|

|

|

|

|||||

|

|

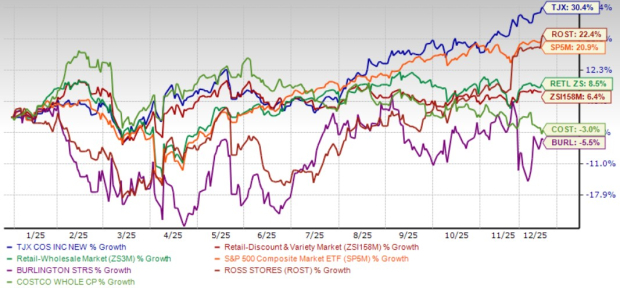

The TJX Companies, Inc. (TJX) has been a clear standout performer in 2025, with shares surging 30.4% year to date. This strong rally reflects investor confidence in TJX’s off-price model, consistent above-plan sales performance and clear market-share gains across geographies.

These strengths have enabled TJX to outpace several key benchmarks, including the Zacks Retail - Discount Stores industry’s growth of 6.4%, the Zacks Retail and Wholesale sector’s gain of 8.5% and the S&P 500’s advance of 20.9% over the same period.

TJX’s shares have also exceeded the performance of major peers in the off-price and value retail landscape. Ross Stores, Inc. (ROST) posted a solid 22.4% gain, but still trailed TJX’s impressive run. Meanwhile, Costco Wholesale Corporation (COST) and Burlington Stores, Inc. (BURL) recorded a decline of 3% and 5.5% year to date, highlighting the relative strength of TJX’s momentum within the broader competitive set.

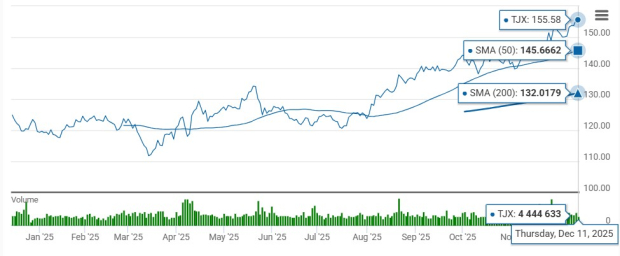

After touching a 52-week high of $157.72 yesterday, TJX closed at $155.58, just modestly below that peak. The stock trades comfortably above the 50 and 200-day simple moving averages of $145.67 and $132.02, respectively, reinforcing its bullish trend and highlighting strong investor sentiment.

TJX continues to benefit from its highly flexible off-price model, which enables rapid sourcing of quality branded merchandise at attractive values. This approach reinforces the treasure-hunt shopping experience that keeps customers returning frequently. Its broad global presence across the United States, Canada, Europe and Australia further strengthens resilience by diversifying revenue streams and customer bases.

Strong customer traffic continues to fuel TJX’s growth, reflected in a 5% comparable sales increase in the third quarter of fiscal 2026. Each division, Marmaxx, HomeGoods, TJX Canada and TJX International, delivered positive comps, highlighting broad momentum across categories and regions. This consistent traffic growth demonstrates the power of TJX’s value proposition and its ability to serve a diverse shopper base.

Expansion remains central to TJX’s long-term plans, with the company ending the fiscal third quarter with 5,191 stores globally. Management continues to target a long-term footprint of 7,000 stores across existing markets and its planned entry into Spain. The strong availability of branded inventory further supports this expansion, allowing TJX to stock new and existing stores with compelling assortments at scale.

Management’s confidence is evident in its raised fiscal 2026 outlook, reflecting the strength demonstrated in the fiscal third quarter. TJX now anticipates full-year comparable sales growth of 4%, a pretax profit margin of 11.6%, and EPS of $4.63 to $4.66, up 9% from last year. This is an improvement over prior guidance, which called for 3% comp growth, pretax margins of 11.4% to 11.5%, and EPS of $4.52 to $4.57. The upgraded outlook underscores TJX’s strong execution amid a mixed retail landscape.

Higher operating costs continue to weigh on TJX’s profitability. Despite better gross margin in the third quarter of fiscal 2026, SG&A deleveraged 60 basis points due to rising payroll, incentive compensation and foundation-related expenses. These pressures make margin expansion harder and force TJX to balance its value proposition with stricter cost control in a highly competitive retail landscape.

Shrink is also a short-term concern for TJX. Last year’s favorable shrink adjustment sets up a tougher comparison for the fiscal fourth quarter, making margin gains harder to achieve even with solid sales. As shrink trends normalize, this could put additional pressure on profitability, making it an important factor to watch heading into year-end.

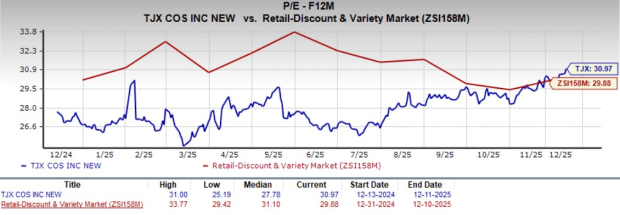

TJX’s forward 12-month P/E of 30.97X sits slightly above the industry average of 29.88X and well above the broader sector average of 24.92X. Compared with peers, TJX falls in the mid-range: Costco trades at a significant premium of 43.17X, Ross Stores sits at the lower end with 12.8X and Burlington Stores is slightly below TJX at 25.17X.

The Zacks Consensus Estimate for TJX’s earnings has seen mixed revisions in recent weeks, reflecting a balanced but steady outlook. Over the past seven days, the fiscal 2026 EPS estimate has inched up 1 cent to $4.66, while the fiscal 2027 estimate has dipped 3 cents to $5.08. Even with these modest adjustments, TJX is still projected to deliver solid earnings growth, up 9.4% in fiscal 2026 and 8.9% in fiscal 2027.

TJX’s combination of strong traffic trends, upgraded fiscal 2026 guidance and sustained market-share gains positions it as one of the more durable names in off-price retail. Its global expansion plans, steady comp growth and healthy merchandise availability help offset challenges tied to rising costs, shrink and a still-competitive retail backdrop.

While the stock’s robust 2025 rally limits near-term upside, TJX’s proven model and consistent execution support expectations for stable performance heading into 2026. Given its current valuation and balanced risk-reward profile, the stock appears better suited for holding rather than aggressive accumulation at present. TJX currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 min | |

| 56 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite