|

|

|

|

|||||

|

|

Bitcoin, the leading cryptocurrency, has surged amid growing recognition as a decentralized, non-sovereign asset and increasing institutional and corporate participation. Supportive U.S. economic policies under President Donald Trump have further accelerated its mainstream acceptance, reinforcing investor confidence. In this evolving landscape, let’s find out which company is better positioned for long-term growth — Coinbase Global Inc. COIN or Riot Platforms RIOT?

Coinbase, the largest regulated cryptocurrency exchange in the United States, is well-positioned to capitalize on increased market volatility and rising digital asset valuations. RIOT, in contrast, is among the largest and most cost-efficient Bitcoin miners in North America, and it stands to benefit from the industry’s structural transition away from pure mining toward higher-margin, recurring-revenue artificial intelligence (AI)/high-performance computing (HPC) infrastructure.

Both these companies are sensitive to Bitcoin price movements.

Coinbase appears well-positioned to benefit from President Trump’s pro-crypto policy direction and his stated desire to create clearer regulatory frameworks. With roughly 83% of its revenues derived from the United States, the company operates at the center of what is increasingly becoming a global hub for digital-asset innovation. This environment aligns closely with CEO Brian Armstrong’s ambition to make Coinbase an “everything exchange,” offering a broad suite of financial services built around crypto infrastructure.

The company is steadily expanding its product portfolio to reinforce this vision. Coinbase has introduced new trading instruments, including an equity index future linked to “Magnificent 7” stocks, complementing its established crypto futures lineup. It has also strengthened its presence in crypto lending by issuing a $100 million Bitcoin-backed loan to CleanSpark. In the decentralized finance space, Coinbase partnered with Morpho to launch a USDC lending product, offering yields of up to 10.8%, with the goal of deepening its influence within the DeFi ecosystem.

Coinbase’s ambitions extend well beyond trading. The crypto-leader is accelerating real-world crypto adoption through Base, its low-cost Layer 2 network designed to support large-scale on-chain activity. At the same time, it is pushing the growth of stablecoins as core financial infrastructure, particularly through Coinbase Payments—a system aimed at reducing card-processing expenses by enabling online payments with stablecoins. Coinbase’s entry into the prediction-market sector through its collaboration with Kalshi also marks a meaningful step toward diversifying revenues away from pure transaction volumes and tapping into an expanding event-driven trading market.

M&A activity has further supported Coinbase’s expansion. The company is in the process of acquiring Vector.fun to strengthen its connection to the Solana ecosystem. This marks its ninth acquisition of the year. Its recent purchases — including Echo, a platform for on-chain capital raising; derivatives exchange Deribit; and token-management platform Liquifi — reflect Coinbase’s focus on broadening its technological capabilities and market reach.

Despite these advances, Coinbase continues to face profitability challenges due to high operating and transaction-related costs. Its financial performance remains closely tied to cryptocurrency price movements. Significant downturns in Bitcoin or Ethereum could put pressure on earnings and liquidity. Nonetheless, Coinbase’s growing ecosystem, strategic acquisitions and favorable regulatory backdrop position it for durable long-term growth in a rapidly evolving digital-asset industry.

Riot has centered its strategy on three pillars within its Bitcoin mining business: operating at a significant scale, maintaining a low-cost production structure, and preserving a strong balance sheet. These pillars have shaped the company’s vertically integrated approach, enabling it to build and operate one of the most extensive portfolios of large-scale powered sites in the industry.

Supported by ample liquidity and a sizable Bitcoin reserve, Riot’s mining infrastructure remains a core strength and continues to generate meaningful profitability. Riot believes Bitcoin mining is still an effective way to monetize its expansive power portfolio, and the business is expected to continue delivering solid, dependable cash flows that help fund future growth.

It is aggressively reallocating its substantial power resources toward the development of high-margin, recurring-revenue data-center services tailored for rapidly expanding AI and high-performance computing markets. With 1,862 MW of fully permitted and readily available power, Riot now ranks among the largest power-backed operators in the North American data-center ecosystem. This positions the company exceptionally well as compute demand accelerates across AI, cloud, and large-scale data workloads.

A key initiative within this transition is the Core & Shell development of the first two buildings at Riot’s Corsicana data-center campus, representing 112 MW of critical IT capacity. The company has already secured long-lead equipment and plans to mobilize construction in the first quarter of 2026. Riot has also expanded its footprint by acquiring an additional 67 acres adjacent to the original Corsicana location, supporting the development of the full 1-gigawatt approved power capacity. These steps reinforce Riot’s evolution into a diversified, large-scale data-center enterprise while it continues incremental investment into its digital-infrastructure buildout.

With demand for compute power outpacing global supply, Riot’s combination of vast power capacity, strategic land holdings, and early-stage development pipelines gives it a meaningful competitive advantage. Successfully securing leases with AI and cloud clients would shift Riot’s business mix toward more stable, recurring revenue streams. Coupled with its strong balance sheet, ample working capital and significant Bitcoin holdings, Riot is well positioned to capitalize on the unprecedented growth in data-center and AI infrastructure.

The Zacks Consensus Estimate for COIN’s 2025 revenues implies a 11.7% year-over-year increase, while that for EPS implies a 5.4% year-over-year increase. EPS estimates have moved 14.4% north over the past 30 days.

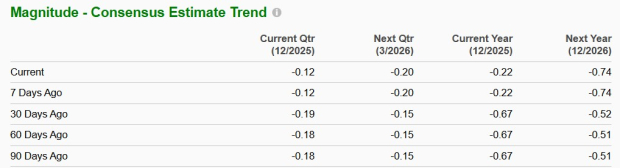

The Zacks Consensus Estimate for RIOT’s 2025 revenues implies a 74% increase, while that for EPS indicates a 164.7% year-over-year decrease. Loss estimates have improved over the past 30 days.

COIN shares have gained 6.7% year to date, while RIOT shares have rallied 46.5% in the same time.

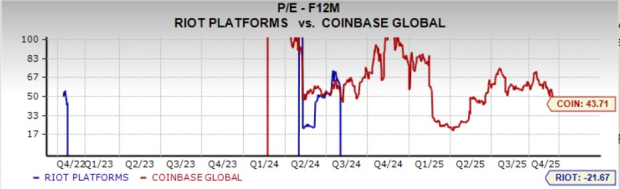

Coinbase is trading at a forward 12-month price-to-earnings multiple of 43.7, below its median of 44.6 over the past three years. RIOT’s forward 12-month price-to-earnings multiple sits at -21.67, worse than its median of -18.82 over the past three years.

Coinbase benefits from a well-diversified revenue base that includes trading fees, staking, custodial services and derivatives, all bolstered by growing institutional demand. Its inclusion in the S&P 500, the acquisition of Deribit and significant involvement in USDC custody strengthen its regulatory standing and support its long-term strategic trajectory.

Riot is well poised due to its unique combination of large, readily available power capacity in high-demand regions, proven data-center leadership and development expertise, and a strong balance sheet supported by over 19,000 Bitcoin, $400 million in cash and robust capital-market access. Its large-scale, efficient mining operations generate substantial revenues and cash flow to fund data-center expansion, while its seasoned management and operational teams provide the experience needed to execute on this next phase of growth. However, RIOT stated that volatility in Bitcoin’s price or a steep rise in global mining difficulty could hurt mining profitability and shrink the value of its BTC holdings.

COIN and RIOT carry a Zacks Rank #3 (Hold) each. However, COIN’s near-term growth prospects place it ahead of RIOT.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite