|

|

|

|

|||||

|

|

In an environment defined by shifting interest rates and heightened competition across the banking sector, two major U.S. banking names continue to attract investor attention: Citigroup, Inc. C, a global financial institution undergoing a sweeping transformation, and PNC Financial PNC, a disciplined regional leader doubling down on domestic expansion. Both face similar kinds of challenges and opportunities influenced by economic conditions and internal strategies.

Let’s take a closer look at how each bank’s strategy, fundamentals, and earnings trajectory position them for the road ahead.

Under CEO Jane Fraser, Citigroup is advancing its multi-year strategy to streamline operations and focus on its core businesses. Since announcing plans in April 2021 to exit consumer banking in 14 markets across Asia and EMEA, the company has completed exits in nine countries.

This month, C announced that it will integrate the Retail Banking unit into the Wealth business and elevate U.S. Consumer Cards as a core business. Also, Citigroup gets approval to sell its Russian banking unit, marking a significant step in the bank’s long-planned withdrawal from the country. In September 2025, the company announced an agreement to sell a 25% stake in Banamex to a Mexican business leader, reaching a milestone toward full divestiture and deconsolidation of Banamex. Earlier, in May 2025, it announced an agreement to sell its consumer banking business in Poland. The bank is also progressing with the wind-down of its Korean consumer banking operations and preparations for an IPO of its Mexican consumer, small business, and middle-market banking operations. These initiatives will free up capital and enable the company to pursue investments in wealth management operations, thereby driving fee income growth.

Aligned with its goal of achieving leaner operations, Citigroup has overhauled its operating model and leadership structure, reduced bureaucracy and complexity while enhancing efficiency. This month, C announced that it will initiate the process of transitioning the role of its chief financial officer (CFO). The bank’s current CFO, Mark Mason, will step down in early March 2026, making way for Gonzalo Luchetti. In January 2024, the company announced plans to cut 20,000 jobs (about 8% of its global workforce) by 2026, having already lowered headcount by more than 10,000 employees. The strategy is showing traction. C expects revenues to top $84 billion in 2025, with an anticipated 4-5% CAGR through 2026.

Further, with the Federal Reserve’s two rate cuts this year and expectation of further easing, loan growth is improving while deposit costs gradually stabilize, setting C up for witnessing strong net interest income (NII) growth. Management has raised its 2025 guidance: NII (ex-Markets) is now projected to grow 5.5%, up from 4% previously.

In contrast, PNC is taking the opposite approach, leaning into expansion, not contraction. The bank is using targeted acquisitions and partnerships to broaden capabilities and reshape its revenue mix.

In September 2025, PNC Financial entered into a definitive agreement to acquire FirstBank Holding Company, including its subsidiary FirstBank (expected to close in early 2026). The deal will expand PNC Financial’s presence in Arizona, bringing its network to more than 70 branches with the addition of 13 FirstBank branches. In May 2025, it agreed to acquire Aqueduct Capital Group, strengthening fund placement services at its global investment banking arm, Harris Williams. Together, these initiatives position PNC Financial to diversify its business mix, capture market opportunities, and drive sustainable earnings growth.

In a strategic move to strengthen its domestic presence, PNC Financial is set to expand its branch network across the United States. In November 2025, the company expanded its earlier $1.5 billion branch initiative announced in 2024, raising total investment to about $2 billion. The updated plan includes opening more than 300 branches across nearly 20 U.S. markets, renovating its entire branch network by 2029, and hiring over 2,000 new employees to support growth and customer service efforts by 2030.

Additionally, PNC’s NII is also projected to improve in the upcoming period, supported by the improving lending activity and the gradual stabilization of funding costs. Management anticipates NII to rise 6.5% year over year in 2025.

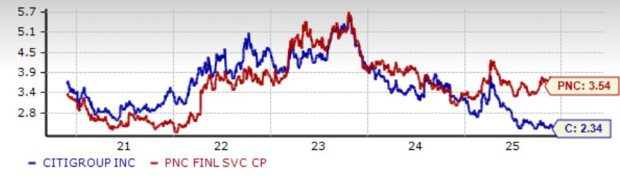

Year to date, shares of PNC Financial and Citigroup have risen 3.2% and 49.7%, respectively, compared with the industry’s growth of 30.3%.

Price Performance

In terms of valuation, PNC is currently trading at a 12-month forward price-to-earnings (P/E) of 10.90X. The C stock, on the other hand, is currently trading at a 12-month forward P/E of 10.50X.

Price-to-Earnings F12M

Further, both are trading at a discount compared with the industry average of 14.27X. However, C stock is cheaper than PNC Financial.

Additionally, C and PNC reward their shareholders handsomely. Post-clearing the 2025 Fed stress test, Citigroup hiked its dividend 7.1% to 60 cents per share. It has a dividend yield of 2.34%. Similarly, PNC Financial hiked quarterly cash dividends on common stock by 6% to $1.70 per share. It has a dividend yield of 3.54%. Based on dividend yield, PNC has an edge over C.

Dividend Yield

The Zacks Consensus Estimate for PNC’s 2025 and 2026 earnings indicates a rise of 14.7% and 11.4% respectively. Earnings estimates for both years have been revised upward over the past month.

Estimate Revision Trend

The Zacks Consensus Estimate for C’s 2025 and 2026 earnings indicates a 27.7% and 31.1% jump, respectively. Earnings estimates for both years have been revised upward over the past month.

Estimate Revision Trend

Both Citigroup and PNC Financial are executing well on their respective strategic path. PNC provides higher dividend income and steady, predictable earnings leverage in a moderating rate environment, while C offers deep restructuring benefits, global revenue diversification, and meaningful operating-efficiency improvements.

However, Citigroup’s multiyear transformation is unlocking capital, simplifying operations, and reallocating resources toward higher-growth, higher-return businesses. The bank’s substantial progress on international exits, its revamped operating model, and the acceleration of NII growth all strengthen the case for a sustained rebound in profitability.

Importantly, the C stock valuation remains more attractive than PNC's. Also, analyst expectations further underscore the opportunity; Citigroup’s projected earnings growth for both 2025 and 2026 far outpaces PNC’s, reflecting stronger operating leverage and greater long-term potential.

Currently, C and PNC carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite