|

|

|

|

|||||

|

|

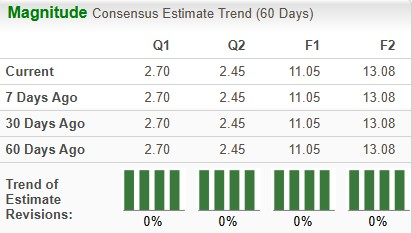

Jabil, Inc. JBL is scheduled to report first-quarter fiscal 2026 earnings on Dec. 17. The Zacks Consensus Estimate for sales and earnings is pegged at $8.01 billion and $2.7 per share, respectively. Earnings estimates for JBL have remained unchanged for 2025 and 2026 over the past 60 days.

The leading electronics manufacturing services firm has had a solid earnings surprise history in the trailing four quarters, exceeding earnings expectations on all occasions. It delivered a four-quarter earnings surprise of 8.78%, on average.

Our proven model does not conclusively predict an earnings beat for Jabil for the first quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the chances of an earnings beat. That is not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Jabil currently has an ESP of -0.09% with a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

During the quarter, Jabil expanded its portfolio by introducing the J 422G server to cater to the growing AI and data center market. The server processor is engineered to meet the high efficiency and performance requirements of AI, machine learning, high-performance computing and large language models. The product launch is aligned with Jabil’s prior announcement of $500 million investment in North Carolina.

In the quarter under review, the company has inked a definitive agreement to acquire Hanley Energy Group. Hanley specializes in energy management and critical power solutions. The integration of Hanley’s comprehensive expertise in power systems and energy optimization will significantly bolster Jabil’s portfolio of power management solutions for data centers. The AI data center market is growing at a rapid pace. Jabil aims to develop a differentiated capability that goes beyond just developing and manufacturing to deployment and after-service as well. The buyout will allow Jabil to steadily move toward that direction.

In the to-be-reported quarter, Jabil has expanded its partnership with Inno, a leading metal parts manufacturer, to invest in a facility in Thailand. The collaboration is set to produce battery energy storage system enclosures. This will boost Jabil’s vertical integration capabilities and also diversify its supply chain.

Per the Zacks Consensus Estimate, JBL’s Regulated Industries vertical is projected to report revenues of $3.05 billion, indicating growth from $2.95 billion a year ago. The growth is expected to be driven by healthy demand in the Healthcare and packaging verticals. However, the company is facing demand softness in the auto and transportation sector. Demand in the renewable and energy infrastructure vertical also remained weak during this quarter. Revenues from Connected Living & Digital Commerce are pegged at $1.28 billion, down from $1.54 billion. Demand softness in consumer-centric products continues to impact revenue growth.

Strong growth is expected in the Intelligent Infrastructure segment. Revenues from this segment for the first quarter are pegged at $3.67 billion, indicating growth from $2.49 billion.

Over the past year, JBL has surged 64.7% compared with the industry’s growth of 102.2%. It has underperformed its peers, Flex Ltd. FLEX and Celestica Inc. CLS. Flex has gained 81%, while Celestica has surged 209.6% during this period.

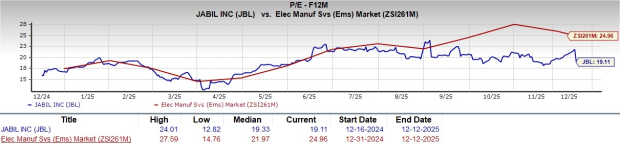

From a valuation standpoint, Jabil appears to be trading at a discount relative to the industry. Going by the price/earnings ratio, the company’s shares currently trade at 19.11 forward earnings, lower than 24.96 for the industry and its mean of 19.33.

Strength in AI-related growth in cloud data center infrastructure and capital equipment markets is expected to be a major growth driver for the company. As enterprises across industries rush to integrate AI across their operations, it is pushing hyperscalers to rapidly expand their data center footprint. This trend is driving demand for Jabil’s data center infrastructure solutions, liquid cooling and power management systems. Moreover, Jabil’s flexible approach allows it to develop tailored solutions for each customer’s unique requirements, from hyperscalers to fintech trading platforms.

Wars in Europe and the Middle East and tariff-related uncertainties have led to supply chain disruptions across many sectors. Amid this backdrop, major organizations worldwide are aiming to source their components from suppliers who are more resilient to these threats. Jabil has a strong presence in more than 25 countries worldwide. The company’s worldwide connected factory network enables it to scale production according to evolving market dynamics. Its multi-region presence has boosted its reliability to its customers. These factors are major tailwinds for the company.

However, it is to be noted that Jabil operates in a highly competitive Electronics Manufacturing industry. Companies like Flex and Celestica are also rapidly expanding into the AI data center market, which could pose a challenge to Jabil’s expansion initiative in this domain. Moreover, Many of Jabil’s current and potential customers are assessing the merits of in-house manufacturing against the advantages of outsourcing. This is also a major challenge.

The company is also exposed to customer concentration risks. With the growing competition in the industry, the loss of any major customers can impact its top-line growth.

The capital equipment vertical is exposed to the cyclical nature of the semiconductor industry. Despite near-term strength, the sharp upward and downward cycle of the industry can impact growth.

Jabil is set to gain from growth in the Intelligent Infrastructure segment, backed by solid momentum in the AI data center market. A diverse portfolio, robust supply chain network, and customer-focused approach are driving growth. Despite the AI-driven growth engine, the company is facing headwinds in multiple verticals, such as auto, transportation and renewable energy. Customer concentration and intense competition remain concerns. With a Zacks Rank #3, JBL appears to be treading in the middle of the road, and new investors could be better off if they trade with caution.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite