|

|

|

|

|||||

|

|

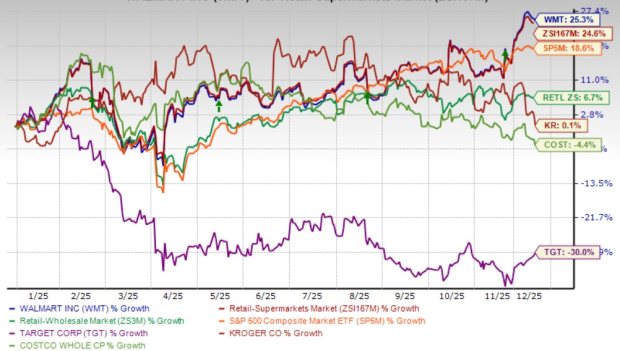

Walmart, Inc. WMT has been a strong outperformer in 2025, with shares advancing 25.3% year to date. The rally underscores investor confidence in Walmart’s consistent execution, rapid omnichannel expansion and continued share gains across household income segments, even in a choppy consumer environment.

These upsides have helped the world’s largest retailer to outperform the industry’s growth of 24.6%, the Zacks Retail – Wholesale sector’s increase of 6.7% and the S&P 500’s gain of 18.6% so far this year. Walmart shares have also fared better than major peers like Target Corporation TGT, The Kroger Co. KR and Costco Wholesale Corporation COST. While Kroger inched up 0.1%, Costco and Target declined 4.4% and 30%, respectively, year to date.

Walmart’s steady rally this year is backed by a healthy set of fundamentals. The retailer continues to post broad-based sales and profit growth, with its third-quarter fiscal 2026 performance reflecting strength across Walmart U.S., Sam’s Club and International.

The company’s e-commerce momentum remains exceptional, growing 27% in the third quarter, with U.S. e-commerce up 28% and International up 26%. Faster delivery (35% of U.S. store-fulfilled orders were delivered in under three hours), combined with improved marketplace growth and expanding digital capabilities, has helped Walmart deepen customer engagement.

Walmart’s omnichannel ecosystem is growing, benefiting from strong grocery traffic, improving trends in general merchandise and notable strength in fashion. Membership income also remains a highlight across both Sam’s Club and Walmart+, with newer benefits like OnePay and improved delivery speed driving record net adds. International operations continue to provide a meaningful growth lift, led by strong results from Flipkart, China and Walmex.

Walmart’s business mix is shifting toward higher-margin streams, including advertising, membership and improved e-commerce unit economics, now representing about one-third of consolidated adjusted operating income. Early investments in automation and AI are also helping the company expand fulfillment efficiency and support margin performance.

Even with strong fundamentals, a few challenges linger. Merchandise mix remains a drag, as growth leans toward lower-margin food and health & wellness categories. Tariffs continue to create cost pressure, particularly in Walmart U.S. inventory. Flipkart’s Big Billion Days timing shift and ongoing price investments in Mexico also weighed on the International segment’s margins.

Apart from this, the new maximum fair pricing legislation set to take effect in early 2026 is expected to affect Walmart’s pharmacy business. While Walmart is managing costs well, the company is still operating in a consumer environment marked by moderation in discretionary spending, which could limit upside in key general merchandise categories.

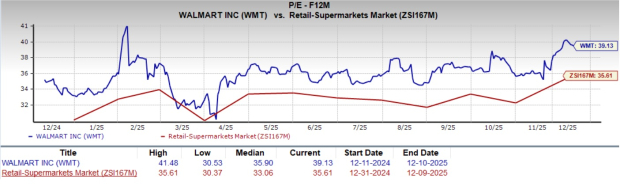

Walmart’s forward 12-month P/E of 39.13X stands above the industry average of 35.61X. Its Value Score of C suggests only limited room for further multiple expansion in the near term. Compared with peers, Walmart sits at the higher end of the valuation range — Target and Kroger trade at significantly lower multiples of 12.34 and 11.75, respectively, while Costco commands a premium at 42.69.

Although Walmart’s elevated valuation is supported by consistent execution and growing contributions from higher-margin businesses, it also leaves the stock more sensitive to any moderation in consumer spending or a slowdown in key profit drivers.

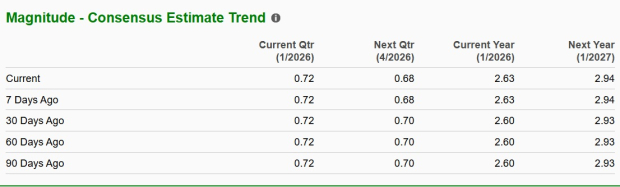

Analysts’ earnings estimates for Walmart have moved higher, suggesting that they see current challenges as temporary and expect the company to sustain strong growth in the long run. The Zacks Consensus Estimate for fiscal 2026 and 2027 EPS has risen over the past 30 days.

Walmart enters 2026 with solid momentum in key growth engines — e-commerce, membership, marketplace and advertising — all supported by faster delivery, sharper inventory management and expanding automation. The company’s scale advantages and strengthening digital capabilities position it well to keep gaining share. However, margin pressures from mix, tariffs, pharmacy headwinds and ongoing cost inflation may continue to weigh on quarterly performance.

Given the stock’s elevated valuation, investors may find it more prudent to maintain positions rather than chase new ones at current levels. Nonetheless, Walmart’s durable business model, improving profit streams and long-term investment initiatives make it a compelling hold heading into 2026. Walmart currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours |

Stock Market Today: Dow Skids As EU Makes Trump Tariff Move; These Gold Stocks Shine (Live Coverage)

WMT

Investor's Business Daily

|

| 3 hours | |

| 4 hours |

Stock Market Today: Dow Dives As EU Makes Trump Tariff Move; Novo Plunges On This (Live Coverage)

WMT

Investor's Business Daily

|

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite