|

|

|

|

|||||

|

|

Currently, CVS Health CVS and UnitedHealth Group UNH are two major vertically integrated behemoths in the U.S. healthcare market and key constituents of the S&P 500 index. Both companies have transformed beyond their original identities — CVS Health from a retail pharmacy chain into a healthcare powerhouse through its acquisition of Aetna and UnitedHealth from a traditional insurer into a tech-enabled care provider via its expansive Optum platform. Each now combines insurance, care delivery, pharmacy benefit management (PBM) and value-based service models to offer end-to-end healthcare solutions.

For investors, it is difficult to choose between the two, as both CVS and UnitedHealth continue to diversify their revenue streams and scale up their clinical and digital infrastructure. While they share structural similarities in business segmentation — insurance, health services, and pharmacy operations — their financial trajectories, operating margins, capital deployment strategies and risk exposures differ notably. Let’s examine which is the stronger buy right now.

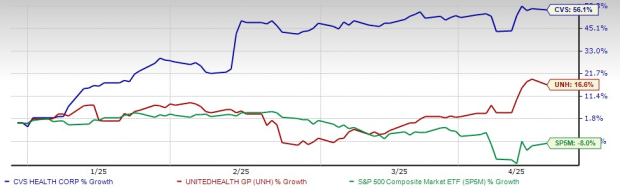

After a rough 2024, marked by high utilization at its Aetna insurance unit as well as reimbursement pressure, CVS Health has experienced a dramatic recovery so far in 2025. The stock has become the S&P 500’s top performer, with a year-to-date return of 56%, thereby outperforming all other index members by a significant margin. UnitedHealth, on the other hand, is at number 16 on the chart with a 16.5% gain. The stocks, however, outperformed the benchmark’s 8% dip during this period.

Aetna Margin Recovery and Cost Efficiencies in Focus: CVS Health is prioritizing margin recovery in its Aetna business, which posted 23% year-over-year revenue growth in the fourth quarter despite an adjusted operating loss. Favorable reserve developments and less severe-than-expected medical trends supported the performance. For 2025, CVS Health projects $132 billion in healthcare benefits revenues and at least $1.5 billion in adjusted operating income, with a 100-basis-point Medical Benefit Ratio improvement to 91.5%.

While Medicare Advantage and individual exchange membership may decline, these are expected to be offset by growth in commercial self-insured plans and stronger plan design. The company is also executing a $2 billion multi-year cost efficiency initiative with 2025 savings expected to fully absorb rising variable expenses.

Strong Cash Flow Generation and Shareholders’ Return: CVS Health’s 2024 operating cash flow of $9.1 billion exceeded expectations due to early cash receipts from the pharmacy segment. While 2025 guidance projects $6.5 billion in cash flow from operations, the two-year outlook of $15.6 billion in cumulative operating cash flows is a strong indicator of financial stability and flexibility. The company returned $3.3 billion in dividends in 2024 and expects to maintain dividend payments in 2025. It executed debt management strategies to moderately reduce leverage despite interest expense headwinds, with a long-term focus on regaining investment-grade targets.

Reimbursement Issues, Cyberattack Fail to Mar UNH's Momentum: In 2024, UnitedHealth faced substantial external pressure in the form of CMS Medicare rate cuts, Medicaid redeterminations and the Change Healthcare cyberattack. Despite these, the company deployed nearly $17 billion in growth capital to further strengthen its capabilities. It also returned over $16 billion to shareholders through dividends and share repurchases, highlighting the company's financial strength and disciplined capital allocation.

For 2025, UnitedHealth expects cash flow from operations to approach $33 billion, or 1.2x net income — a clear sign of robust underlying profitability.

UNH's Shift Toward Value-Based Care with Optum: Optum Health’s revenues are set to grow from $105 billion in 2024 to $117 billion in 2025, with value-based care reaching 5.4 million patients, up 650,000 driven by services like in-home care. Optum Rx expects revenue growth with 98% retention and 750 new clients, expanding in specialty and infusion services while curbing drug costs.

Bullish Outlook for 2025 and Beyond: UnitedHealth cut its 2024 operating cost ratio by 150 basis points, aided by early AI-driven productivity gains. It is also moving to fully transparent pharmacy rebate models by 2028 to strengthen client trust. Despite a 150-basis-point medical care ratio (MCR) variance in 2024, UNH has proactively priced for 2025, targeting an 86.5% +/-50 bps MCR, supported by strong retention, growing Health Maintenance Organization (HMO) adoption and broader managed care offerings.

The Zacks Consensus Estimate for CVS’ 2025 earnings per share suggests an 8.7% improvement from 2024.

The Zacks Consensus Estimate for UNH’s 2025 EPS implies an improvement of 7.5% over the previous fiscal.

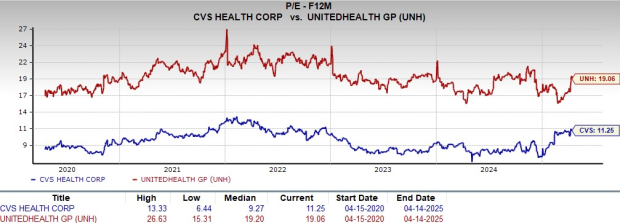

CVS is trading at a forward 12-month price-to-earnings, which is a commonly used multiple for valuing healthcare stocks, of 11.25X, above its 5-year median of 9.25X and pretty close to the 5-year high of 13.33X. Meanwhile, UNH is presently trading at a forward 12-month price-to-earnings of 19.06X, which is below its 5-year median and high of 19.20X and 26.63X respectively.

This suggests that while UNH may appear slightly elevated relative to CVS, it remains attractively valued when compared with its own historical average.

While both companies present compelling long-term value, UNH, a Zacks Rank #2 (Buy) stock, currently stands out with stronger margins, cash flow, and a below-average P/E despite growth across Optum. CVS Health, a Zacks Rank #3 (Hold) stock, meanwhile, is grappling with challenges like elevated medical costs and shifting payer dynamics in Medicare Advantage. The company recently established a "baseline with upside potential" strategy, signaling cautious optimism and operational discipline.

You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 12 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite