|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

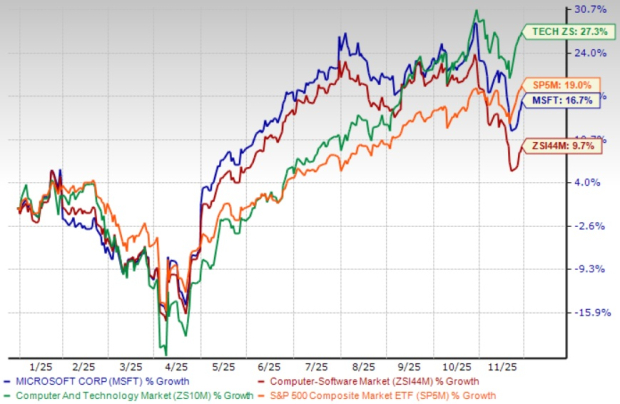

Microsoft MSFT has delivered a 16.7% year-to-date gain, outpacing the Zacks Computer-Software industry and cementing its position as a leader in the AI revolution. The technology giant's strengthened partnership with OpenAI, finalized in October 2025, marks a pivotal moment that could determine whether the stock continues its upward trajectory or requires a period of consolidation before advancing further.

Microsoft and OpenAI announced a comprehensive restructuring of their partnership agreement in late October 2025, resolving months of negotiations over computing exclusivity and corporate governance. Under the new arrangement, Microsoft maintains approximately 27% ownership in OpenAI Group PBC, with an investment valued at $135 billion. The agreement preserves Microsoft's exclusive intellectual property rights through 2032 and extends Azure API exclusivity until artificial general intelligence is achieved or through 2030, whichever comes first.

The partnership restructuring allows both companies greater operational flexibility while maintaining strategic alignment. OpenAI has committed to purchasing an incremental $250 billion of Azure services, providing Microsoft with substantial long-term revenue visibility. However, Microsoft no longer holds the right of first refusal as OpenAI's compute provider, enabling the ChatGPT creator to diversify its infrastructure partnerships with other providers, including Oracle and Google Cloud. This shift reflects the massive computational demands of advanced AI development that even Microsoft's extensive infrastructure cannot singularly satisfy.

Microsoft's first-quarter fiscal 2026 results demonstrated robust momentum across its business segments. The company reported revenues of $77.7 billion, representing 18% year-over-year growth, while operating income increased 24% to $38 billion. Azure and other cloud services revenues accelerated 40% in constant currency, with management attributing significant contributions to AI-related demand. Microsoft Cloud revenues reached $49.1 billion, growing 25% in constant currency and reflecting strong enterprise adoption of cloud infrastructure and AI capabilities.

The Intelligent Cloud segment generated $30.9 billion in revenues, which grew 28% year over year, while the Productivity and Business Processes division delivered $33 billion, up 17%. Commercial remaining performance obligation reached $392 billion, surging 51%, and providing substantial forward revenue visibility. Management emphasized that Azure remained capacity-constrained through the quarter, with expectations that supply limitations would persist through at least June 2026. This constraint, while limiting near-term growth, signals robust underlying demand that positions Microsoft favorably once additional capacity comes online.

Microsoft's capital expenditure strategy has become a focal point for investors evaluating the stock's near-term trajectory. The company spent $34.9 billion on capital expenditures in the fiscal first quarter of 2026, with management indicating that spending growth would accelerate throughout the fiscal year. Approximately half of these expenditures targeted short-lived assets, primarily GPUs and CPUs, to support increasing Azure platform demand and AI workload expansion.

Management announced plans to increase total AI capacity by over 80% in fiscal 2026 and nearly double its data center footprint over two years. While these investments position Microsoft to capitalize on structural AI adoption trends, the magnitude of spending put pressure on near-term profitability metrics. The company absorbed a $3.1 billion impact to net income in the fiscal first quarter of 2026 from losses related to OpenAI investments, which reduced earnings per share by 41 cents.

The Zacks Consensus Estimate for MSFT’s fiscal 2026 earnings is pegged at $15.61 per share, up 0.6% over the past 30 days. The estimate indicates 14.44% year-over-year growth.

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

Microsoft's November 2025 announcements at its Ignite conference highlighted significant progress in monetizing its AI investments through Copilot adoption. The company introduced Microsoft 365 Copilot Business, a more accessible pricing tier for small and medium businesses with fewer than 300 users. It will be launched in December 2025. More than 90% of Fortune 500 companies now utilize Microsoft 365 Copilot, with over 150 million monthly active users of first-party Copilots across the product portfolio.

The company unveiled Agent 365, a control plane for managing and securing AI agents, alongside new autonomous capabilities, including a Sales Development Agent and enhanced Copilot Studio features. These innovations position Microsoft to capture additional revenues as enterprises increasingly deploy AI agents to automate business processes. Management emphasized that Copilot represents a window into agents in the flow of work, integrating custom and third-party agents seamlessly into existing workflows.

Microsoft currently trades at a forward price-to-sales ratio of 10.6 times, representing a significant premium to the Zacks Computer-Software industry average of 7.59 times. This elevated valuation reflects market expectations for sustained AI-driven growth but limits the margin of safety for new investors entering positions at current levels.

Amazon AMZN-owned Amazon Web Services (AWS), Alphabet GOOGL-owned Google Cloud and Microsoft—combined— had 62% share of the global enterprise cloud infrastructure services market in third-quarter 2025, according to new data from Synergy Research Group.

Amazon Web Services maintains its leadership position in cloud infrastructure with approximately 29% market share, though its growth rate of 17.5% trails both Microsoft Azure's 27% and Google Cloud's 32% expansion. Oracle ORCL has emerged as a formidable competitor in AI-focused infrastructure, reporting explosive 359% growth in remaining performance obligations to $455 billion and positioning itself as a specialized AI cloud provider. Amazon remains the largest cloud provider by revenues, generating over $120 billion annually from AWS, while Microsoft's Intelligent Cloud segment produced $106 billion in fiscal 2025. Google Cloud has grown to approximately two-thirds of Azure's scale, demonstrating the intensifying competition across the hyperscale cloud market.

While the OpenAI partnership provides Microsoft with substantial long-term revenue visibility through the $250 billion Azure services commitment, the combination of premium valuation, intensifying competition and near-term capacity constraints suggests a measured approach. The 16.7% year-to-date gain already reflects much of the positive OpenAI news, and investors should consider holding existing positions or waiting for better entry points as the market digests ongoing infrastructure investments and competitive dynamics evolve. Microsoft currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 16 min | |

| 16 min | |

| 36 min | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite