|

|

|

|

|||||

|

|

American travel spending is poised for acceleration in 2026 as sustained consumer demand and supportive monetary policy converge to drive sector growth. Per the U.S. Travel Association's Fall 2025 forecast, total U.S. travel spending is projected to grow 2.2% in 2026 to reach $1.2 trillion. Four online travel platforms stand out for their ability to capture diverse booking channels heading into 2026. Booking Holdings BKNG, Expedia Group EXPE, Airbnb ABNB and TripAdvisor TRIP each offer differentiated exposure across traditional hotels, alternative accommodations, business travel and experiential bookings as the projected $1.2 trillion in U.S. travel spending drives growth.

Domestic leisure travel is expected to expand 1.9% to $920.5 billion, while international inbound travel rebounds with 3.7% growth to 70.4 million visits. Major events, including the FIFA World Cup and America's 250th Anniversary celebrations, are expected to drive significant tourism activity throughout the year.

The macroeconomic backdrop provides additional support for travel spending heading into 2026. The Federal Reserve implemented three consecutive interest rate cuts in 2025, reducing the federal funds rate by 75 basis points to a range of 3.50-3.75% by December. The cumulative 175 basis points of easing since September 2024 has improved consumer spending capacity across discretionary categories, including travel, while the Fed projects GDP growth of 2.3% for 2026, suggesting economic conditions that support continued leisure spending momentum.

Several emerging preferences are expected to shape travel patterns in 2026. Travellers are increasingly seeking quiet escapes and wellness-focused retreats, as digital fatigue drives demand for peaceful destinations. AI integration is accelerating across booking platforms, with tools like ChatGPT streamlining trip planning and reducing decision fatigue. Literary and film-inspired travel continues to gain momentum, with destinations featured in upcoming productions attracting visitor interest. Road trips are experiencing a resurgence as cost-conscious travellers seek affordable alternatives. Hyper-personalised experiences tailored to specific life stages are emerging, from wellness retreats to hobby-focused getaways. These shifts towards intentional, experience-driven travel align with online platforms' strategic investments in curated content and AI-powered personalisation tools.

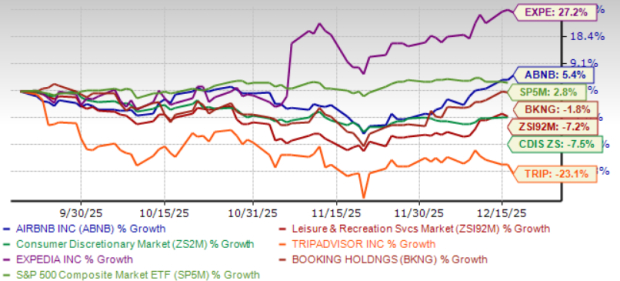

Over the past three months, shares of major online travel platforms have shown divergent performance. Expedia Group led with gains of 27.2%, significantly outperforming the broader market as investors rewarded B2B momentum and margin expansion. Airbnb advanced 6.4%, supported by platform diversification initiatives. Booking Holdings declined 1.8% despite strong operational results, while TripAdvisor fell 23.1% as the market digested its fundamental business transformation. These varying performances create different entry points for investors seeking travel sector exposure heading into 2026.

The chart below shows the price performance of our four picks in the past three-month period.

Expedia Group's B2B segment continuously delivered robust double-digit bookings growth through 2025, positioning it well for 2026, while serving as a key competitive differentiator. EXPE expects further margin expansion while prioritising AI integration through partnerships, including OpenAI, to enhance customer acquisition. The Vrbo brand's return to growth and Hotels.com's improving trajectory provide additional momentum. This Zacks Rank #1 (Strong Buy) stock benefits from geographic diversification with strong Asian market performance. The Zacks Consensus Estimate for EXPE's 2026 EPS has remained unchanged over the past 30 days to $18.23, suggesting continued growth as strategic priorities drive results. You can see the complete list of today’s Zacks #1 Rank stocks here.

TripAdvisor executed a fundamental strategic restructuring during 2025, transitioning from its legacy hotel metasearch business toward an experiences-focused marketplace model. The Viator segment continues demonstrating strong momentum. The transformation is supported by $85 million in annualised cost savings. For 2026, TRIP expects stable-to-moderate revenue growth with the Experiences business projected to surpass legacy segments, with anticipation of improved adjusted EBITDA driven by disciplined cost control. This Zacks Rank #3 (Hold) stock reflects the ongoing strategic transition. The Zacks Consensus Estimate for TRIP's 2026 EPS has inched upwards by a penny in the past 30 days to $1.69.

Booking Holdings delivered robust financial performance through 2025, solidifying its position as the dominant global travel platform. The alternative accommodations segment continues expanding and outpacing traditional hotel growth. For 2026, BKNG maintains a constructive outlook with 8.4 million alternative accommodation listings. The integration of 150,000 attractions from FareHarbor expands the experiences offering. BKNG expects further margin expansion driven by operational efficiency and the Connected Trip initiative gaining traction. This Zacks Rank #3 stock's market-leading position strengthens into 2026. The Zacks Consensus Estimate for BKNG's 2026 EPS has inched upwards by 19 cents in the past 30 days to $262.93.

Airbnb navigated a transitional year in 2025, investing in diversification initiatives to unlock new growth avenues. North American bookings rose 5% year over year, demonstrating resilient demand in the company's core market. The company launched Airbnb Services and reimagined Experiences, representing the platform's most significant expansion beyond stays. For 2026, ABNB expects revenue growth of approximately 9.7% to reach $13.49 billion as the diversification strategy matures. This Zacks Rank #3 stock reflects the platform expansion into 2026. The Zacks Consensus Estimate for ABNB's 2026 EPS has inched upwards by a penny in the past 30 days to $4.71.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 6 hours | |

| 7 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite