|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

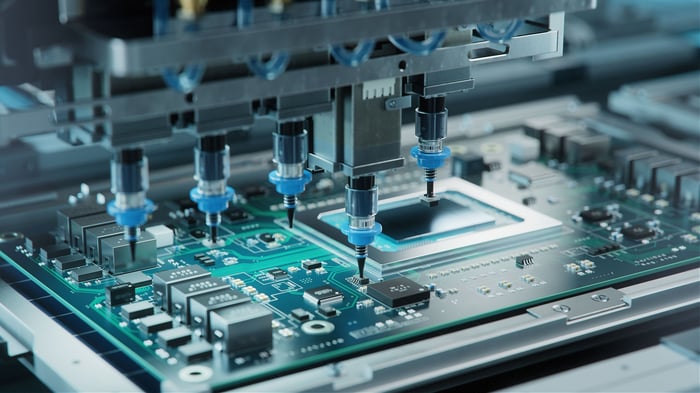

Nvidia leads the AI data center processor chip market.

A major name within the technology sector, however, finally poses a true threat to Nvidia's dominance.

There's no denying Nvidia (NASDAQ: NVDA) dominated the first chapter of the artificial intelligence (AI) era. Its tech is found in the vast majority of the planet's artificial intelligence data centers. And the company has deservedly grown into the world's biggest, with a market cap of nearly $4.3 trillion.

Nothing attracts competition like a lucrative and underserved business, however. So it comes as no surprise that some competitors are finally creeping into the chipmaking market.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

But perhaps the biggest threat to Nvidia going forward is a name no one expected. That's Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), which is reportedly in talks with Facebook parent Meta Platforms to sell it billions of dollars' worth of AI processing chips.

Nvidia shareholders should be concerned.

Image source: Getty Images.

Yes, Alphabet's Google is in the chip business. It began thinking about making its own data center chips all the way back in 2013, in fact, and by 2015 had actually constructed its very first "Tensor" processor custom-built for artificial intelligence workloads (back when AI wasn't aimed at consumers or just meant to simplify work for employees).

Initially, this tech was only intended for Google's internal use, helping it handle search engine traffic, serve as the backbone for its then-young cloud-based business apps, and power its image-recognition tools. By 2018, Google added access to its powerful Tensor Processor Units -- or TPUs -- to its cloud computing customers' menu of services. Developmental work continued in the meantime, even as Nvidia raced ahead, turning its graphics-processing tech into what would end up being first-generation commercial artificial intelligence.

Now Alphabet's Google is tiptoeing onto Nvidia's third-party turf ... probably. On Monday of last week, credible whispers surfaced that Meta is looking to outright purchase Tensor AI processors for use in its own data centers, marking a major shift in how companies can access an alternative to Nvidia-made silicon.

In the grand scheme of things, one mega-deal such as this one doesn't necessarily change everything.

The dealmaking won't likely stop here, though. There will be more, and not just for Google's Tensor chips. Tech giants ranging from Advanced Micro Devices to Intel and even Qualcomm have also been working on mainstream artificial intelligence processors, while smaller companies like Marvell Technology have also been working on more customized AI processing tech. All of these outfits will benefit from the ongoing proliferation of AI in one way or another. Alphabet has simply proven that it's possible to compete with the industry's de facto leader.

Don't misread the message. Nvidia isn't doomed. Alphabet is, however, uniquely and very well-positioned to penetrate the piece of the AI market that Nvidia currently dominates, for a couple of reasons.

First, it's got deep pockets to fund the continued development and refinement of its artificial intelligence hardware. Last year alone, Alphabet turned $350 billion worth of revenue into a little over $100 billion in net income. That's more net profit than AMD, Intel, and Qualcomm reported for the same year, combined.

As for the second reason, this development should worry Nvidia shareholders; Alphabet's already got deep reach into the business market that might be interested in utilizing its AI tech.

While not the planet's biggest cloud computing service provider, Google is one of the biggest, and one of the few major providers that's actually growing market share at this time (according to data from Synergy Research Group). The fact that Meta had already recently inked a $10 billion contract to purchase cloud computing services from Google over the course of the coming 10 years underscores the argument that its cloud customers could also become hardware customers.

Or perhaps Seaport analyst Jay Goldberg's simple point sums it up nicely: This is a "really powerful validation" for Google's Tensor processors.

Current Nvidia shareholders don't need to panic just yet. There's likely to be plenty of business to go around for a while. Indeed, an outlook from Precedence Research suggests the global AI semiconductor market is poised to grow at an average annual pace of 29% through 2034, jibing with expectations from SkyQuest and Coherent Market Insights.

Still, valued at nearly 40 times this year's projected profits of $4.68 per share, Nvidia's stock is priced as if it has no real rival -- the last thing it needs is a credible threat to the company's AI dominance that Alphabet now brings to the table. If and when it becomes clear that Nvidia can't hold off would-be competitors forever, the crowd could panic, pulling the rug out from underneath this name with no real warning. That's one of the downsides of owning a market darling like Nvidia that's been put on a pedestal.

Bottom line? If you're trying to balance your potential reward with realistic risk, it would be wild to ignore the risk that Google's entry into the AI chip market means for Nvidia. Not because Google is going to dethrone it, but because it confirms that AI data center owners/operators are willing to consider cost-effective alternatives. That's a dynamic investors haven't had to think about yet.

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $580,171!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,084,986!*

Now, it’s worth noting Stock Advisor’s total average return is 1,004% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of December 1, 2025

James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Intel, Meta Platforms, Nvidia, and Qualcomm. The Motley Fool recommends Marvell Technology and recommends the following options: short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.

| 11 min | |

| 42 min |

Stock Market Today: Nasdaq Leads Charge On Tariff News; Amazon Jumps As Data Play Surges (Live Coverage)

NVDA

Investor's Business Daily

|

| 49 min | |

| 51 min | |

| 1 hour | |

| 1 hour |

Stock Market Today: Dow Turns Higher As Supreme Court Nixes Trump Tariffs (Live Coverage)

NVDA

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour |

Nvidia Stock, After Big Meta Chip News, Sets Up Ahead Of Quarterly Earnings Report

NVDA

Investor's Business Daily

|

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite