. The business model allows it to operate on slim margins while achieving high sales volumes. The model creates a strong value proposition, leading to decent membership renewal rates — 92.3% in the United States and Canada and 89.8% worldwide in the fourth quarter of fiscal 2025. We note that membership fee income rose 14% to $1,724 million in the quarter.

The company’s operational discipline is evident from its approach to supply chain management and procurement. By leveraging scale and efficiency, Costco secures favorable terms with suppliers and passes savings on to customers. This disciplined cost management improves margins and shields the company from inflationary pressures. Coupled with limited-markup policies, Costco proves that profitability and affordability can coexist in a competitive retail landscape.

Costco’s capacity to adapt to changing consumer preferences has also been key to its growth. The company modifies its product mix to include both everyday essentials and unique, high-demand items — a strategy that broadens its appeal across diverse customer groups. We note that Costco's net sales for October increased 8.6% year over year to $21.75 billion. Using data-driven market analysis and flexible merchandising, Costco has gradually expanded its presence both domestically and internationally.

Costco’s strategic investments in technology and logistics are strengthening its multi-channel ecosystem. The company’s digital initiatives have improved member engagement and operational efficiency, combining online convenience with the effectiveness of its warehouse model. By boosting e-commerce capabilities and expanding logistics infrastructure, Costco not only taps into new growth opportunities but also ensures stable demand from a wide member base. Digitally-enabled comparable sales surged 16.6% in October.

BJ’s Wholesale draws strength from its membership-driven model, which provides a recurring revenue base. The company’s ability to attract and retain members, particularly within higher-value tiers, creates dependable traffic. This positions BJ’s to expand wallet share over time, as loyal members respond favorably to value-driven merchandising. The company ended the third quarter of fiscal 2025 with 8 million members, supported by a tenured renewal rate of 90% and a higher-tier penetration level of 41%.

BJ's digital ecosystem, including same-day services, in-club fulfillment and mobile-enabled shopping, has emerged as another major driver. Digitally active members tend to have higher average baskets and visit more often than members who shop in-store only. The company's focus on convenience via order pickup, delivery partnerships and app-based checkout is also resonating well with customers. These provide an additional boost to BJ's comparable club sales. The metric rose 1.1% in the third quarter, and 1.8% when excluding gasoline sales. Digitally enabled comparable sales surged 30%.

Merchandising remains a distinctive advantage, with owned brands and fresh offerings, which allows BJ’s Wholesale to differentiate on both price and quality. The retailer’s continued investment in curated assortments strengthens its ability to compete against national brands and rivals in the warehouse space. Management’s Fresh 2.0 initiative strengthens BJ’s ability to deliver quality at lower price points, reinforcing member loyalty.

BJ’s Wholesale is accelerating its footprint with a plan to open 25-30 new clubs in two fiscal years. The company has demonstrated that newly opened clubs can ramp quickly when supported by disciplined site selection, strong local marketing and robust distribution capabilities. As BJ’s enters new regions and deepens its presence in existing ones, it benefits from increasing brand awareness and improved supply-chain scale. Management also cited that clubs opened over the past five years deliver comps roughly three times the chain average.

Despite these strengths, BJ’s Wholesale faces potential headwinds that could temper its pace. Categories tied to discretionary and seasonal spending remain pressured. Moreover, a mid-single-digit decline in gasoline prices hurt total comparable club sales in the third quarter. The company also operates in a highly competitive landscape where pricing aggression from peers could compress margins or force heavier promotional activity.

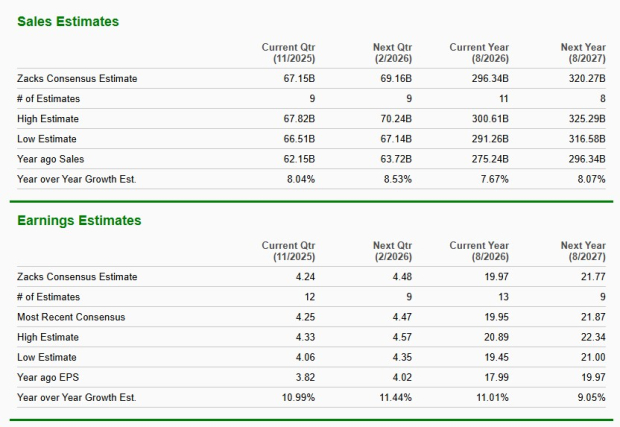

The Zacks Consensus Estimate for Costco’s current fiscal-year sales and EPS calls for year-over-year growth of 7.7% and 11%, respectively. The consensus estimate for EPS for the current fiscal year has risen by 9 cents to $19.97 over the past 60 days.

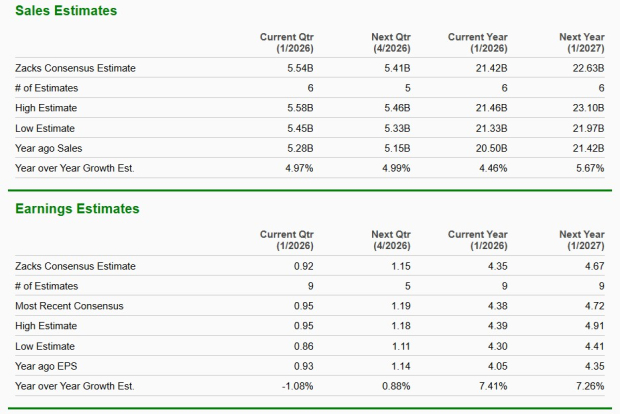

The Zacks Consensus Estimate for BJ’s Wholesale’s current financial-year sales and EPS implies year-over-year growth of 4.5% and 7.4%, respectively. The consensus estimate for EPS for the current fiscal year has risen by 3 cents to $4.35 over the past seven days.

Shares of Costco have slipped 12.2% over the past six months, a notably smaller pullback than BJ’s Wholesale Club’s steeper 22.3% decline.

Costco is trading at a forward 12-month price-to-earnings (P/E) ratio of 43.85, below its one-year median of 50.09. Meanwhile, BJ’s Wholesale Club’s forward P/E ratio stands at 19.37, below its median of 23.60.

While both Costco and BJ’s Wholesale Club carry a Zacks Rank #3 (Hold), Costco ultimately stands out as the stronger pick for investors right now. BJ’s continues to execute well with a focused footprint, growing digital adoption and disciplined merchandising, but Costco’s broader scale, strong member loyalty, consistent execution across markets, and ability to navigate challenging consumer conditions position it more favorably in the current environment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 22 min | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 6 hours |

Retail Giant's Bullish Trend Offers This Option Trade For Costco Stock

COST

Investor's Business Daily

|

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours |

The Latest: Supreme Court strikes down Trumps tariffs, upending central plank of economic agenda

COST

Associated Press Finance

|

| 8 hours |

The Latest: Trump addresses press after Supreme Court strikes down his sweeping tariffs

COST

Associated Press Finance

|

| 8 hours |

The Latest: Trump says hell sign an executive order to enact a 10% global tariff

COST

Associated Press Finance

|

| 8 hours | |

| 8 hours | |

| 8 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite