|

|

|

|

|||||

|

|

Beam Therapeutics BEAM and Intellia Therapeutics NTLA are clinical-stage companies developing investigational gene therapies. While BEAM’s pipeline candidates are still in early-stage development, NTLA is evaluating two candidates in late-stage development.

But which one makes for a better investment pick today? Let's examine the fundamentals of the two stocks to make a prudent choice.

Beam Therapeutics is one of the few biotechs that has shown immense potential in the gene therapy space. The company’s proprietary base-editing technology potentially enables the development of a differentiated class of precision genetic medicines that target a single base in the genome without making a double-stranded break in the DNA, thereby minimizing errors.

One of the company’s assets developed using the above technology is BEAM-101, an ex vivo therapy being evaluated in the phase I/II BEACON study for sickle cell disease (SCD). Initial safety and efficacy data from this study (announced last December) showed that treatment with BEAM-101 led to a robust and durable increase in fetal hemoglobin and a reduction in sickle hemoglobin. Updated data from this study will be provided at the 2025 ASH annual meeting next month. The FDA recently granted orphan drug and regenerative medicine advanced therapy (RMAT) designations to BEAM-101 in the SCD indication.

BEAM recently initiated dosing in a phase I healthy volunteer study evaluating BEAM-103, an experimental anti-CD117 monoclonal antibody for the treatment of SCD.

Beam is also exploring the potential of in vivo therapies. Unlike ex-vivo therapies, where cells are removed, modified and then inserted back into one’s body, in vivo therapies involve infusing new genes directly into the body. The company is currently developing two such candidates — BEAM-301 and BEAM-302 — for treating glycogen storage disease type 1a (GSD1a) and alpha-1 antitrypsin deficiency (AATD), respectively, in separate phase I/II studies. While Beam Therapeutics is currently dosing patients in the BEAM-301 study, an update on the BEAM-302 study is expected in early 2026.

The company also has partnerships with pharma giants like Eli Lilly and Pfizer, which provide financial support in the form of collaboration revenues.

Yet, Beam's biggest challenge lies in its lack of an approved product in its portfolio. Since the company’s pipeline is still in early- to mid-stage development, there are still at least a couple of years away from a potential market launch. As a result, the company is highly dependent on its collaboration partners for growth. Any dispute with these partners could be detrimental to Beam’s economic interests and may adversely impact the stock.

While most gene editing biotechs start with an initial focus on ex vivo therapies, Intellia took a different approach by focusing on the more complex in vivo approach. The company is currently advancing two late-stage in vivo candidates — lonvo-z (formerly NTLA-2002) for hereditary angioedema (HAE) and nex-z (formerly NTLA-2001) for transthyretin (ATTR) amyloidosis.

In September, Intellia completed enrolment in the pivotal phase III HAELO study evaluating lonvo-z as a one-shot therapy to prevent HAE attacks by suppressing the plasma kallikrein activity. Top-line data from this study are expected by mid-2026. If this data is positive, a commercial launch for the therapy is planned by the first half of 2027.

The company’s second candidate, nex-z, is being developed in collaboration with Regeneron Pharmaceuticals REGN. Last month, NTLA suffered a major setback when the FDA placed a clinical hold on two late-stage studies — MAGNITUDE and MAGNITUDE-2 — evaluating this Regeneron-partnered therapy for ATTR amyloidosis with cardiomyopathy (ATTR-CM) and ATTR amyloidosis with polyneuropathy (ATTRv-PN), respectively.

This hold was placed after a patient in the MAGNITUDE study experienced grade 4 liver transaminase elevations, indicating a notable increase in liver enzymes. As of Nov. 6, Intellia claimed that this adverse effect occurred in less than 1% of all patients enrolled in the MAGNITUDE study. No such events have been reported in the MAGNITUDE-2 study. Although NTLA is actively working with investigators and regulators to understand the issue and develop additional risk-mitigation strategies, it has raised concerns about nex-z’s safety in the long run.

Like Beam, Intellia also lacks a stable revenue stream. To curb cash burn, Intellia started a strategic reorganization at the start of this year focused on prioritizing the development of its late-stage candidates. As part of this initiative, it stopped development of some research programs, including the in vivo gene insertion candidate, NTLA-3001, for AATD-associated lung disease. NTLA is looking to reduce its current workforce by nearly 27% before year-end.

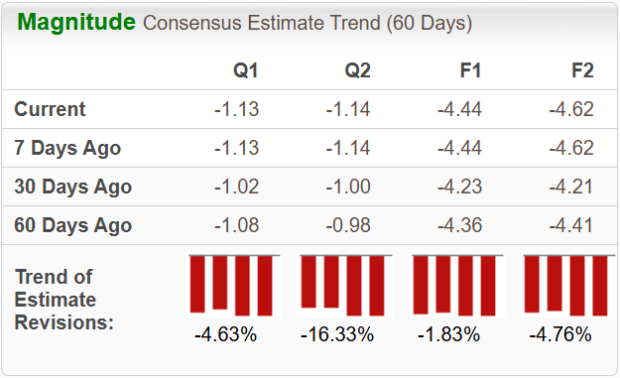

The Zacks Consensus Estimate for BEAM’s 2025 sales implies a year-over-year decline of nearly 37% while loss estimates per share are expected to improve by 3%. Loss estimates for both 2025 and 2026 have widened over the past 30 days.

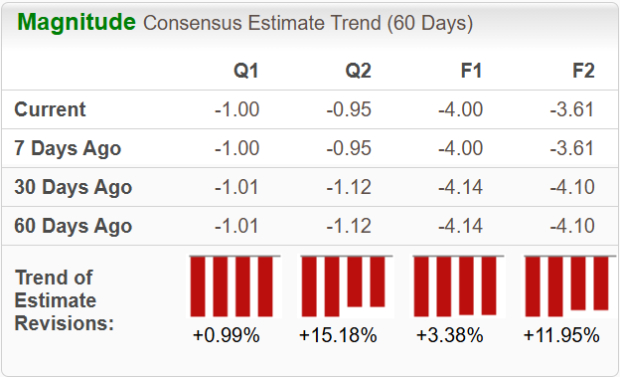

We expect NTLA’s 2025 sales to decline about 4% year over year, while the bottom-line estimates are expected to narrow by nearly 24%. Loss estimates for 2025 and 2026 have narrowed over the past 30 days.

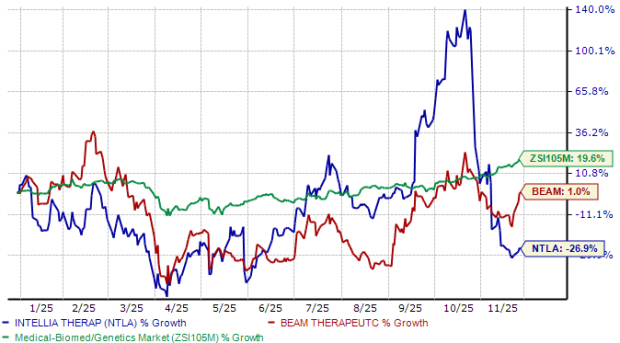

Year to date, shares of BEAM have gained 1%, while those of NTLA have plummeted 27%. In comparison, the industry has risen nearly 20%, as seen in the chart below.

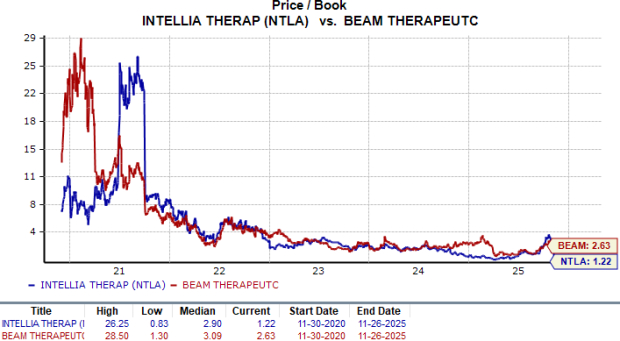

From a valuation standpoint, Beam Therapeutics seems to be more expensive than Intellia Therapeutics, going by the price/book (P/B) ratio. BEAM’s shares currently trade at 2.63 times trailing book value, higher than 1.22 for NTLA.

Both Beam and Intellia carry a Zacks Rank #3 (Hold), which makes choosing one stock over the other difficult. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Though both companies are innovating in gene editing, Beam Therapeutics seems to be the safer pick at present (despite its pricey valuation). While Intellia’s pipeline is in late-stage development and appears closer to a commercial launch, the setback with nex-z has cast a negative sentiment around the stock. On the contrary, BEAM’s broader pipeline, spanning both in vivo and ex vivo therapies, offers greater diversification to investors despite being in early-stage development.

We believe there is room for growth in BEAM stock, driven by solid fundamentals and a recent positive uptrend in stock price movement.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite