|

|

|

|

|||||

|

|

Annaly Capital Management, Inc. NLY shares touched a new 52-week high of $22.80 during Wednesday's trading session. However, the stock closed the session a little lower at $22.67.

Over the past three months, NLY shares have gained 7% outperforming the industry’s growth of 0.2%. Further, it fared better than its close peers, Invesco Mortgage Capital Inc. IVR and Two Harbors Investment Corp. TWO.

Easing Mortgage Rates: The Federal Reserve has reduced policy rates twice in 2025 and has remained cautious about delivering a potential third cut by year-end. Given this, mortgage rates are easing. Per a Freddie Mac report, the average rate on a 30-year fixed-rate mortgage was 6.23% as of Nov. 26, 2025, down from 6.26% in the previous week and 6.81% in the same week a year ago.

Given the decline in mortgage rates, purchase originations are likely to improve in the upcoming period. Refinance volumes are also expected to rise due to the gradual fall in borrowing costs.

This will likely to boost net interest spread, improving the portfolio’s overall yield, supporting the financials of NLY in the upcoming period.

Prudent Investment Strategy: The company follows a disciplined investment strategy, focusing on careful asset selection and effective capital allocation to achieve stable and consistent returns. It primarily invests in traditional Agency mortgage-backed securities (MBSs), which offer downside protection, while also targeting non-agency and credit-focused asset classes to enhance overall returns. Its scaled mortgage servicing rights (MSR) platform benefits from a low prepayment environment, and the company continues to strengthen this platform through strategic partnerships. In October 2025, Annaly entered a long-term subservicing and MSR purchase agreement with PennyMac Financial Services, leveraging PennyMac’s robust servicing infrastructure and recapture capabilities to expand scale and improve operational efficiencies. As of Sept. 30, 2025, Annaly’s total investment portfolio stood at $97.8 billion, reflecting a balanced and diversified approach designed to support long-term growth.

Agency MBS Exposure Provides Downside Protection: Annaly benefits from a significant allocation to Agency MBS, backed by government-sponsored enterprises, which ensures principal and interest payments and makes these investments relatively safer. Management remains optimistic about the 2025 outlook, noting that Agency MBS currently offers attractive relative returns compared with funding costs. As of Sept. 30, 2025, $87.3 billion of Annaly’s portfolio consisted of highly liquid Agency MBS, most of which carry an actual or implied ‘AAA’ rating, supporting attractive risk-adjusted returns in the fixed-income markets and reinforcing the company’s defensive positioning.

Decent Liquidity Position: Annaly continues to prioritise liquidity and prudent leverage management to navigate market volatility effectively. As of Sept. 30, 2025, the company held $8.8 billion in total assets available for financing, including $5.9 billion in cash and unencumbered Agency MBS, providing ample liquidity during adverse market conditions. This decent liquid position equips Annaly to sustain its operations and capitalize on opportunities, even amid periods of economic stress and financial-market uncertainty, reinforcing its overall financial resilience.

Sustainable Capital Distribution: Annaly has demonstrated a continued focus on shareholder returns through disciplined capital management. On Jan. 31, 2025, the company’s board approved a new common share repurchase program, authorizing up to $1.5 billion in buybacks through Dec. 31, 2029. While no shares have been repurchased under this plan yet, the program provides significant flexibility.

Apart from the share repurchase program, the company pays regular dividends. In March 2025, NLY raised its cash dividend by 7.7% to 70 cents per share. Over the past five years, the company has raised its dividend once. Its current dividend yield stands at 12.3%, slightly above the industry average of 12.1%, while Invesco Mortgage and Two Harbors Investment offer yields of 16.7% and 13.3%, respectively.

Market Volatility: NLY’s operating performance is closely tied to broader financial markets and macroeconomic conditions. Volatility in mortgage markets, interest-rate swings, and adverse shifts in the yield curve may affect its investments. Despite the Federal Reserve reducing policy rates, elevated mortgage rates continue to pressure fixed-income assets and widen spreads. As a result, near-term benefits may be muted, and the company’s performance could remain constrained under persistent market and macroeconomic uncertainties.

Portfolio Adjustments Amid Market Volatility: The company actively adjusts its investment portfolio to navigate evolving financial conditions. With a hedge ratio of 92% as of the third quarter of 2025, the company prioritizes risk and liquidity management. Consequently, in the short term, strong returns may remain limited, and book value could be affected, reflecting a cautious approach to current market volatility.

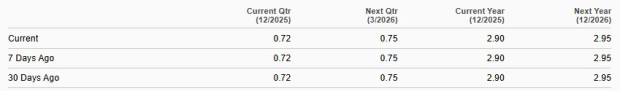

Analysts maintain a neutral stance on the company’s earnings growth potential. Over the past month, the Zacks Consensus Estimate for earnings for 2025 and 2026 has remained unchanged. The projected figure implies a growth of 7.4% for 2025 and 1.5% for 2026.

From a valuation perspective, NLY appears expensive. The company’s 12-month trailing price to book (P/B) ratio of 1.17X is above the industry’s 0.97X. Meanwhile, Invesco Mortgage has a trailing P/B ratio of 0.90X while Two Harbors Investment is trading at 0.91X.

Annaly’s new 52-week high reflects improving sentiment around mortgage rates, stronger portfolio stability, and ongoing strategic enhancements in its MSR platform and Agency MBS allocation. The company’s disciplined investment posture, ample liquidity, and commitment to shareholder returns add to its appeal, especially for income-focused investors.

However, valuation remains stretched relative to the industry, and heightened market volatility could restrain near-term performance. With earnings estimates holding steady and macro uncertainty still in play, NLY may offer attractive long-term defensiveness but limited short-term upside. As such, investors should weigh the company’s solid fundamentals against broader interest-rate risks before making new allocations at current levels.

NLY currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 9 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-18 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-11 | |

| Feb-04 | |

| Feb-04 | |

| Feb-03 | |

| Feb-02 | |

| Jan-30 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite