|

|

|

|

|||||

|

|

In the rapidly evolving e-commerce landscape, both Shopify SHOP and Sea Limited SE operate major digital commerce ecosystems, offering online retail platforms and payment solutions across global markets.

Shopify’s suite of merchant tools, payments and logistics has made it a cornerstone of digital retail across North America and other developed markets. Meanwhile, Sea’s Shopee platform dominates Southeast Asia and parts of Latin America, driven by its mobile-first marketplace model and embedded fintech services.

Per the Grand View Research report, the global e-commerce market is projected to reach $12.35 trillion by 2030 at an 11.6% CAGR; both companies are positioned for meaningful growth. So, which stock offers greater upside, Shopify or Sea Limited? Let’s find out.

Shopify remains a leading force in global e-commerce infrastructure platforms. In the reported third quarter 2025, the company delivered 32% revenue growth, alongside an 18% free cash flow margin, its ninth consecutive quarter of double-digit FCF margins. GMV rose to $92 billion, showing solid consumer demand. Management noted that checkout activity remains strong, with buyers continuing to prefer brands powered by Shopify.

Shopify’s key strengths include its expanding product ecosystem, led by Shopify Payments, which now accounts for 65% of GMV and Shop Pay, which grew 67% to $29 billion in volume. Its AI-driven tools, such as the Sidekick assistant, are also scaling rapidly, with 750,000 shops using it for the first time and almost 100 million cumulative conversations, strengthening merchant productivity and platform stickiness. Shopify is also capturing more enterprise clients, including brands like Estée Lauder and Mattel, which reinforces its credibility and long-term growth runway.

Opportunities include deep AI integration, global expansion — particularly in Europe — and continued penetration of omni-channel commerce through retail and B2B offerings, the latter of which is growing nearly 100% year over year.

Shopify faces a few headwinds, including higher payment losses, a weak macro backdrop and tariff-related cost pressures on merchants.

The Zacks Consensus Estimate for full-year 2025 revenues is pegged at $11.44 billion, indicating 28.78% year-over-year growth. The Zacks Consensus Estimate for 2025 earnings has also been revised up by one cent to $1.46 over the past 30 days, underscoring improving sentiment around Shopify’s earnings outlook.

Sea Limited’s E-commerce segment, Shopee, reaffirms its position as the leading e-commerce platform across Southeast Asia, Taiwan, and parts of Latin America. In the third quarter of 2025, GMV and gross orders both grew 28.4% year over year, while e-commerce GAAP revenues rose 34.9% to $4.3 billion, driven by strong marketplace and ad revenue. With management expecting over 25% GMV growth in 2025, Shopee continues to be a major growth driver.

Strengths center on Shopee’s deep logistics channel, built through years of investment in SPX Express. now handles more than half of total orders, delivering consistently faster and cheaper fulfillment across varied geographies.

Shopee is dealing with rising logistics and marketing costs, along with higher shipping subsidies. These pressures have weighed on profitability and led to a 6% year-over-year decline in value-added services revenues, showing stress in parts of its e-commerce model.

Competition is also intensifying across key regions. In Latin America, Shopee is up against a dominant MercadoLibre, while in Southeast Asia, JD.com is growing rapidly with a strong logistics backbone. These competitive pressures could make sustaining growth more challenging in the coming quarters.

For 2025, the Zacks Consensus Estimate for revenues is pegged at $23.28 billion, indicating growth of 37.43% from the year-ago quarter’s reported figure. The consensus mark for earnings is pinned at $3.60 per share, down 6.2% over the past 30 days.

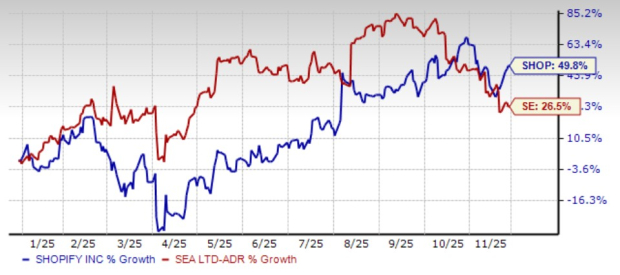

With a year-to-date gain of 49.8%, Shopify shares have outperformed Sea Limited stock, which has returned 26.5%. SHOP’s broadening ecosystem, rising monetisation, and strengthening profitability signal durable growth that continues to attract long-term buyers.

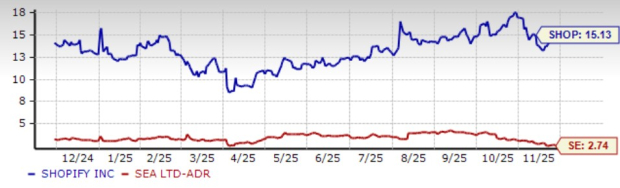

On the valuation front, Shopify trades at a forward 12-month price-to-sales (P/S) multiple of 2.74, far below Sea Limited’s 15.13. The company’s lower valuation is appealing, driven by its stronger profitability, consistent execution and lower risk profile.

Overall, Shopify appears to be the stronger pick. It delivers faster profitability, steadier execution, and rising enterprise adoption, supported by robust GMV growth and an expanding AI-driven product ecosystem. Its significantly lower valuation and better stock performance further enhance its risk-reward profile. While Sea Limited offers solid growth, rising costs and intensifying competition add uncertainty, making Shopify a more attractive and resilient long-term investment.

Currently, with a Zacks Rank #3 (Hold), Shopify stands ahead of Sea Limited, which is rated Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 hours | |

| 15 hours | |

| 15 hours | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Financial Stocks Are Falling. Its About More Than AI Heard on the Street

SHOP -6.78%

The Wall Street Journal

|

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite