|

|

|

|

|||||

|

|

Carnival Corporation & plc CCL is scheduled to release fourth-quarter fiscal 2025 results on Dec. 19.

The Zacks Consensus Estimate for CCL’s fiscal fourth-quarter earnings per share (EPS) is pegged at 25 cents, suggesting 78.6% growth from 14 cents reported in the prior-year quarter. The consensus mark for earnings has increased by 4.2% in the past 60 days.

The consensus mark for fiscal fourth-quarter revenues is pegged at $6.36 billion, indicating growth of 7.2% from the year-ago quarter’s reported figure.

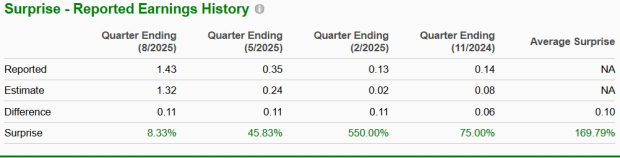

Carnival has an impressive earnings surprise history. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 169.8%.

Our proven model does not conclusively predict an earnings beat for Carnival this time around. A stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to beat on earnings. But that's not the case here.

CCL’s Earnings ESP: Carnival has an Earnings ESP of -1.08%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Carnival’s Zacks Rank: The company carries a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carnival’s fiscal fourth-quarter performance is likely to have benefited from strong same-ship execution, disciplined pricing and improving balance sheet dynamics. Stable booking trends with sustained close-in demand and high pricing are likely to have aided the company’s performance in the fiscal fourth quarter. This demand backdrop, combined with limited net capacity growth, likely supported ticket pricing and load factors in the to-be-reported quarter.

Revenue trends in the fiscal fourth quarter are likely aided by continued strength in onboard and pre-cruise spending. The company has emphasized steady growth in onboard revenue per passenger, supported by improved revenue management systems, targeted merchandising and higher attachment rates for excursions and premium experiences. In addition, the early operational contribution from Celebration Key is likely to have provided incremental yield support through itinerary premiums and enhanced guest satisfaction.

Our model estimates fiscal fourth-quarter passenger ticket revenues to rise 5.2% year over year to $4.05 billion. We expect onboard and other revenues to increase 6.1% year over year to $2.21 billion.

However, cost-related headwinds are likely to have persisted in the fiscal fourth quarter. Management indicated that while cost-saving initiatives continued to flow through results, these benefits were partially offset by higher variable compensation driven by stronger operating performance. In addition, ongoing investments in destinations and ship maintenance activities, including refurbishments and dry docks, are expected to influence cost comparisons in the back half of the year.

While the company continues to emphasize disciplined cost management and efficiency initiatives, these factors are likely to have contributed to higher operating expenses in the fiscal fourth quarter. Per our model, total operating expenses in the fiscal fourth quarter are anticipated to rise 5.3% year over year to $5.7 billion.

Carnival shares have gained 19.4% in the past six months, outperforming the Zacks Leisure and Recreation Services industry’s growth of 7.6% and the S&P 500’s rise of 16.5%. The company’s peers, including Royal Caribbean Cruises Ltd. RCL. Norwegian Cruise Line Holdings Ltd. NCLH and OneSpaWorld Holdings Limited OSW, have gained 5.1%, 17.1% and 9.2%, respectively, during the same time period.

From a valuation perspective, Carnival stock is currently trading at a discount. It is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 11.68, well below the industry average of 17.15. Other industry players, such as Royal Caribbean, OneSpaWorld Holdings and Norwegian Cruise, have a P/E of 15.8, 18.22 and 8.15, respectively.

Carnival is executing from a position of operational strength, supported by sustained booking momentum, historically high pricing across key source markets and disciplined same-ship yield execution. Management highlighted record forward bookings, elevated customer deposits and improving close-in demand, underscoring the durability of consumer interest despite a more mature demand environment. Strategic investments in high-return initiatives — including destination development such as Celebration Key, fleet upgrades through programs like AIDA Evolution, and enhanced revenue management and marketing capabilities — are reinforcing the company’s ability to drive higher yields and onboard monetization. With capacity growth remaining constrained and returns on invested capital reaching levels not seen in nearly two decades, Carnival appears well-positioned to translate operational momentum into improving cash flow generation and shareholder value over time.

That said, investment risks remain. While refinancing and deleveraging efforts have materially strengthened the balance sheet, net interest expense remains elevated versus pre-pandemic levels, continuing to weigh on earnings. Cost pressures tied to labor, variable compensation and ongoing investments in destinations and ship refurbishments could temper near-term margin expansion. In addition, management acknowledged that yield upside in the second half of the year is more limited than in earlier periods, suggesting less room for outperformance should demand soften. Broader macroeconomic uncertainty, potential shifts in consumer spending behavior and execution risk around new destination ramp-ups remain key factors investors should monitor as Carnival continues its financial recovery and growth strategy.

Carnival heads into its upcoming earnings release with supportive underlying fundamentals, including resilient booking trends, firm pricing and steady growth in onboard spending. Continued progress in destination development and fleet initiatives, alongside improving balance sheet dynamics and an attractive valuation relative to peers, reinforces the company’s longer-term positioning.

However, near-term visibility remains somewhat limited. The lack of a clear earnings beat signal, combined with ongoing cost pressures and elevated interest expense, suggests potential volatility around the results.

Given this setup, a measured approach appears prudent. For investors already holding the stock, maintaining exposure is reasonable given the improving fundamentals and discounted valuation. However, for those looking to add new positions, waiting for greater clarity on cost containment and post-earnings price action may offer a more favorable risk-reward.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite