|

|

|

|

|||||

|

|

Wall Street’s rally of U.S. stocks in 2023 and 2024 continued in 2025, albeit at a slow pace. The rally was predominantly driven by the technology sector with unprecedented adoption of generative and agentic artificial intelligence (AI) technology across the world.

Here we recommend three AI chipset manufacturing behemoths that are set to dominate the AI space in 2026. These are: NVIDIA Corp. NVDA, Micron Technology Inc. MU and Marvell Technology Inc. MRVL.

These companies have reported strong earnings results in their last reported quarter with solid guidance. Finally, each of our picks currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our three picks in the past three months.

NVIDIA — the undisputed global leader of generative artificial intelligence (AI)-powered graphical processing units (GPUs) — reported strong third-quarter fiscal 2026 earnings results, in which the revenue growth rate exceeded 50% from the prior year for the tenth consecutive quarter.

Revenues from Data Center (89.8% of revenues) jumped 66% year over year and 25% from the previous quarter, mainly driven by higher shipments of the Blackwell GPU computing platforms. CFO Colette Kress said, "Blackwell Ultra is now our leading architecture across all customer categories while our prior Blackwell architecture saw continued strong demand."

NVDA has decided to announce its roadmap for Rubin Next, to be introduced in 2027, and Feynman AI chips to be launched in 2028. NVIDIA is supported by an extremely bullish demand scenario. The company expects between $3 trillion and $4 trillion in AI infrastructure spending by the end of the decade.

Four major clients of NVDA, namely, Microsoft Corp. (MSFT), Alphabet Inc. (GOOGL), Meta Platforms Inc. (META) and Amazon.com Inc. (AMZN), have decided to invest a massive $380 billion in 2025 as capital expenditure for AI-infrastructure development. All these companies have forecast their AI capex spending to rise in 2026.

NVIDIA is increasingly focusing on powering advanced driver-assistance systems, autonomous vehicles and robotics. Apart from the robust business of data centers and gaming, the automobile industry, especially the self-driving and new energy vehicles, is turning out to be the next catalyst.

For the fourth quarter of fiscal 2026, NVIDIA anticipates revenues of $65 billion (+/-2%), above the Zacks Consensus Estimate of $60.3 billion. The non-GAAP gross margin is projected to be 75% (+/-50 bps). Non-GAAP operating expenses are estimated at $5 billion.

NVIDIA represents a rare opportunity to invest in a company with proven execution and substantial unrealized potential in the AI revolution. Astonishing growth potential of the global AI infrastructure market and NVDA’s strong guidance and business visibility despite revenue loss in China are noteworthy.

NVIDIA has a forward P/E (price/earnings) of 36.8% compared with the industry’s P/E of 34.4% and the S&P 500’s P/E of 19.7%. The stock has a long-term (3-5 years) EPS growth rate of 46.3%, significantly above the S&P 500 Index’s 15.8% growth rate.

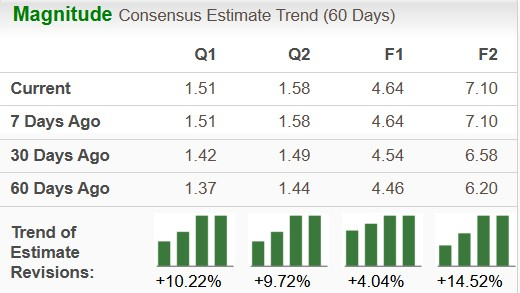

NVDA has an expected revenue and earnings growth rate of 42.2% and 52.9%, respectively, for next year (ending January 2027). The Zacks Consensus Estimate for next year’s earnings has improved 9.4% over the last 30 days.

Marvell Technology reported strong third-quarter fiscal 2026 earnings results. Data center revenues of $1.52 billion increased 37.8% year over year and 1.8% sequentially, driven by strong traction in custom XPU silicon, electro-optic interconnect products and next-generation switch offerings. The segment contributed 73.2% of total revenues, reaffirming its position as MRVL’s largest end market.

MRVL is a promising player in the solid-state drive controllers market. The storage market is seeing a steady increase in demand, given the fast-growing data volume, especially the exponential growth in unstructured data. Completion of inventory digestions is likely to aid growth for MRVL across the enterprise networking and carrier infrastructure end markets.

Custom AI silicon and electro-optics products have positioned MRVL as a critical player in high-performance computing. The company’s partnerships with leading hyperscalers ensure sustained growth, with management confident that revenues from its custom XPU (accelerated computing) solutions will continue expanding in fiscal 2027 and beyond.

MRVL announced the acquisition (expected to close in the first quarter of fiscal 2027) of Celestial AI, which specializes in the Photonic Fabric technology platform. This platform is purpose-built for scale-up optical interconnect.

Marvell Technology highlighted that Celestial AI is “deeply engaged” with several hyperscalers and ecosystem partners. Celestial AI has already won a major contract with one of the biggest hyperscalers. This hyperscaler intends to use the photonic fabric chiplets in its next-generation scale-up architecture.

Hyperscalers are also central to the company’s other product lines. MRVL is pushing boundaries with 400G per lane PAM technology, enabling 3.2T optical interconnects and future-proofing hyperscaler infrastructure.

The acquisition of Celestial AI will put Marvell on a firm footing in the next-generation energy-efficient AI infrastructure space to compete intensely with bigwigs like NVIDIA and Broadcom Inc. (AVGO).

MRVL expects fiscal fourth-quarter revenues to be $2.20 billion (+/- 5%). The Zacks Consensus Estimate for revenues is pegged at $2.15 billion, implying an 18.52% year-over-year improvement. MRVL expects data center revenue growth to be higher next year, marking accelerating AI demand.

The company projects non-GAAP earnings per share for the fiscal fourth quarter to be $0.79 (+/- $0.05). The Zacks Consensus Estimate for revenues is pegged at $0.78, implying 30% year-over-year improvement.

Strong growth in MRVL’s data center, enterprise networking and carrier infrastructure revenues coupled with the proposed acquisition of Celestial AI could be a game-changer for the company.

Marvell Technology has a forward P/E of 28.8% compared with the industry’s P/E of 32.7% and the S&P 500’s P/E of 19.7%. The stock has a long-term (3-5 years) EPS growth rate of 46.9%, significantly above the S&P 500 Index’s 15.8% growth rate.

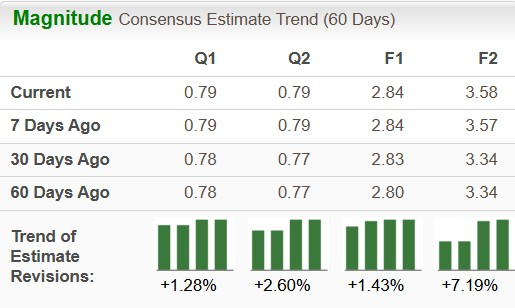

MRVL has an expected revenue and earnings growth rate of 22.5% and 25.7%, respectively, for next year (ending January 2027). The Zacks Consensus Estimate for next year’s earnings has improved 6.9% over the last 30 days.

Micron Technology reported solid fiscal first-quarter 2026 earnings results. Its core cloud memory business unit, which reported sales of $5.28 billion, up a whopping 99.5% year over year. Soaring demand for Micron's high-bandwidth memory (HBM) chips has been a major driver of the company's stellar quarterly performance.

MU’s HBM chips, which enable high-speed data processing and reduce power consumption, remain in short supply due to the AI infrastructure boom, which is why they are in high demand. Record sales in the data center end market and accelerating HBM adoption have been driving MU’s Dynamic Access Random Memory (DRAM) revenues higher.

The growing adoption of AI servers is reshaping the DRAM market as these systems require significantly more memory than traditional servers. This is boosting demand for both high-capacity DIMMs (Dual In-line Memory Module) and low-power server DRAM. MU is capitalizing on this trend with its leadership in DRAM technology and a strong product roadmap that includes HBM4, slated for volume production in 2026.

Micron’s diversification strategy is also bearing fruit. MU has created a more stable revenue base by shifting its focus away from the more volatile consumer electronics market toward resilient verticals such as automotive and enterprise IT. Micron supplies HBM chips to NVIDIA as well as to its rival Advanced Micro Devices Inc. (AMD).

As AI adoption accelerates, the demand for advanced memory solutions, such as DRAM and NAND is soaring. MU’s investments in next-generation DRAM and 3D NAND ensure that it remains competitive in delivering the performance needed for modern computing.

MU expects even stronger results in fiscal second-quarter 2026, with revenues projected between $18.3 billion and $19.1 billion, and diluted EPS ranging from $8.22 to $8.62. The company reported a record free cash flow of $3.9 billion in fiscal first-quarter 2026, providing ample funds to support future growth initiatives.

Micron Technology has a forward P/E of 11.4% compared with the industry’s P/E of 24.2% and the S&P 500’s P/E of 19.7%. The stock has a long-term (3-5 years) EPS growth rate of 35.4%, significantly above the S&P 500 Index’s 15.8% growth rate.

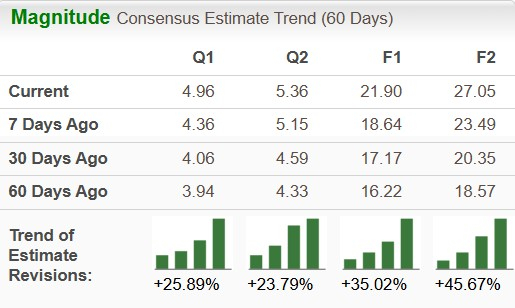

MU has an expected revenue and earnings growth rate of 53.7% and more than 100%, respectively, for the current year (ending August 2026). The Zacks Consensus Estimate for current-year’s earnings has improved 9.6% over the last seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite