|

|

|

|

|||||

|

|

Higher-performance computer processors are capable of using more memory.

In turn, this is creating unanticipated demand for computer memory.

Micron’s newfound pricing power is likely to last longer than people may expect.

It comes as no surprise that another year of growth from the artificial intelligence (AI) industry has lifted AI stocks like Nvidia (NASDAQ: NVDA), Broadcom (NASDAQ: AVGO), and Palantir Technologies (NASDAQ: PLTR). Nvidia, of course, makes most of the computing processors used by AI data centers, while Broadcom connects all of them into a unified neural network. Palantir offers software that does something constructive with all this hardware.

There's an important name largely being left out of the discussion, however, even though its stock is up 175% year to date for all the right reasons. That's Micron Technology (NASDAQ: MU), with more of the same kind of strength in the cards at least for the year ahead. Here's what you need to know.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

It's one of those companies most people have heard of but may not know exactly what it does. In simplest terms, Micron makes memory chips for computers, servers, data centers, and yes, even AI platforms.

There are actually two kinds of computer memory. Micron makes both of them. The first of these is often categorized as "storage," meaning it stores digital data -- including a device's operating system like Windows or Android -- even when a computer or an entire data center is powered off. You may know this hardware as a hard disk drive, or more recently, a solid-state drive.

The second kind of memory required by every digital computing device is RAM (short for random access memory), although most RAM these days is more functional SDRAM (synchronous dynamic random access memory). This is where your device temporarily stores digital information. The more SDRAM capacity you have, the better, since it means your tech can simultaneously handle and access more data. But all of this information goes away when you turn your device off.

Image source: Getty Images.

So what? Just like your smartphone or computer, data centers -- which are just thousands of processors tethered together -- also need RAM. And as has been the case with personal computers since their infancy, more and more powerful AI data center processors are driving demand for more memory. That's why SDRAM prices have soared more than 130% this year, according to numbers from PC Part Picker, yet the world is still buying it in droves.

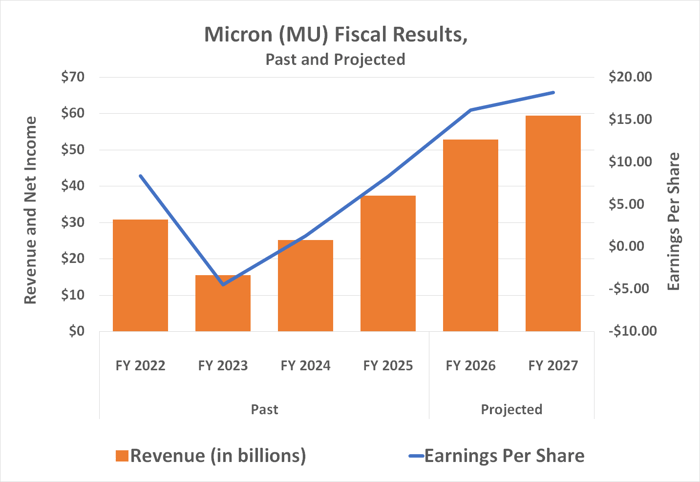

For its fiscal year ended in September, Micron's top line grew to the tune of 50%, spurring explosive growth in its net income and profit-margin rates. Twenty-six percent ($8.5 billion) of last year's revenue ($37.4 billion) trickled down to the bottom line. The thing is, this banner year is very likely to be followed up by a similar one.

As much as the AI industry has already grown, it's still only scratched the surface of what it's expected to become. An outlook from Precedence Research suggests the worldwide AI data center market is poised to grow at an average annual pace of 28% through 2034, jibing with a prediction from Global Market Insights. Expressed another way, consulting firm McKinsey & Company says institutions are ready to invest nearly $7 trillion in artificial intelligence solutions between now and 2030.

These growing expenditures on AI hardware, of course, will be pointless without comparable spending growth on computing memory. That's why Global Market Insights adds that the worldwide DRAM market itself is likely to grow by more than 20% per year through 2032 when it should be worth more than $450 billion.

Analysts also expect Micron to thrive on this tailwind for at least a couple of more years before the growth pace cools off and the addition of production capacity catches up with demand, finally pinching profitability as a result (as has so often been the case in the very hot-and-cold computer memory business).

Data source: CFRA. Chart by author.

This AI-driven growth could prove to be stronger and to last longer than most people might anticipate. The term "supercycle" is being increasingly used to describe the memory market's current dynamic, with a handful of analysts suggesting that the industry's unusually firm pricing power could remain robust for closer to three-to-four years.

In the meantime, demand for data storage -- disc drives and flash drives -- also continues to swell without the same sort of pricing drama the SDRAM side of the business is dishing out. Precedence Research believes this market is going to grow at an annualized pace of more than 16% through 2034, boding well for about one-fourth of Micron's revenue mix.

Of course, if the whispered predictions of a brewing supply crunch on the storage technology front end up being right, Micron's bottom line could roll in better than expected for at least the fiscal year now underway.

It's still not the easiest stock to own. Most investors who keep tabs on it -- or even own it -- tend to lump Micron together with most other AI stocks that helped create the feared AI bubble. If it feels like the industry is going to run into a wall, Micron shares could suffer a setback even bigger than November's.

Even a modest setback would be an attractive buying opportunity, however. Micron stock is already reasonably priced at less than 20 times this fiscal year's expected per-share earnings, as well as next year's. Even if its current pricing power isn't going to last forever, it's going to last long enough to justify a richer valuation than the one the market is assigning it right now.

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $556,658!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,124,157!*

Now, it’s worth noting Stock Advisor’s total average return is 1,001% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of December 1, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

| 26 min | |

| 34 min | |

| 37 min | |

| 45 min | |

| 47 min | |

| 58 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite