|

|

|

|

|||||

|

|

The U.S. residential real estate market has transitioned into a new structural environment marked by low inventory, higher mortgage rates and increasing demand for integrated digital transaction platforms. Against that backdrop, Opendoor Technologies OPEN and Compass COMP have emerged as two of the most closely-watched companies in the real estate technology space. Both were early disruptors and are now pursuing large-scale transformation efforts, though from different starting points and through different business models. Opendoor is rebuilding itself as a leaner, AI-centric commerce platform for home transactions, while Compass has evolved into the largest agent-powered brokerage ecosystem in the country.

These companies are also worth comparing today because both have meaningful catalysts in motion: Opendoor is recasting itself operationally and technologically under a new CEO, introducing a more aggressive approach to automation and unit economics, while Compass continues to scale both profitability and market share resilience. Their turnaround stories intersect in areas like efficiency, market share, and expansion of digital real estate workflows. Yet valuation, profitability timelines, and growth trajectories set them apart.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

Opendoor is in the middle of what management calls a refounding of the business. Under its new CEO, the company has shifted decisively toward a software-first operating model and has introduced more than a dozen AI-driven products. These initiatives include end-to-end automated home scoping, new valuation tools, and Opendoor Checkout, which allows buyers to tour and purchase homes without speaking to an agent. Management has stressed that the prior execution model was weighed down by operational inefficiencies, consultant dependency, and slow product iteration. That has now changed. In fact, the company nearly doubled its acquisition pace in the span of seven weeks, rising from 120 homes contracted per week to 230 homes as product and pricing changes took effect.

Alongside product acceleration, Opendoor is undertaking a comprehensive overhaul of its cost base. The company has eliminated consultants, reduced software vendor expenses, and strengthened its pricing engine and resale velocity. Management has also outlined a clear profitability pathway and expects to reach adjusted net income breakeven by the end of next year through transaction scale, margin improvements, and tighter unit economics. The recent warrant distribution program reinforces the company’s alignment with shareholders. The warrants give existing investors upside participation without immediate dilution and allow the business to raise capital only if exercised, supporting balance sheet flexibility.

However, Opendoor’s transformation comes at a time when the P&L is still under pressure. Third-quarter 2025 revenues fell to $915 million from $1.37 billion in the year-ago quarter, inventory levels remain below historical norms, and the company reported a net loss. While Opendoor’s long-term upside potential remains significant and arguably superior to traditional brokerage models because of its automation and transaction velocity, the turnaround involves execution risk, exposure to housing cycle liquidity, and a timeline that is still unfolding.

Compass sits on a more mature business foundation and posted the strongest third-quarter 2025 results in its history. Revenue increased 23.6% to $1.85 billion, transactions grew 22%, and adjusted EBITDA rose to $93.6 million. The company also delivered its seventh consecutive quarter of positive free cash flow, reaching $73.6 million, and posted healthy cash reserves with no revolver drawdowns. Compass continues to expand its agent footprint, rising to 21,550 principal agents, while maintaining a remarkable 97.3% quarterly retention rate. Even in a challenging housing market, Compass has consistently outgrown the broader industry and gained market share.

Beyond core brokerage economics, Compass is expanding into platform services that increase attach rates and transaction monetization. One-Click Title and Escrow, Compass One client dashboard, its mortgage JV, and AI-powered agent tools continue to increase platform usage and recurring transaction flows. The company is also gearing up for a transformational merger with Anywhere Real Estate, which is expected to unlock more than $300 million in net cost synergies and expand service presence and scale across more markets. Unlike Opendoor, Compass already benefits from scale and operating leverage today, and its strategy is translating into sustainable cash flow and improved operational metrics.

There are still challenges. Compass faces exposure to brokerage commission pressure, regulatory litigation risk, and integration complexity with the pending merger. However, the company’s execution track record, profitability profile, and rising platform economics give it notable advantages at this stage of the market cycle compared to Opendoor, which remains in restructuring mode.

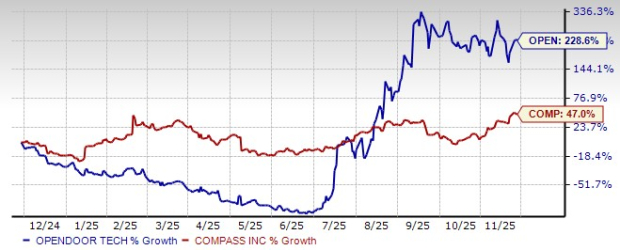

Opendoor shares have risen 228.6% over the past year, significantly outperforming Compass, which is up 47% over the same period. The market is already pricing in a turnaround and acceleration in Opendoor’s model. However, such outperformance also suggests higher volatility and greater execution expectations.

OPEN Vs COMP Performance

On valuation, Compass trades at a forward 12-month price-to-sales ratio of 0.75X versus Opendoor at 1.23X. Compass is priced more attractively relative to its revenue base, margin trajectory, and cash flow profile. Opendoor’s valuation premium reflects its long-term growth optionality but comes with greater operational risk.

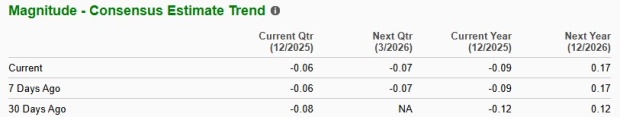

The earnings estimate trend highlights the divergence. For Opendoor, the 2025 loss estimate narrowed from 24 cents to 23 cents, and 2026 losses are expected to narrow to 21 cents per share. Revenue is expected to fall 18% in 2025 before returning to double-digit growth in 2026.

For Compass, the 2025 loss estimate has narrowed from 12 cents to 9 cents, and the company is expected to swing to earnings of 17 cents per share in 2026. Revenue is also projected to grow more rapidly at 22.7% in 2025 and 14.4% in 2026.

Compass has a more favorable revision trajectory and a more definitive path to profitability than Opendoor.

Opendoor remains one of the most compelling long-duration bets in real estate and could ultimately build a more scalable technology platform if it achieves its AI- and software-driven vision. The product pipeline is accelerating, and the company is addressing structural inefficiencies that have historically weighed on margins. The upside case is strong, but it also requires patience and successful execution in a capital-intensive model.

Compass offers a clearer near-term investment profile. The company already generates strong revenue growth, consistent free cash flow, and solid operating leverage. It has multiple catalysts, including platform monetization, agent growth, and the Anywhere Real Estate merger, all while trading at a more attractive valuation. The Zacks Rank also reflects that relative positioning: Opendoor currently carries a Rank #4 (Sell), while Compass holds a Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Considering the current fundamentals, Compass looks like the more solid bet in the near term and offers the stronger balance of earnings momentum, valuation support, and operating performance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 51 min | |

| 53 min |

AI Stealth Play Receives Bullish Initiation; Data Center Revenue Expected To Grow 64%

COMP

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite