|

|

|

|

|||||

|

|

About the Industry

The Zacks HMO industry consists of entities (either private or public) that take care of subscribers’ basic and supplemental health services. Companies in this space primarily assume risks and assign premiums to health and medical insurance policies. Industry participants also provide administrative and managed-care services for self-funded insurance. Services are generally offered by a network of approved care providers (called in-network), which include primary care physicians, clinical facilities, hospitals and specialists. However, out-of-network exceptions are made during emergencies or when necessary. Health insurance plans can be availed through private purchases, social insurance or social welfare programs.

4 Trends Defining the HMO Industry's Future

Rising Medical Expenses: Healthcare costs for U.S. health insurers are climbing due to multiple factors. The resurgence of previously postponed medical care, routine screenings and chronic disease management has led to increased healthcare utilization and a surge in insurance claims. Additionally, the cost of prescription drugs continues to escalate sharply. Demographic trends, including an aging population, and a growing incidence of chronic illnesses like obesity-related diabetes and cardiovascular disease, are further intensifying long-term cost pressures. These dynamics have strained the Health Benefit Ratio (a key profitability metric for insurers), thereby compressing profit margins.

Regulatory Challenges: Health insurers in the domestic market are navigating a period of heightened regulatory uncertainty. Legislative proposals such as the One Big Beautiful Bill Act seek to reduce federal Medicaid funding, introduce work requirements and tighten eligibility verification, measures that could lower coverage levels and compress reimbursement rates for both providers and insurers. At the same time, Medicare Advantage payment rate adjustments and potential reductions in required coverage under the ACA are creating uncertainty. Health insurers are especially vulnerable, as reduced Medicaid and Medicare payments can push already thin margins into the red. Additionally, reductions in ACA subsidies may depress enrollment in marketplace plans. Given that commercial insurance products typically deliver higher margins than Medicaid or ACA plans, insurers are increasingly prioritizing the expansion of their commercial portfolios. That said, the anticipated Medicare Advantage rate increases in 2026 may provide some margin support.

Scarcity of Healthcare Professionals: The ongoing nationwide shortage of nurses and other healthcare professionals continues to strain hospital operations, especially as patient volumes rise. Key factors driving this crisis include an aging nursing workforce, widespread burnout and unequal workforce distribution. HMOs collaborate with hospitals, physicians and other providers to deliver cost-effective care to their members. The quality and reliability of these services are essential for maintaining customer satisfaction and renewing health plans. However, a reduced nursing workforce can compromise the ability of hospitals to deliver high-quality care, ultimately impacting customer retention and the reputation of HMO companies.

Strategic Emphasis on Mergers and Acquisitions: In addition to leveraging technological advancements, HMOs frequently engage in M&A to enhance their capabilities, penetrate new markets, strengthen their foothold in existing regions, grow their customer base and reinforce their national presence. These strategic moves also foster diversification, enabling firms to maintain a competitive edge. With the Federal Reserve announcing three interest rate cuts for 2025 and signaling further reductions in 2026, borrowing costs are expected to ease. This more favorable interest rate environment will likely encourage M&A activity by allowing industry players to secure financing more affordably, minimizing the need to deplete internal cash reserves.

Zacks Industry Rank Indicates Bearish Outlook

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all member stocks, indicates tepid near-term prospects. The Zacks Medical-HMOs industry is housed within the broader Zacks Medical sector. It currently carries a Zacks Industry Rank #212, which places it in the bottom 12% of more than 250 Zacks industries.

Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one. The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of the negative earnings outlook for the constituent companies in aggregate.

Despite the dismal scenario, we will present a few stocks that one can retain, given their solid growth endeavors. But before that, it is worth looking at the industry’s recent stock-market performance and the valuation picture.

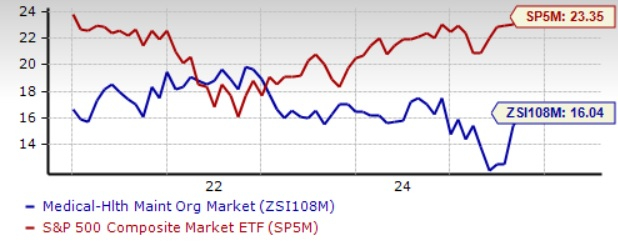

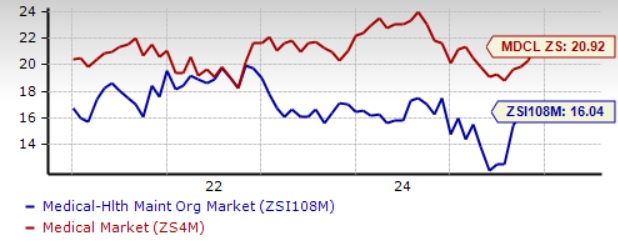

Industry Underperforms S&P 500, Sector

The Zacks Medical-HMO industry has declined 25.8% in the past year against the Zacks S&P 500 composite’s 2.4% growth. The Zacks Medical sector rallied 14.3% in the same time frame.

Industry's Current Valuation

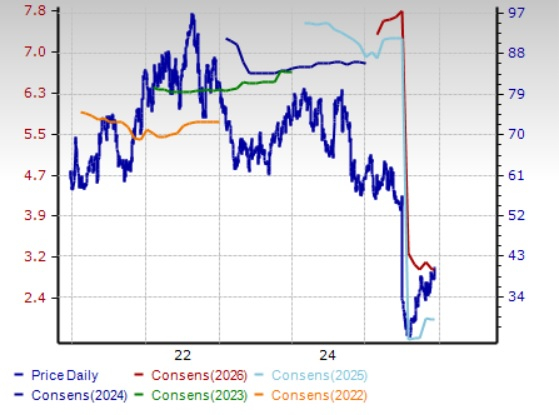

On the basis of the forward 12-month price-to-earnings (P/E) ratio, which is commonly used for valuing medical stocks, the industry is trading at 16.04X compared with the S&P 500’s 23.35X and the sector’s 20.92X.

In the past five years, the industry has traded as high as 19.57X and as low as 11.58X, the median being 16.2X, as the chart below shows.

3 Stocks to Watch

We present three stocks from the space with a current Zacks Rank #3 (Hold). Considering the present industry scenario, it might be prudent for investors to retain these stocks in their portfolios, as these are well-placed to generate growth in the long haul.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UnitedHealth Group: Minnesota-based UnitedHealth Group’s revenues are driven by strong performances from UnitedHealthcare and Optum. The UnitedHealthcare segment benefits from effective Medicare and Medicaid offerings, integrating affordable and attractive features that expand membership and boost premium income. This has led to multiple contract wins for the company. Optum's growth is fueled by acquisitions, advanced technology and data-driven care models. Strategic M&A and telehealth investments further enhance UNH’s nationwide reach and service efficiency.

The Zacks Consensus Estimate for UnitedHealth Group’s 2025 earnings is pegged at $16.29 per share. The consensus mark for revenues implies 11.9% growth from the year-ago figure. UNH’s earnings beat estimates in two of the last four quarters and missed the mark twice, the average negative surprise being 2.25%.

Headquartered in Kentucky, Humana has maintained steady growth fueled by rising premiums and an expanding membership base. The strong performance of these plans has secured the company multiple new contracts with state agencies. Through its CenterWell brand, Humana continues to focus on meeting the healthcare needs of the nation’s senior population. Over the years, the company has also pursued strategic acquisitions, which have broadened its revenue streams.

The Zacks Consensus Estimate for Humana’s 2025 earnings is pegged at $17.08 per share, indicating a 5.4% rise from the 2024 figure. The consensus mark for 2025 revenues implies 10% growth from the 2024 figure. HUM’s earnings surpassed estimates in three of the last four quarters and missed the mark once, the average being 7.54%.

Centene: Headquartered in Missouri, Centene’s revenue growth is driven by strong performance in its Medicare and Medicaid businesses, contributing to increased contract wins and expanding membership. The ongoing preference for Medicare Advantage plans among the aging U.S. population continues to fuel consistent demand for Centene’s Medicare offerings. The company pursues an inorganic growth strategy, utilizing strategic acquisitions and partnerships with healthcare providers to broaden its capabilities.

The Zacks Consensus Estimate for Centene’s 2025 earnings is pegged at $2.00 per share. The consensus mark for 2025 revenues implies 18.5% growth from the 2024 figure. CNC’s earnings outpaced estimates in three of the last four quarters and missed the mark once, the average being 75.18%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 9 hours | |

| 10 hours | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite